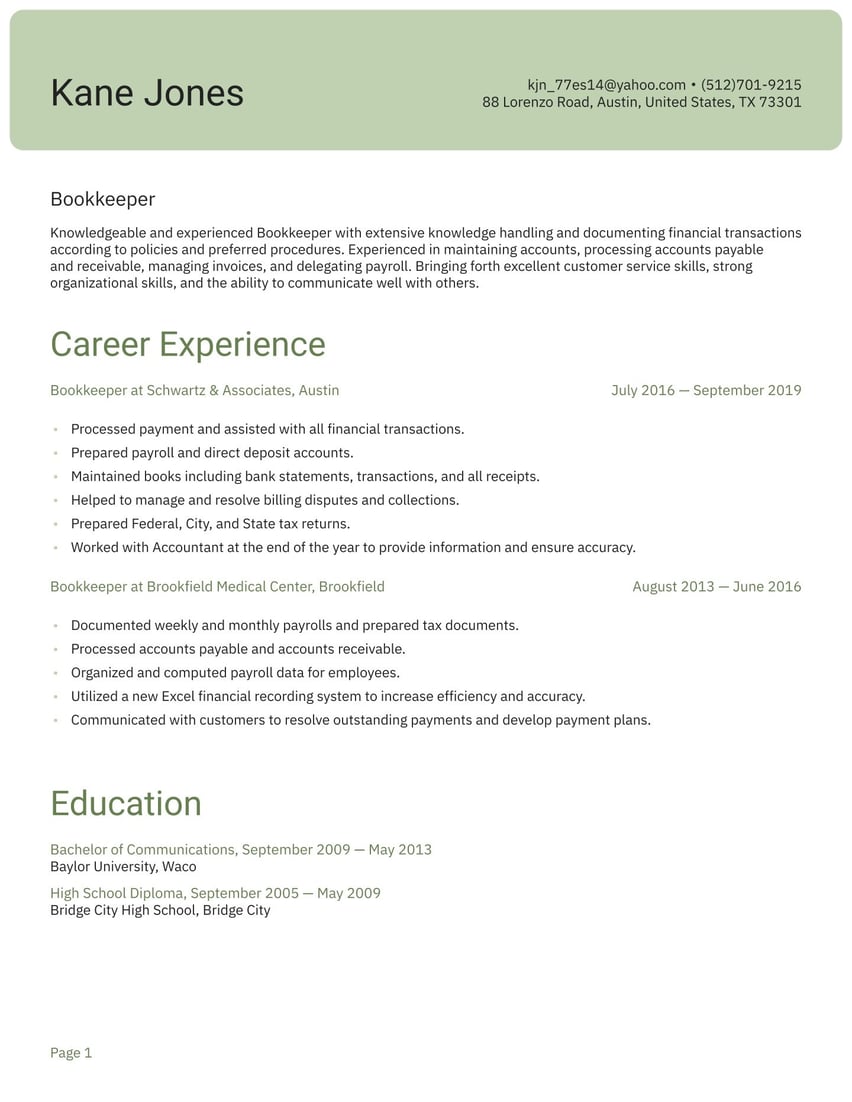

07/2016 - 09/2019, Bookkeeper, Schwartz & Associates, Austin

- Processed payment and assisted with all financial transactions.

- Prepared payroll and direct deposit accounts.

- Maintained books including bank statements, transactions, and all receipts.

- Helped to manage and resolve billing disputes and collections.

- Prepared Federal, City, and State tax returns.

- Worked with Accountant at the end of the year to provide information and ensure accuracy.

08/2013 - 06/2016, Bookkeeper, Brookfield Medical Center, Brookfield

- Documented weekly and monthly payrolls and prepared tax documents.

- Processed accounts payable and accounts receivable.

- Organized and computed payroll data for employees.

- Utilized a new Excel financial recording system to increase efficiency and accuracy.

- Communicated with customers to resolve outstanding payments and develop payment plans.

09/2009 - 05/2013, Bachelor of Communications, Baylor University, Waco

09/2005 - 05/2009, High School Diploma, Bridge City High School, Bridge City

- English

- Spanish

- Advanced Technological Skills

- Bookkeeping Software

- Data Entry Skills

- Accounting Skills

- Team Leadership Skills

- Market Assessment Skills

- Superior Communication Skills

The core question for any employer seeking to hire a bookkeeper is simply “Can I trust this person with the financial data of my business?” A job-winning bookkeeper resume will confidently answer that question and set you up as the person to hire.

Bookkeeper resume examples by experience level

Careful bookkeeping ensures that everyone knows how much money there is to spend—and how much is earned. One mistake can cause serious problems, so every bookkeeping task must be focused and accurate.

Your resume is a reflection of your bookkeeping skills. It must convey an exact, analytical, and meticulous approach. Don’t let the job-hunting ledger go out of balance before you get started.

Resume guide for a bookkeeper resume

Resume.io is here to help with ideas, inspiration, and advice. We’ve developed more than 500 occupation-specific resume guides and resume examples, along with related tips and tools for gaining an advantage over other qualified applicants. And if that wasn’t enough motivation, our resume builder makes creating a top-notch resume quick and easy.

This resume guide and corresponding bookkeeping resume example will cover the following:

- How to write a bookkeeper resume

- Choosing the right resume format for bookkeeping

- How to add your contact information

- Using summaries

- Adding your bookkeeping experience

- Listing education and relevant experience

- Picking the right resume design/layout

- What the bookkeeping market looks like and what salary to expect

How to write a bookkeeper resume

Before writing your bookkeeper resume, you must understand what sections to include. Your resume should contain the following:

- The resume header

- The resume summary (aka profile or personal statement)

- The employment history section

- The resume skills section

- The education section

Accountancy qualifications are fiendishly complicated and regulations are changing all the time. So your resume has to reflect your mastery of the detail. A bookkeeper’s resume must be painstakingly accurate. When your life's work is about detail, everything you do has to reflect that.

That includes doing as much research as possible about the company, its mission and goals, and the position itself so that you can create an effective narrative about your career history and why you’re the best person for the role.

While performing this research, figure out what the company needs right now and demonstrate, via your resume, why you’re the person who can meet those needs. That’s your unique selling proposition, which sets you apart from the competition.

Your resume is the key to success. To accomplish your goals, follow this winning process:

- Focus on accomplishments rather than day-to-day tasks. Your resume should focus on the quantifiable value that you delivered to previous employers. Maybe you improved payment results, increased free cash flow, or made the sales ledger more efficient. Don’t limit this to one section; weave it throughout your resume.

- Don’t send a generic resume to each potential employer; tailor each version of the resume you submit. Tweak the style and tone to that of the company just like you use different tools based on the financial needs of the company you’re working with.

- Complete the picture with a resume format that is traditional and straightforward, but not boring.

- Optimize your resume with appropriate keywords, taken from the job description, so it won’t be filtered out by ATS screening software. To increase your chances of your resume being seen by an actual person, consider using an ATS resume template.

Optimize for the ATS

The advertised job description is often a good place to start for understanding the nature of the position you are applying for, including the company’s goals, culture, and values.

It is also useful for choosing the right keywords to use in your resume to pass through the ATS. Incorporate keywords and skills from the job description, along with critical terminology specific to the industry and job function.

Only the highest-ranking resumes pass through to be reviewed by human hiring staff. The rest are eliminated.

To learn more about conquering the ATS, check out our article Resume ATS optimization.

Choosing the right resume format for bookkeeping

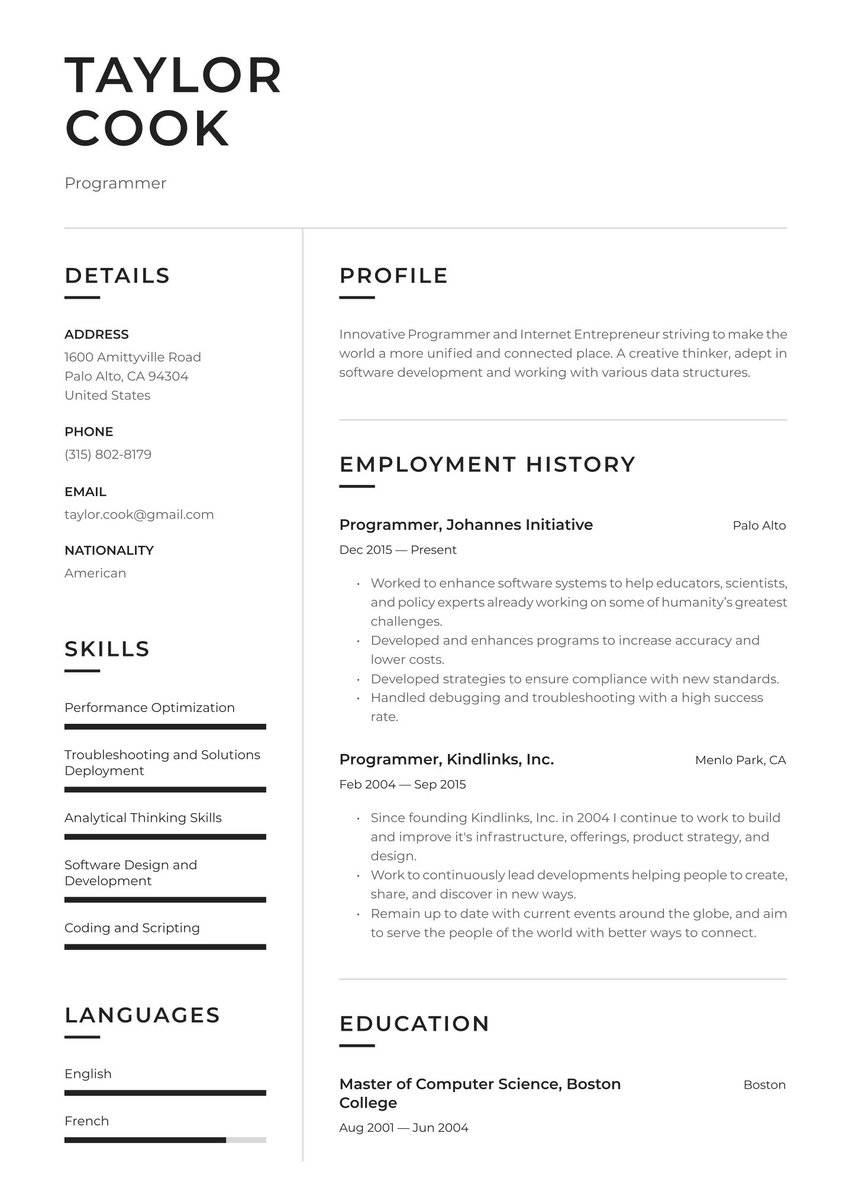

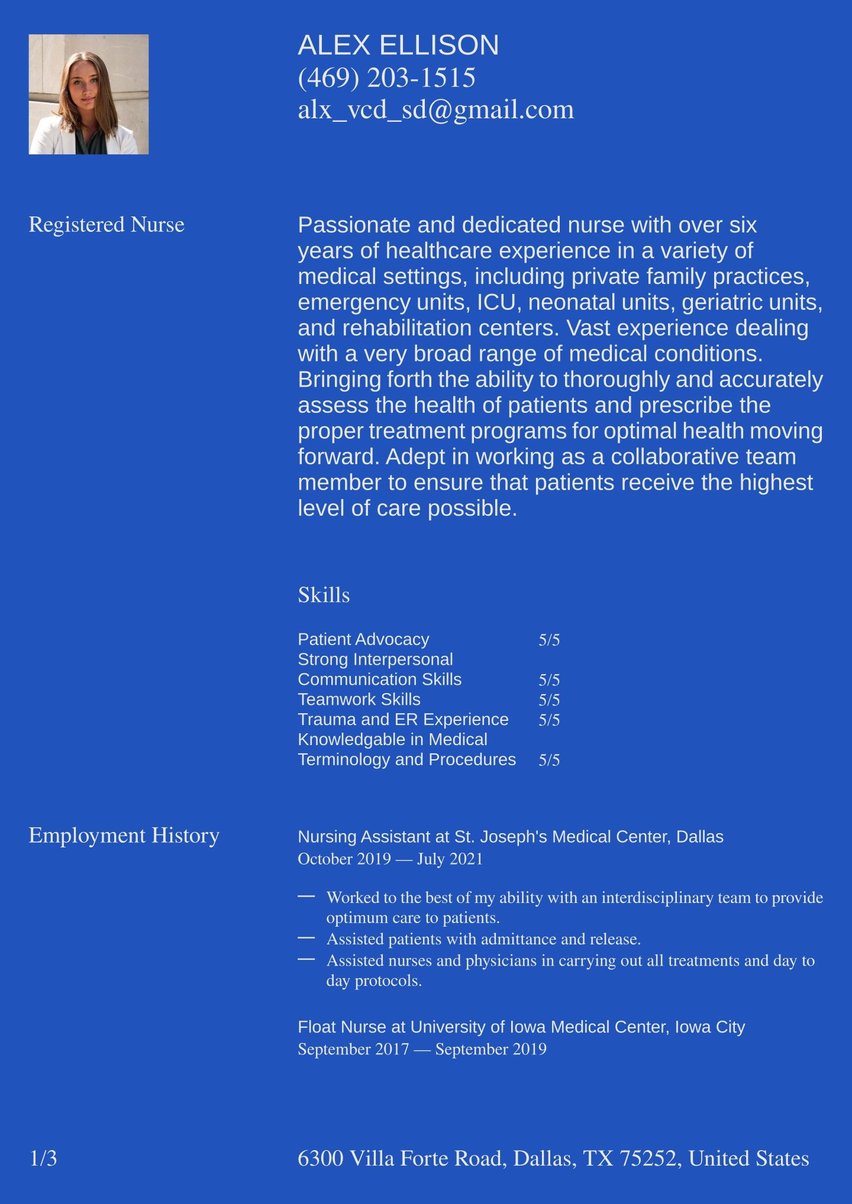

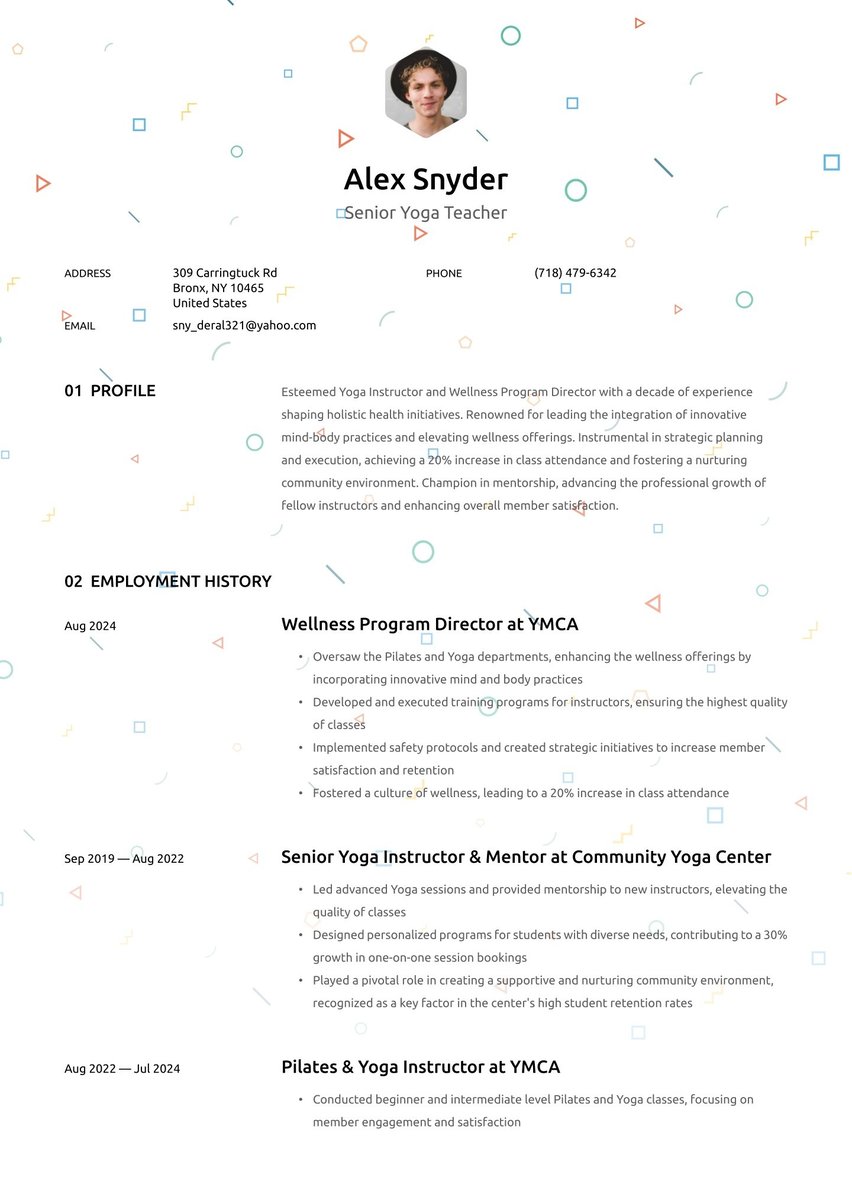

The most commonly used chronological resume format works well for job seekers in almost any occupation, particularly if their work history has followed a linear path in a series of employee positions.

In the work history section, progressive job experience and accomplishments are organized by the employer and are in reverse order from most recent to earliest dates. It would likely be a good fit for most bookkeeper job applicants who already have experience in this field or another kind of accounting or finance background.

Alternative resume formats are sometimes appropriate for those new to the workforce or changing careers, or those with a more varied occupational background. That includes some self-employed professionals with a project-based background well suited to a functional resume format. Other functional resumes emphasize specialized technical skills rather than work history. In some instances, a hybrid resume format makes sense in combining chronological and functional elements.

We have a variety of resume templates in our resume builder, so you can choose the right format for your career goals. And if you need more inspiration, we have a variety of the three main formats available as resume examples.

Keep in mind that bookkeeping tends to be a more conservative, traditional field. Your resume should use a straightforward, ATS-friendly layout that places your qualifications front and center and can be easily scanned by a hiring manager.

Include your contact information

When adding up a company’s quarterly income and expenses, you wouldn’t forget to put a total at the bottom. No one would know the financial situation. Similarly, you would never omit your contact information, as the hiring manager wouldn’t know your situation. Therefore, think of the header as the way the recruiter will contact you to make an interview happen.

- Full name & title. List your first and last name. Underneath, include the job title you’re applying for.

- Professional email address. Use a simple, easily understandable format like [email protected]. Don’t use a silly, casual email address.

- Phone number. List a number where you can be readily contacted, and make sure your outgoing message includes your name and instructions for reaching you.

- Location. List only your city and state. Don’t give your street address or zip code. If you’re looking for a job in a new city, note ' Willing to Relocate' here.

- LinkedIn. If your LinkedIn profile is active, relevant, and shows your bookkeeping skills, include it here.

Don’t include:

- Date of birth. An employer doesn’t need it at this point and could leave you open to age discrimination.

- Personal details. Marital status, religious affiliation, social security number, passport number, etc.

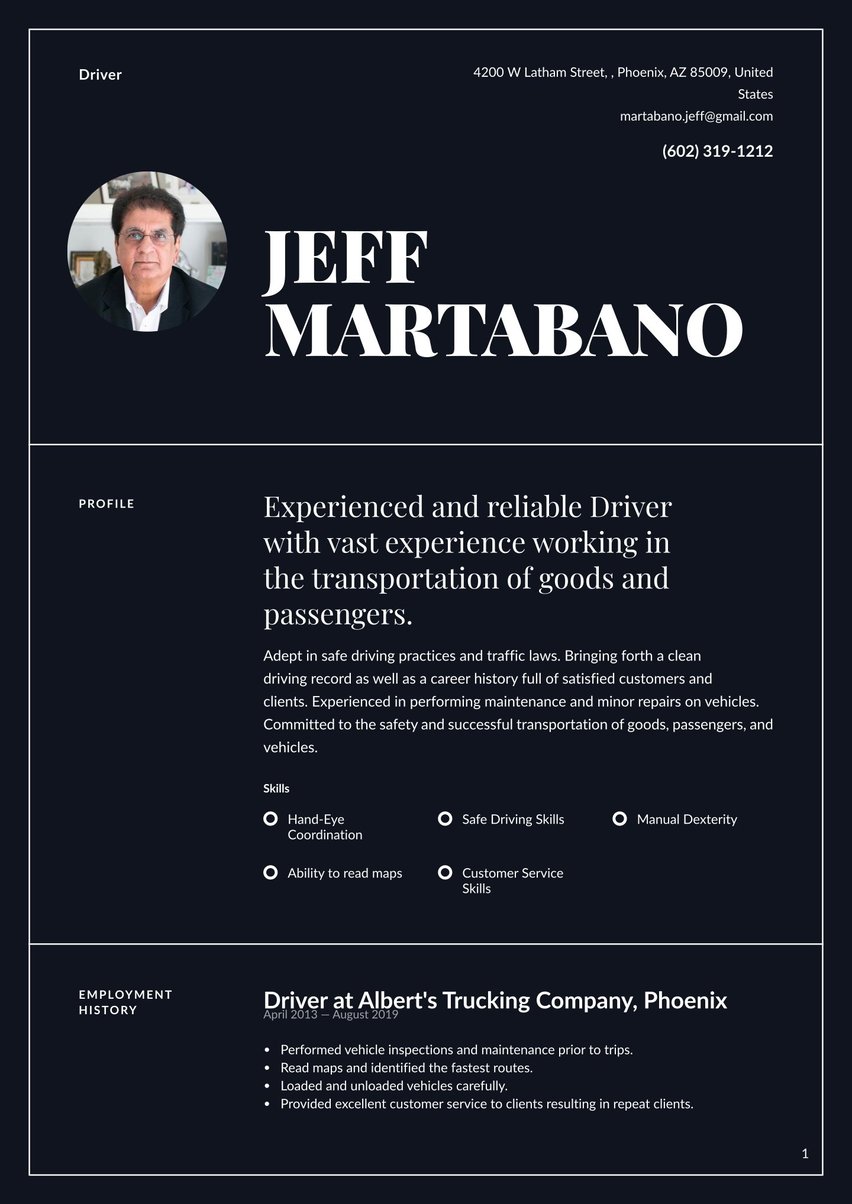

- Photo Headshot. Don’t include a picture of yourself on your resume. Unless you’re in a creative field, it’s not done in the US and could lead to bias on the part of the recruiter.

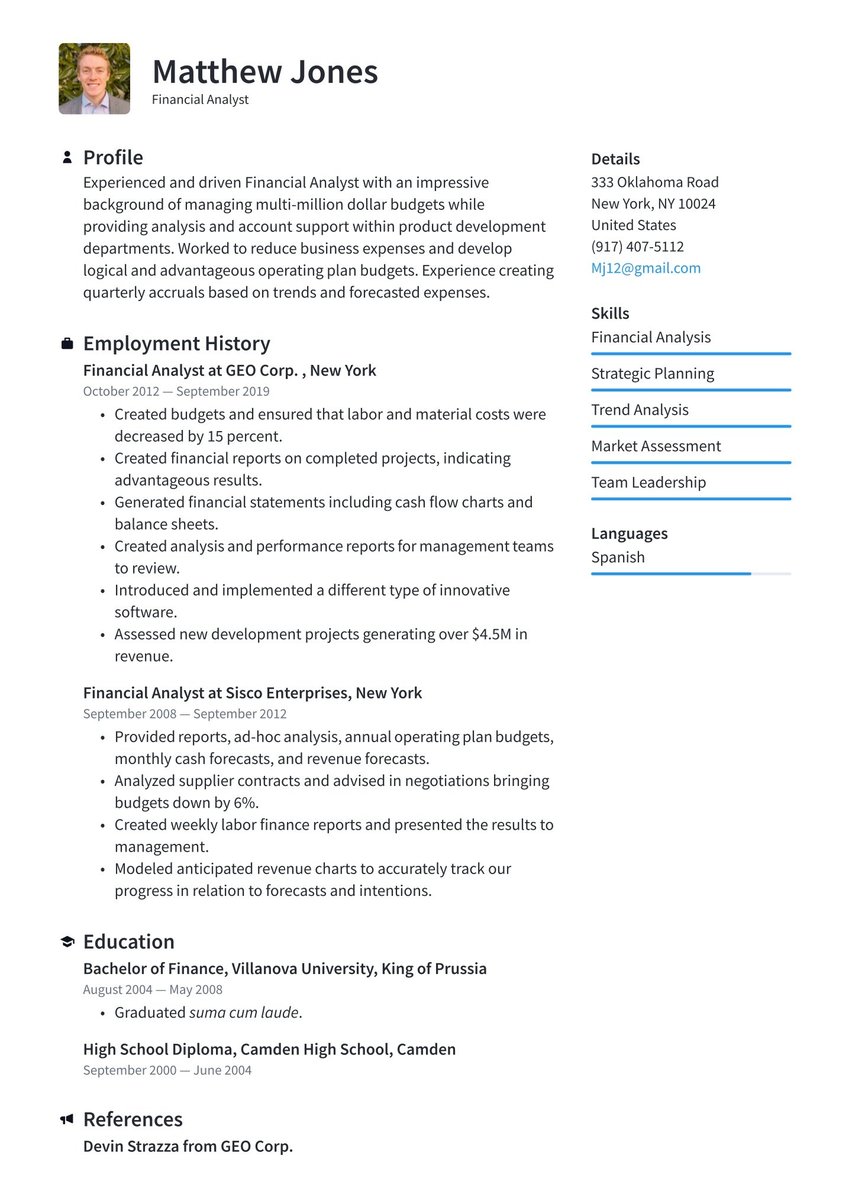

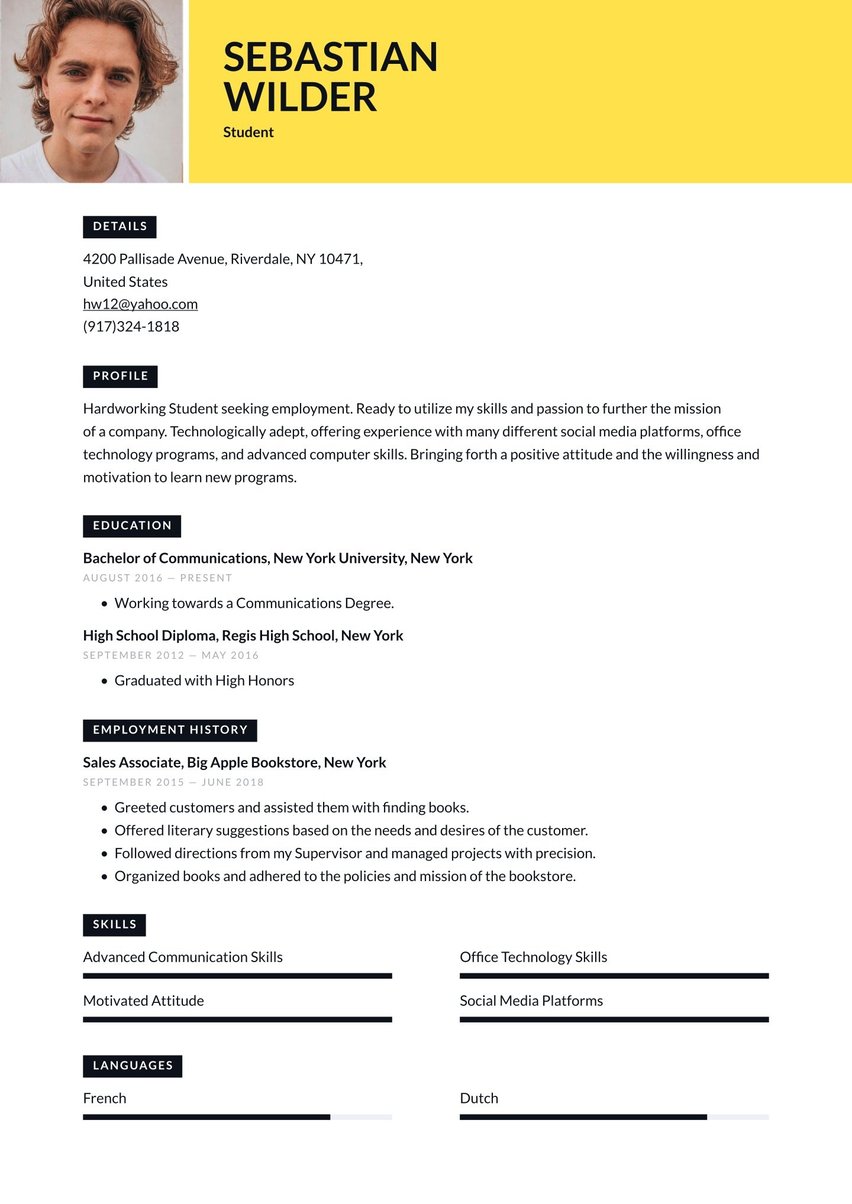

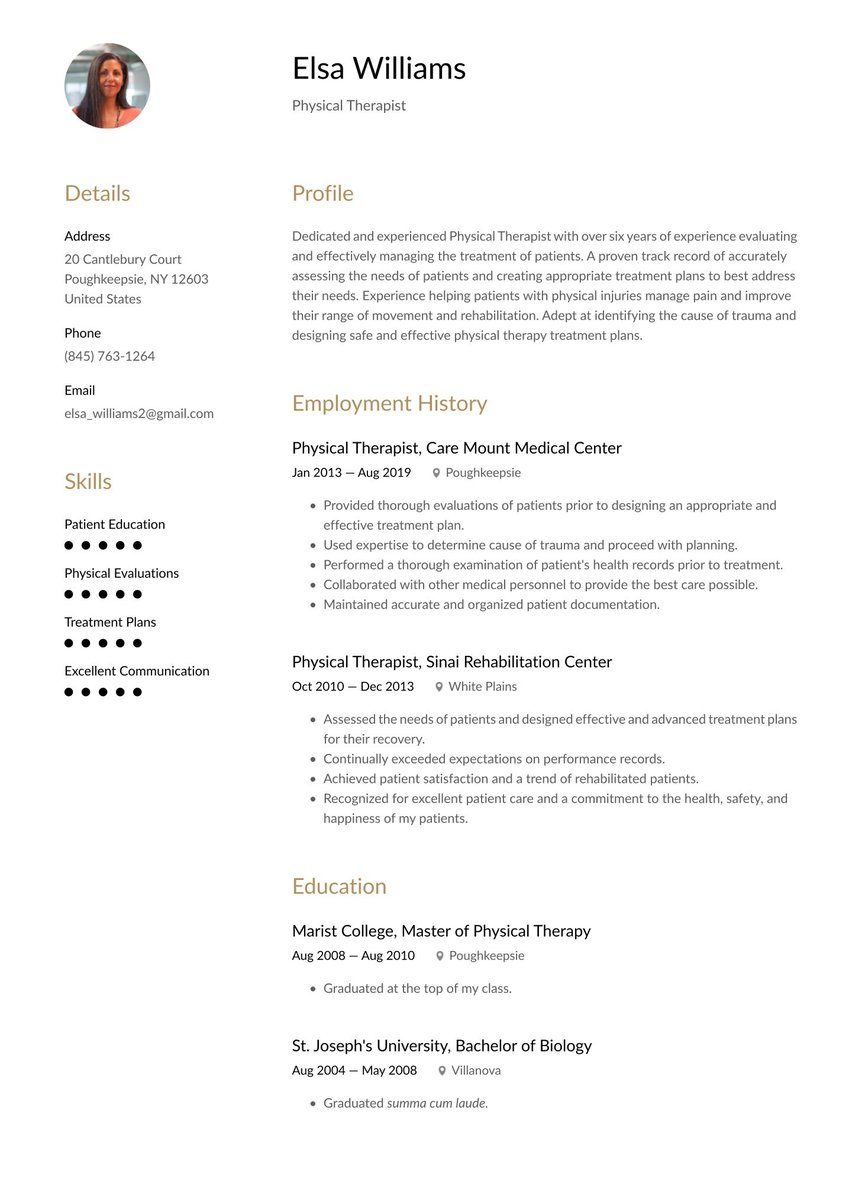

Susan Miller

Bookkeeper

312.331.1212

Chicago, IL

LinkedIn: linkedin.com/in/susan_miller1234/

Make use of a summary

The ATS algorithm places great weight on the content of your resume summary (sometimes called the profile or personal statement). In this section, it’s vital to demonstrate how you go about your work as a bookkeeper.

Your bookkeeper resume summary should portray you as having a safe pair of hands and a clinical mindset for ensuring that all figures add up. It should describe you as someone who puts figures and statistics at the heart of your work. No spreadsheet is too complicated and no expense is too insignificant.

For maximum impact, incorporate action verbs in the simple past or present tense—processed, maintained, reconciled, created, streamlined—and include quantifiable data to support your accomplishments, when possible.

Resume summaries aren’t a “cut and paste” of information on your resume. They’re meant to summarize your skills and natural talents that make you good at what you do—remember your unique value proposition? For example, “Spearheaded a comprehensive overhaul of the expense report system and identified vendor cost reduction opportunities that reduced monthly operating expenses by 10%.”

The summary should emphasize competency first and personality second. Pack it with details about the intricacies and scale of the work experiences highlighted. Ensure that your qualifications and training are center-stage and give them a professional slant. This is a great opportunity to shine and tell your own story.

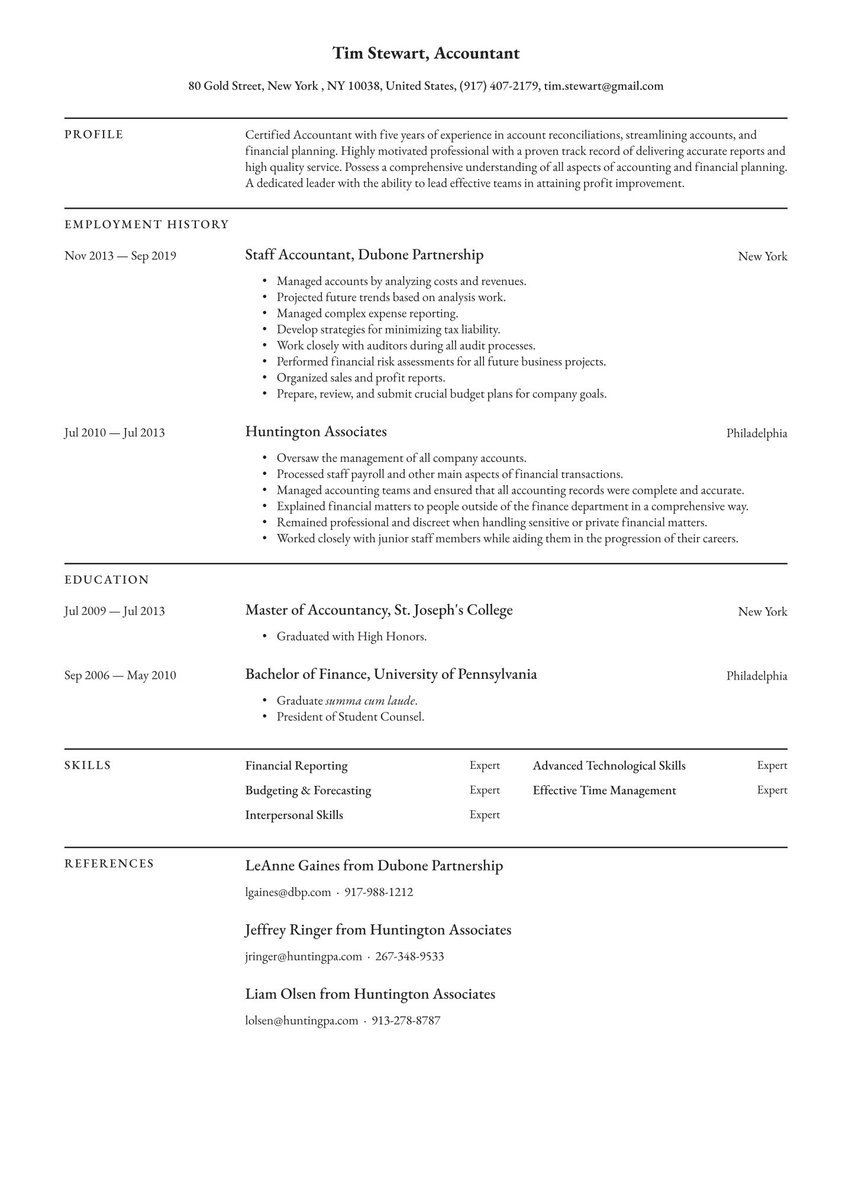

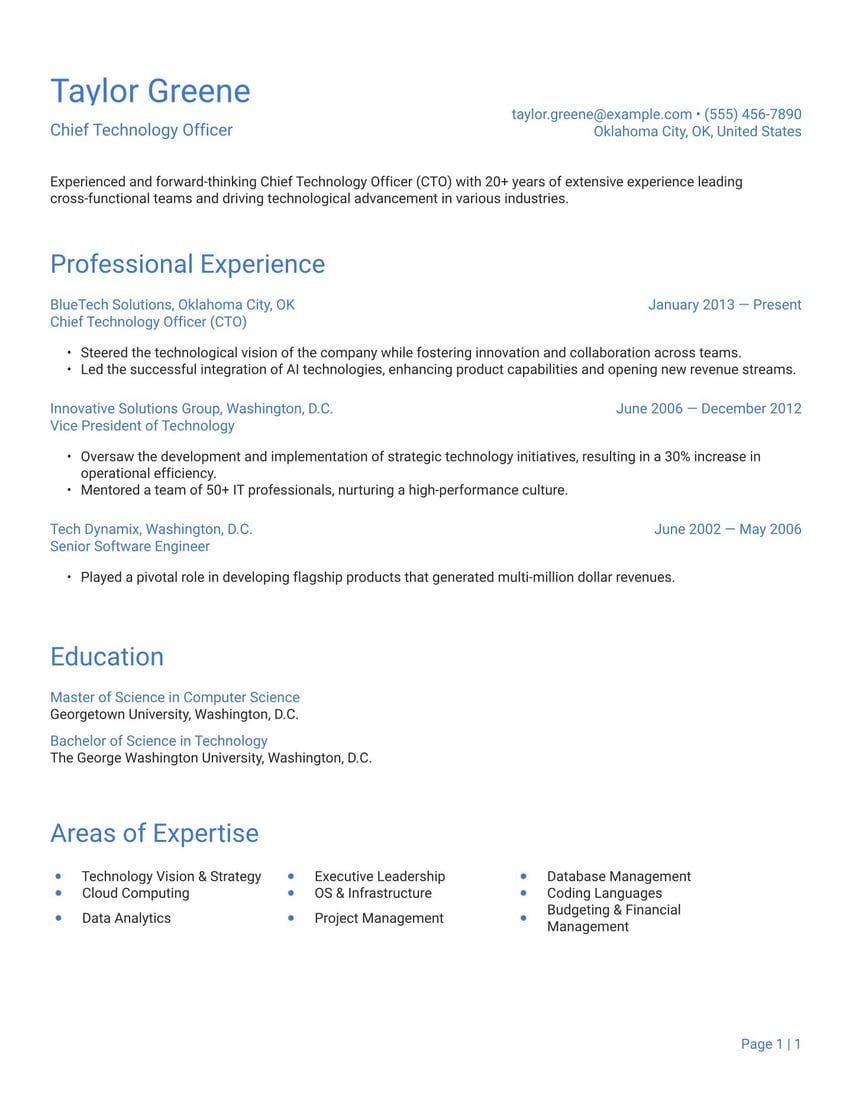

Need inspiration for your summary? Check out our related resumes:

- Accountant resume examples

- Auditing clerk resume sample (entry-level)

- Senior accountant example (senior level)

You can find adaptable bookkeeper resume examples summary below:

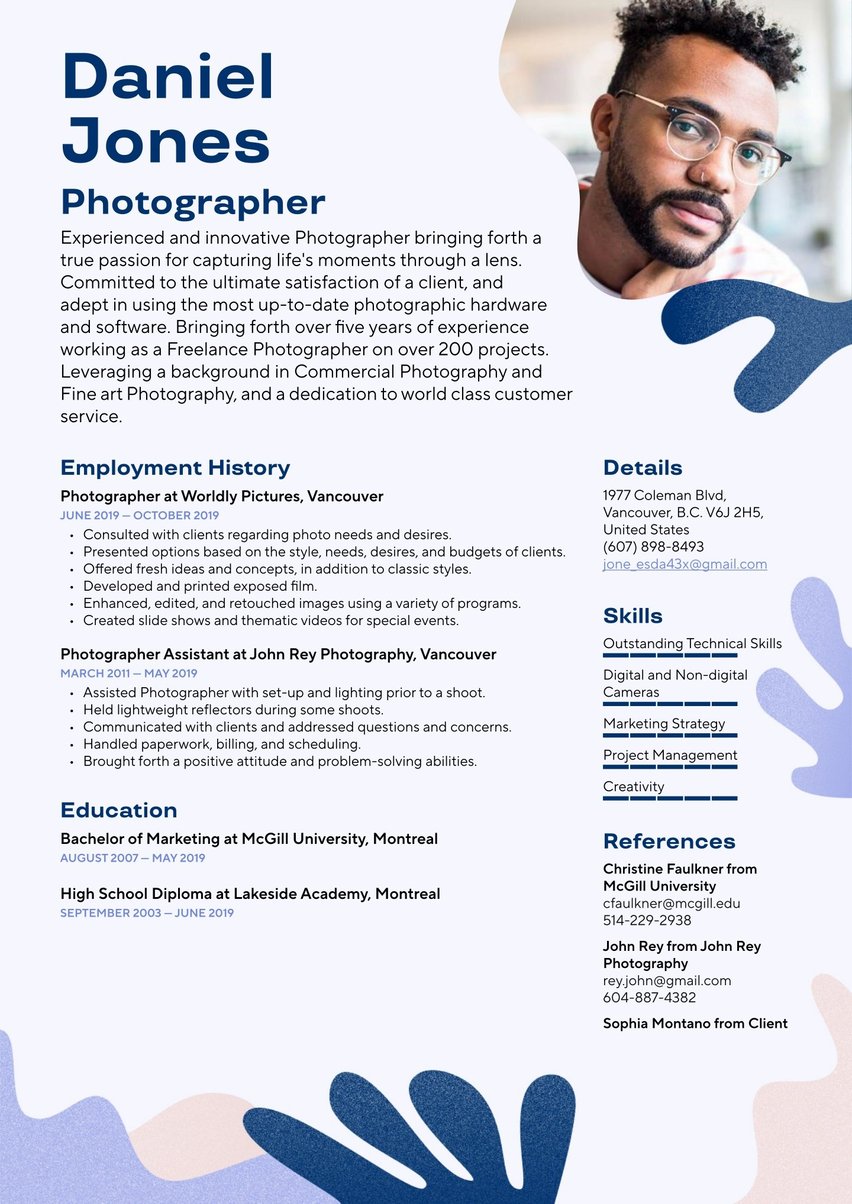

Detail-oriented bookkeeper with foundational experience in managing financial transactions and assisting with payroll processes. Skilled in financial software and basic accounting principles, with a strong aptitude for data entry and tax preparation. Eager to apply organizational and communication skills to contribute to efficient financial operations and continue professional development in bookkeeping.

Knowledgeable and experienced Bookkeeper with extensive knowledge handling and documenting financial transactions according to policies and preferred procedures. Experienced in maintaining accounts, processing accounts payable and receivable, managing invoices, and delegating payroll. Bringing forth excellent customer service skills, strong organizational skills, and the ability to communicate well with others.

Distinguished senior bookkeeper with a proven track record of spearheading comprehensive financial strategies and leading high-stakes accounting operations. Renowned for expert financial oversight and strategic planning, adept at implementing advanced accounting systems and driving process improvements. Instrumental in achieving a 15% reduction in tax discrepancies and enhancing operational efficiency by 25%, demonstrating a commitment to excellence and a visionary approach to fiscal management.

Outline your bookkeeping work experience: a precise record

A bookkeeper's employment history should not just be a list of responsibilities; ideally, it should include the financial impact of your work. Imagine what would happen if you were not there. That is your impact, and it can almost always be quantified.

To start, list your current (or most recent) job at the top of this section and work your way back to your first job. Don’t go back farther than 10-15 years. Focus on your experience that is directly relevant to the role you are applying for. If you feel the need to include them, other (or older) positions can be listed under a separate section called “Other experience.”

Illustrate your experience with measurable results and make sure that there are as many comparable facts and figures as possible to provide context. Don’t use the words “I” or “me.” Don’t forget to use powerful action verbs: balanced, budgeted, controlled, directed, forecasted, investigated, recovered, tracked, and verified.

Try to make your employment history section as packed with as much potentially relevant information as possible. You need to be seen as a leader for the accountancy function, not a follower.

Don’t just list your daily duties; demonstrate the outcome of your efforts. For example, have you ever seen vague, mundane statements like these in a bookkeeping resume?

- "Used AI to improve efficiency."

- "Consistently met deadlines."

- "Balanced monthly budgets."

These are basic tasks that just about any bookkeeper can do. However, they don’t show your unique value proposition or your accomplishments as an in-demand bookkeeper. You want to position yourself as an achiever, not just a “doer.”

Instead, include results-based points throughout your resume. This could include improved efficiencies, reduced errors, money saved, and so on. Additionally, don’t forget those soft skills that demonstrate how well you work with others. For instance, convey your ability to translate financial issues into everyday language.

Remember those boring statements from earlier? Here’s how to rework them to make them more dynamic and impactful:

- "Initiated and oversaw an AI-powered payroll system, reducing manual input by 50% and raising accuracy to 98.8% for a mid-size manufacturing firm with $10M in annual revenue."

- "Managed quarterly tax processes for multiple departments, meeting deadlines and reducing close time from 14 days to 10.”

- "Oversaw monthly bank reconciliations to identify issues and discrepancies and improve financial accuracy by 67%.”

Consider using the STAR method to describe achievements in your resume's work history section: Situation you were in, Task(s) you had, Actions/strategy you used and Result you achieved.

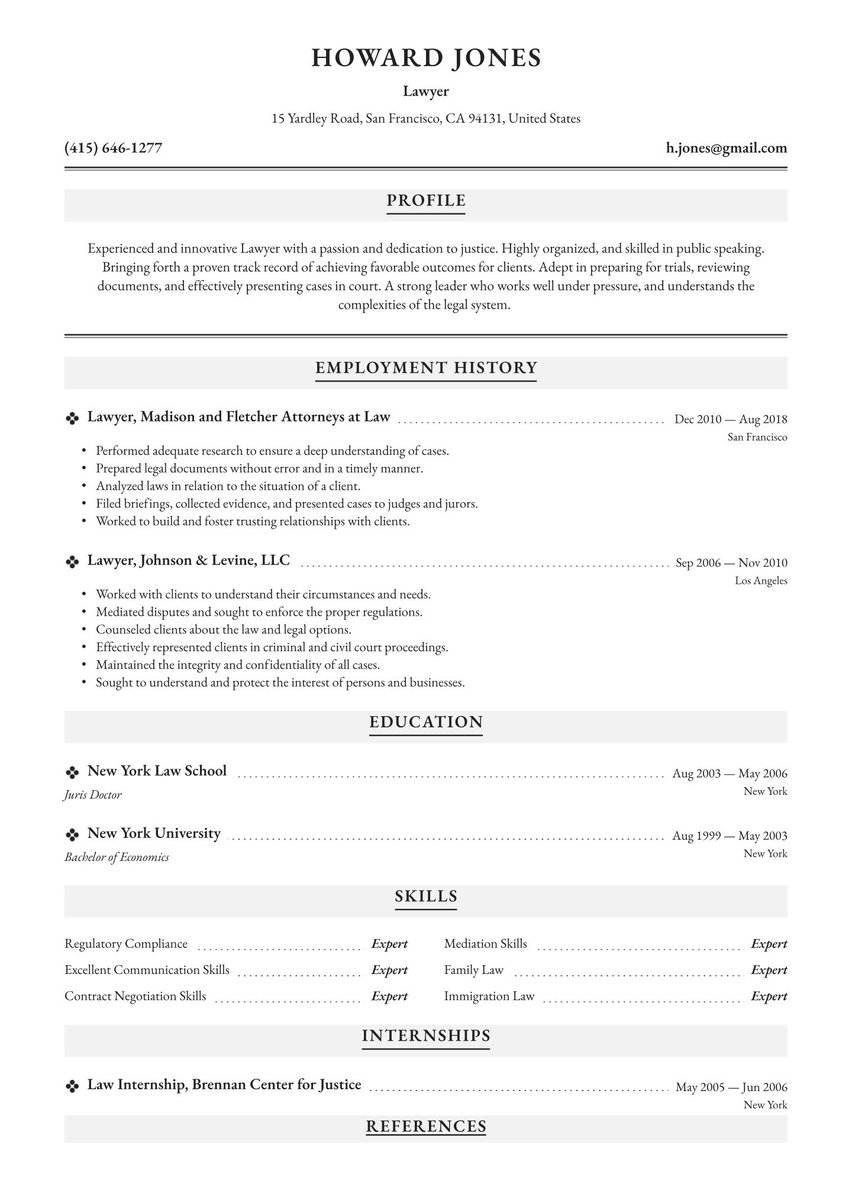

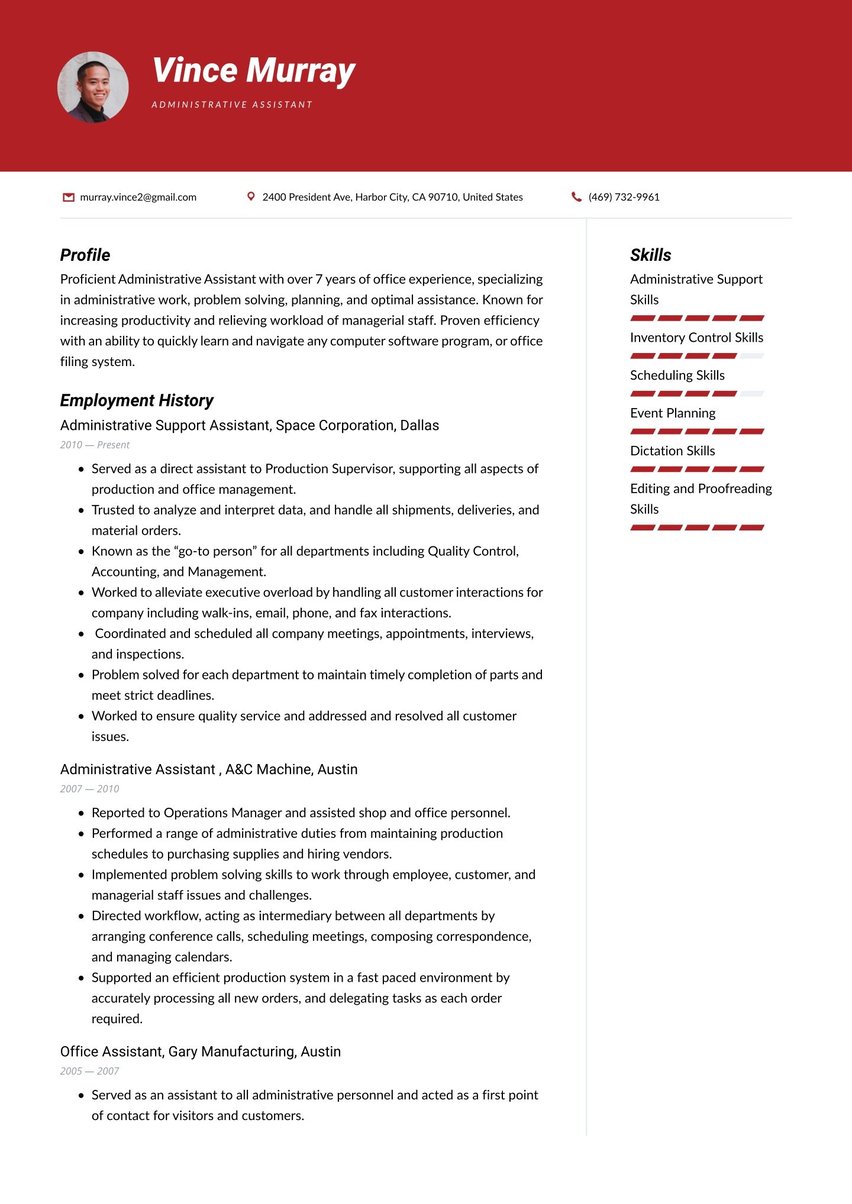

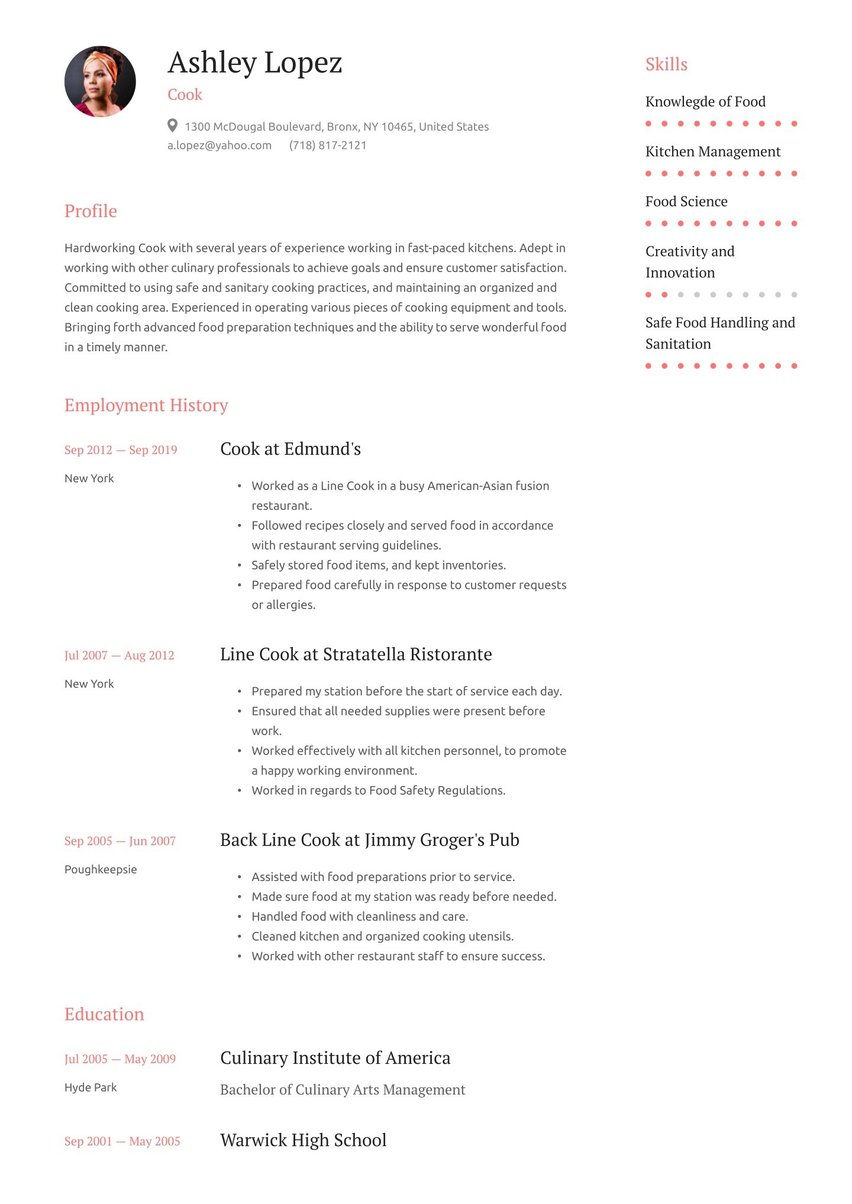

Take a look at the bookkeeper employment history resume sample below:

Bookkeeper at Schwartz & Associates, Austin

July 2016 - September 2019

- Processed payment and assisted with all financial transactions.

- Prepared payroll and direct deposit accounts.

- Maintained books including bank statements, transactions, and all receipts.

- Helped to manage and resolve billing disputes and collections.

- Prepared Federal, City, and State tax returns.

- Worked with Accountant at the end of the year to provide information and ensure accuracy.

Bookkeeper at Brookfield Medical Center, Brookfield

August 2013 - June 2016

- Documented weekly and monthly payrolls and prepared tax documents.

- Processed accounts payable and accounts receivable.

- Organized and computed payroll data for employees.

- Utilized a new Excel financial recording system to increase efficiency and accuracy.

- Communicated with customers to resolve outstanding payments and develop payment plans.

Include the relevant key skills that make you a great bookkeeper

The skills listed on your bookkeeper resume reflect your understanding of their crucial importance to an employer's financial health.

In your skills list, combine hard and soft skills that showcase your comprehensive expertise. Hard skills like math, data entry, preparing financial reports, or even accounting software like Freshbooks or Xero, are most likely going to be requirements for any bookkeeping position.

However, soft skills like time management, communication skills, integrity, and transparency can move you to the front of the line. Don’t discount them, even in a numbers-heavy role like a bookkeeper.

If you need help, resume.io’s resume builder offers a number of pre-written key skills to choose from with applicable proficiency ranges. You can also enter your skills manually if you prefer.

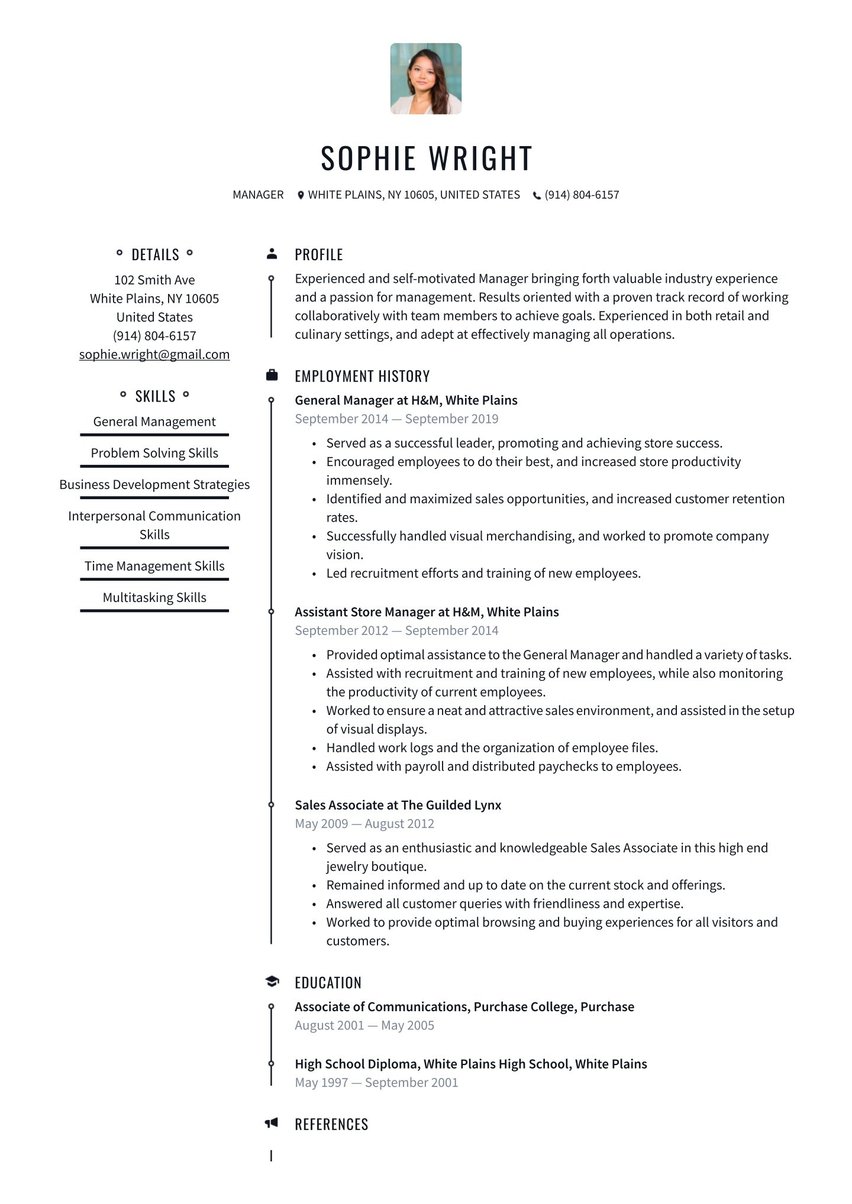

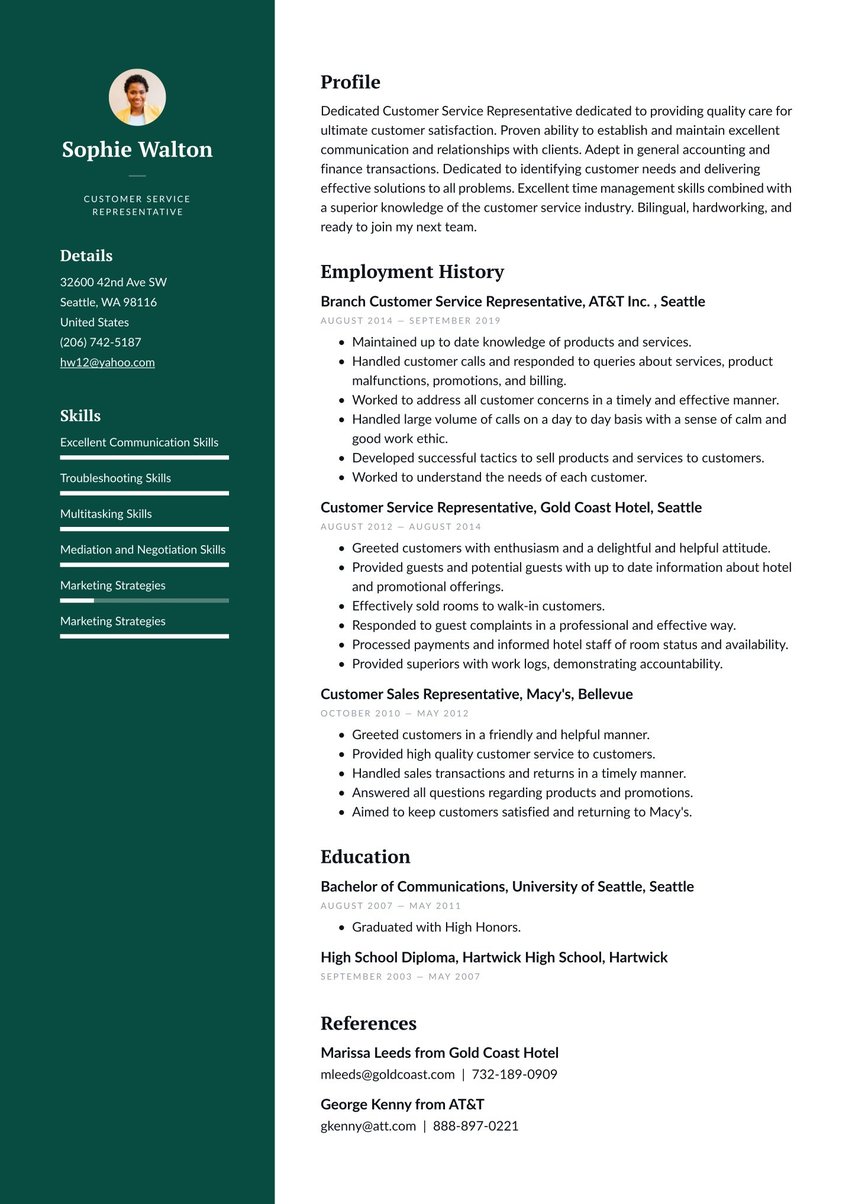

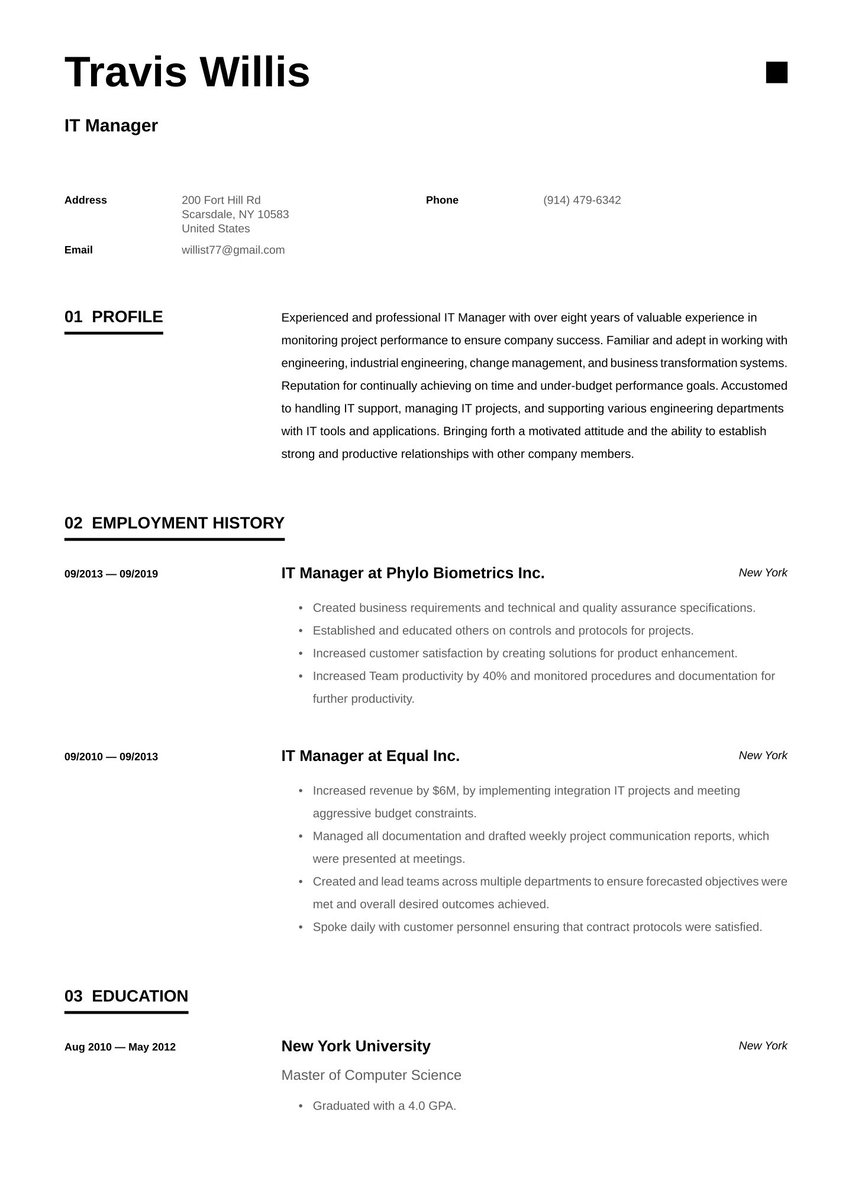

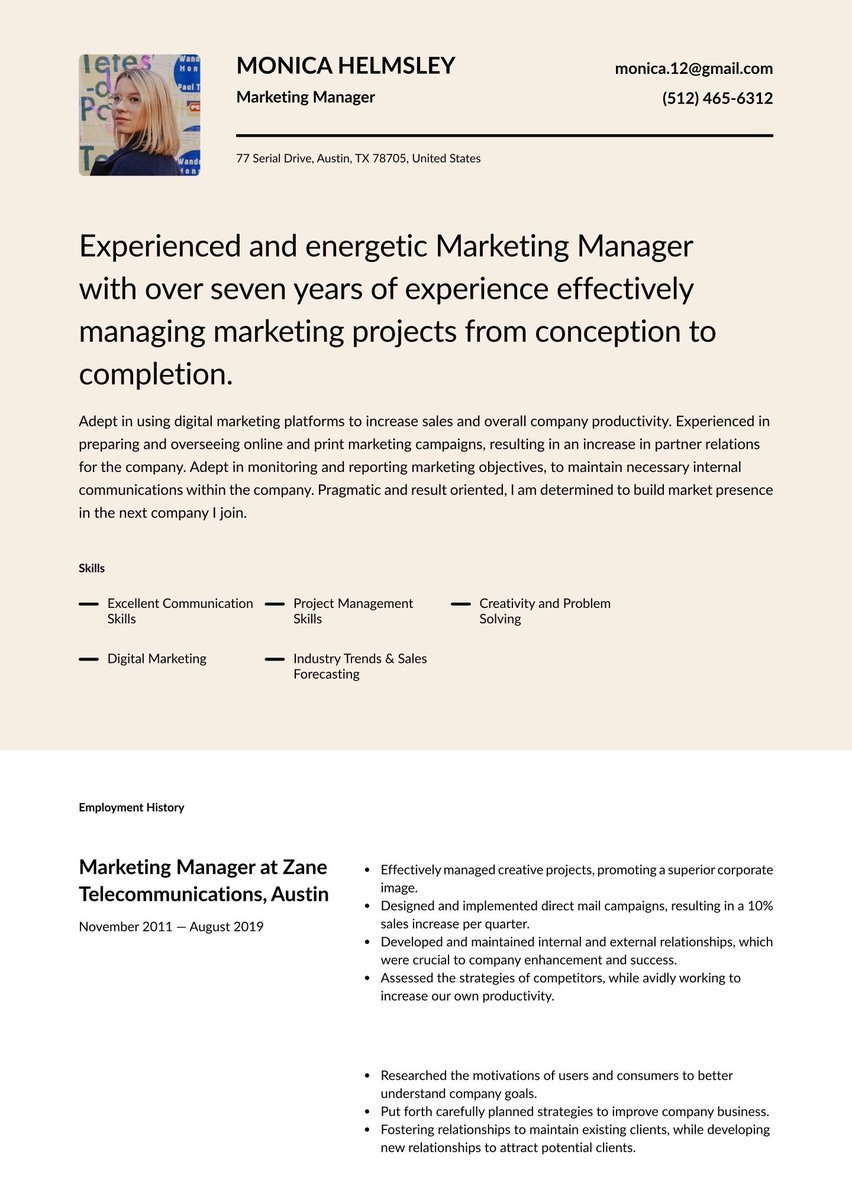

Here’s what the skills box looks like in our bookkeeper resume template.

Key Skills and Proficiencies

Don’t limit your key skills to the “Skills” section. Incorporate them throughout your resume, and support your experience by giving specific examples and achievements.

For example, in your work experience section and professional summary, highlight your

- Organizational skills by describing how you kept files and records organized to accurately account for transactions, expenses, and other important financial information.

- Attention to detail by demonstrating how you can identify minor discrepancies in financial records, thereby saving the company money.

- Accounting software knowledge by demonstrating how you used these products effectively to reduce errors or unnecessary expenses.

Use the job description as a guide for what key skills the company is looking for and include them on your resume when applicable to your situation.

Detail your education & relevant bookkeeping certifications

The education section of your bookkeeper resume is where you list college degrees and other relevant training and credentials in reverse chronological order, from highest to lowest levels. If you have a college degree, omit your high school information.

Beyond formal education, this section is a great opportunity to list certifications or training relevant to car sales. For example:

- Training and certifications. List any outside courses, workshops, seminars, or professional certifications that demonstrate your commitment to keeping your skills up to date.

- Internships. If you had summer internships while in school, include them here. If you have coursework or training in similar fields where the skills are transferable, such as accounting, include them as well.

- Professional development. Membership in organizations such as The American Institute of Professional Bookkeepers (AIPB), shows that you’re enthusiastic about bookkeeping and want to learn from others.

If your education or training is particularly impressive, or you’re just starting or changing careers, consider placing this section above your work history. This format is called a functional resume and it emphasizes transferable skills and education over practical experience.

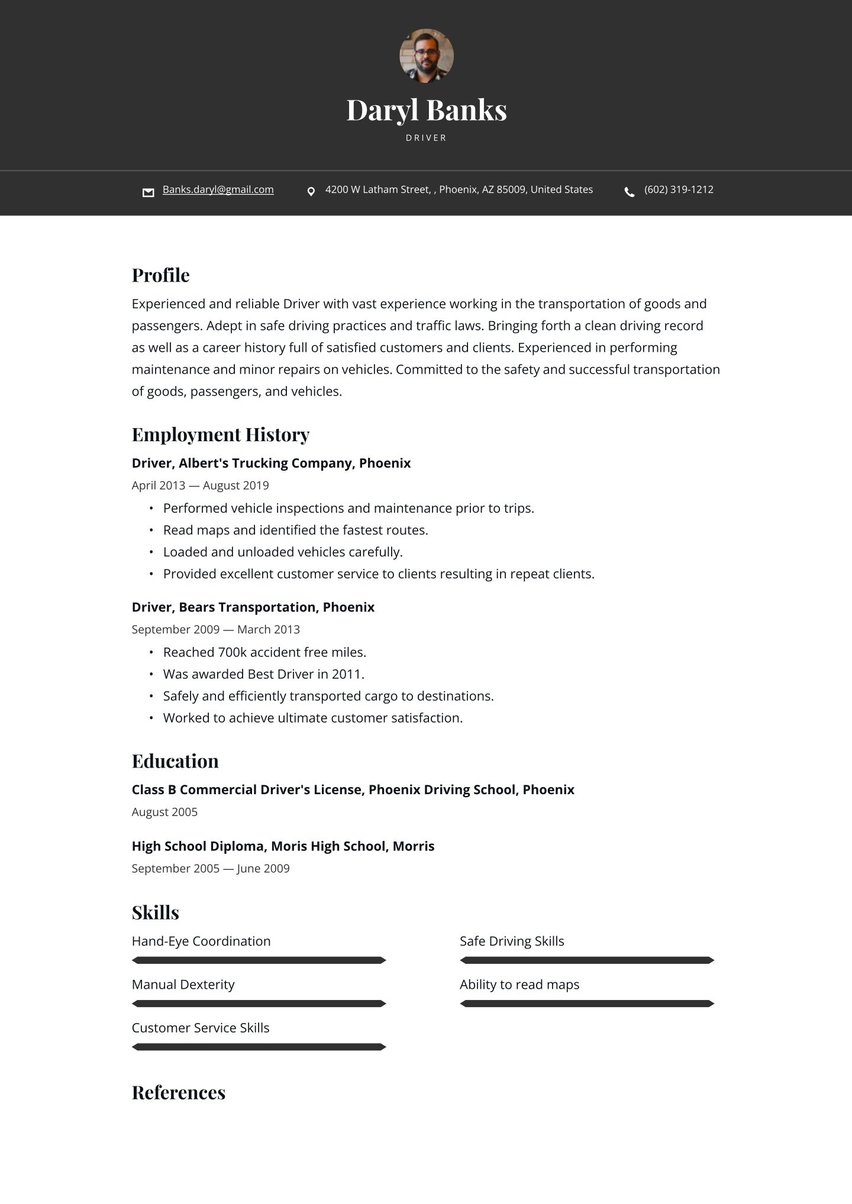

Bachelor of Communications, Baylor University, Waco

September 2009 - May 2013

High School Diploma, Bridge City High School, Bridge City

September 2005 - May 2009

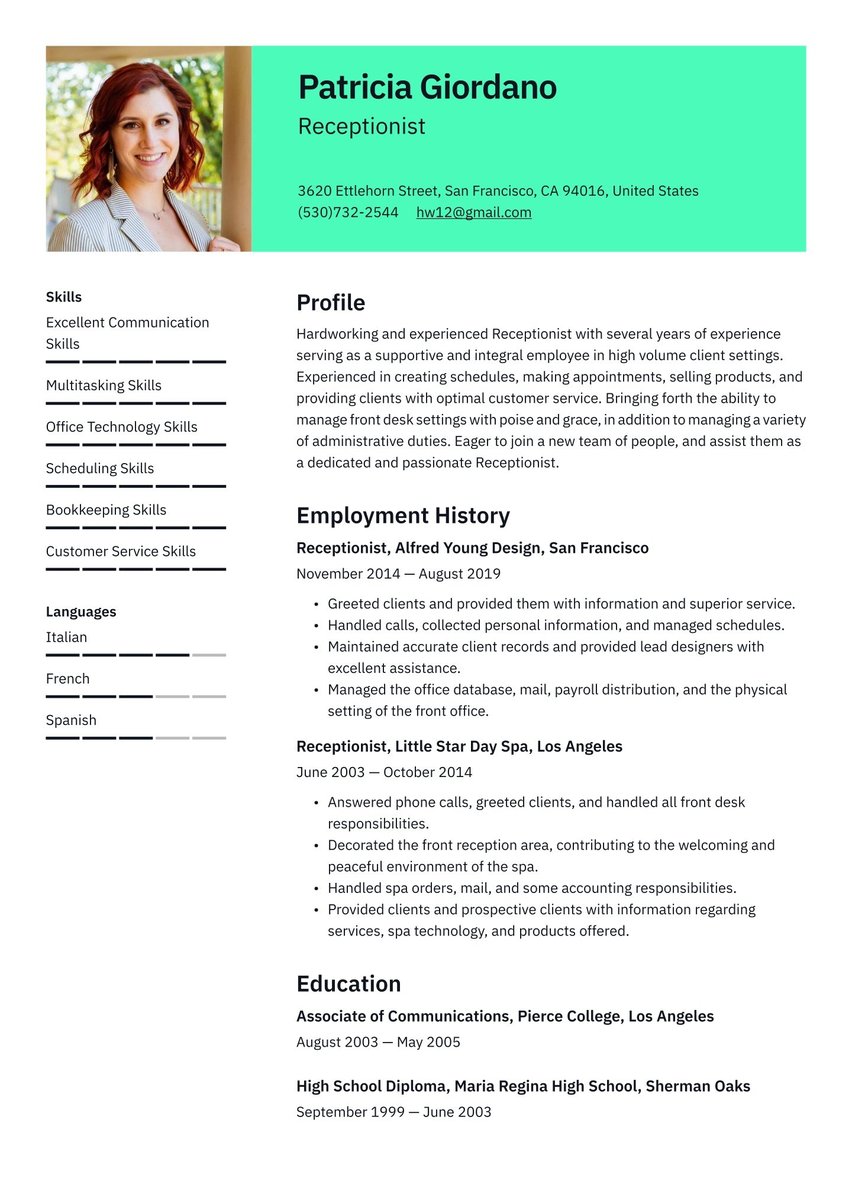

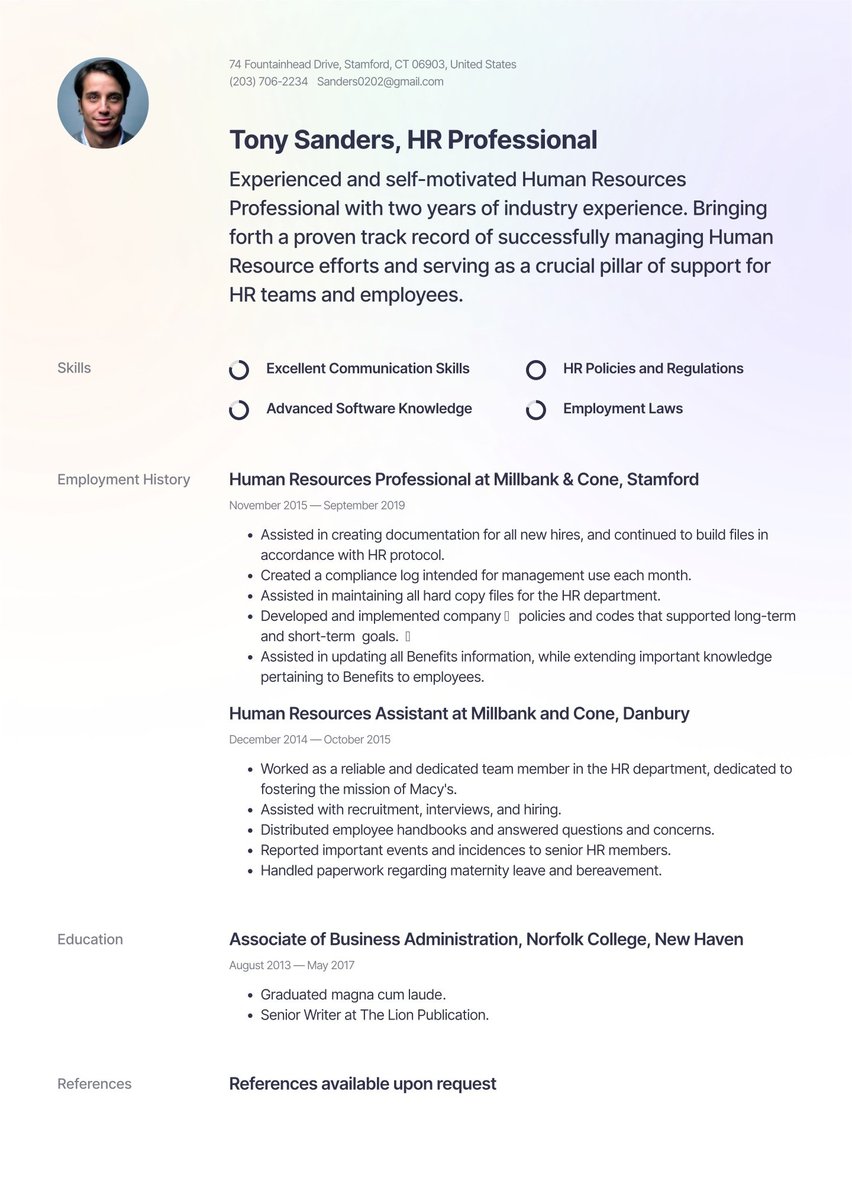

Pick the right resume layout and design for a bookkeeper resume

The right layout, design, and formatting choices will help ensure that every element of your bookkeeper resume is visually clear and effective.

There are no specific rules to follow, but it's generally advisable to match the degree of formality to the industry and employer. Consider the impact you want your resume to make on financial professionals who are likely to value substance over intricacies of style.

Keep the look simple, clean, and uncomplicated. Bullet points are ideal for enhanced readability.

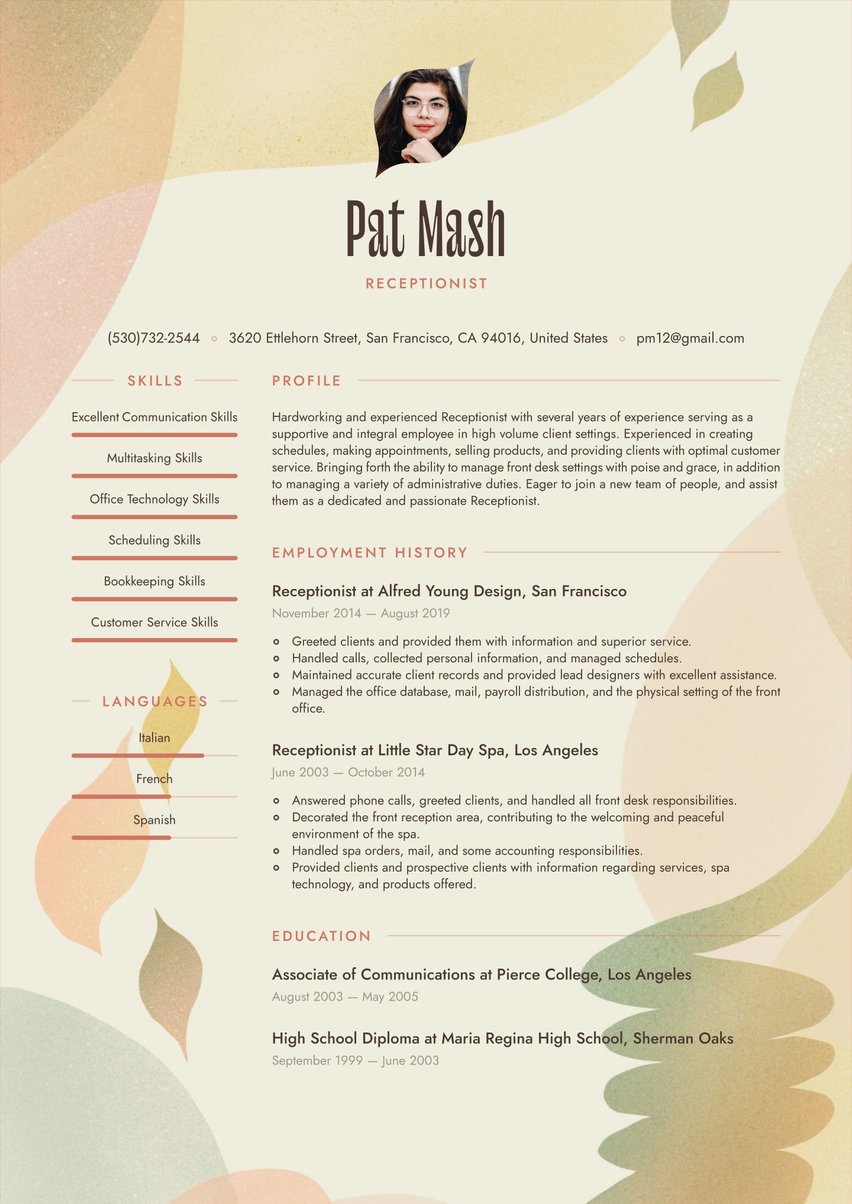

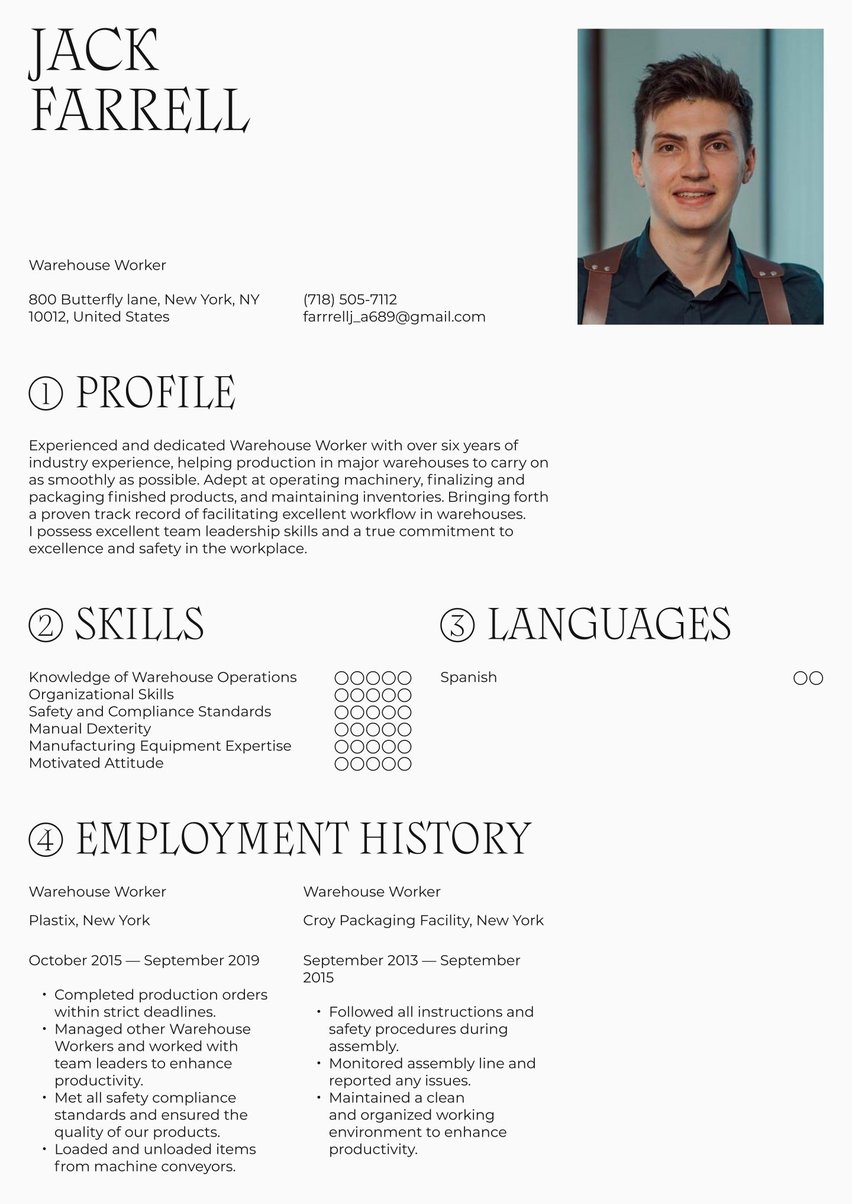

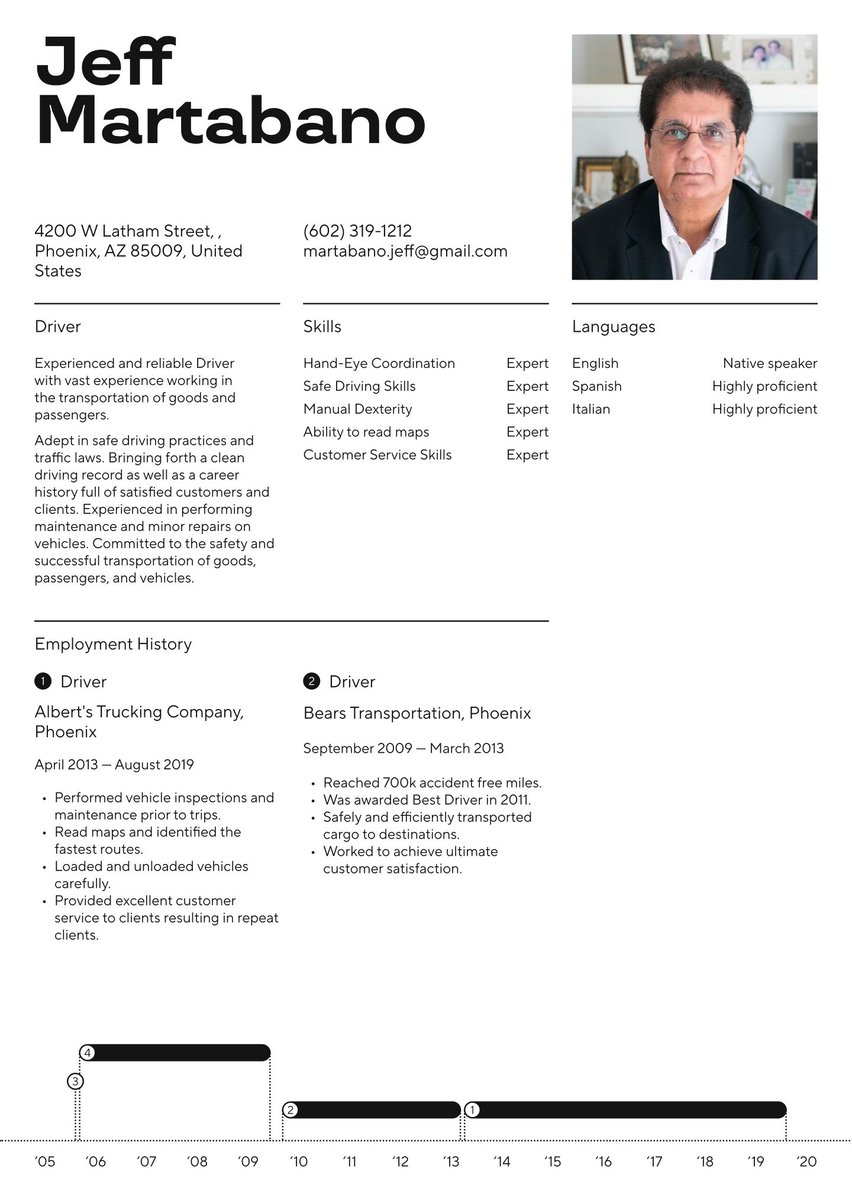

For a bookkeeper resume, we recommend distinct sections, a classic, easy-to-read font, and no or limited color. Bookkeeping tends to be a more traditional field, so your resume shouldn’t have bold graphics or a lot of fussy design elements. The bookkeeper resume sample here, for example, makes use of our Shanghai template—a sleek, clean layout with a block of color at the top for visual impact.

You can't just snap your fingers and create a professional, polished resume, but there are tools that make the process easier, like our field-tested resume templates, which offer a wide range of eye-catching designs where the formatting and structure are already in place. They are easy to customize with replacement text using the resume builder.

Bookkeeper text-only resume example

Profile

Knowledgeable and experienced Bookkeeper with extensive knowledge handling and documenting financial transactions according to policies and preferred procedures. Experienced in maintaining accounts, processing accounts payable and receivable, managing invoices, and delegating payroll. Bringing forth excellent customer service skills, strong organizational skills, and the ability to communicate well with others.

Employment history

Bookkeeper at Schwartz & Associates, Austin

July 2016 - September 2019

- Processed payment and assisted with all financial transactions.

- Prepared payroll and direct deposit accounts.

- Maintained books including bank statements, transactions, and all receipts.

- Helped to manage and resolve billing disputes and collections.

- Prepared Federal, City, and State tax returns.

- Worked with Accountant at the end of the year to provide information and ensure accuracy.

Bookkeeper at Brookfield Medical Center, Brookfield

August 2013 - June 2016

- Documented weekly and monthly payrolls and prepared tax documents.

- Processed accounts payable and accounts receivable.

- Organized and computed payroll data for employees.

- Utilized a new Excel financial recording system to increase efficiency and accuracy.

- Communicated with customers to resolve outstanding payments and develop payment plans.

Skills

- Advanced Technological Skills

- Bookkeeping Software

- Data Entry Skills

- Accounting Skills

- Team Leadership Skills

- Market Assessment Skills

- Superior Communication Skills

Education

Bachelor of Communications, Baylor University, Waco

September 2009 - May 2013

High School Diploma, Bridge City High School, Bridge City

September 2005 - May 2009

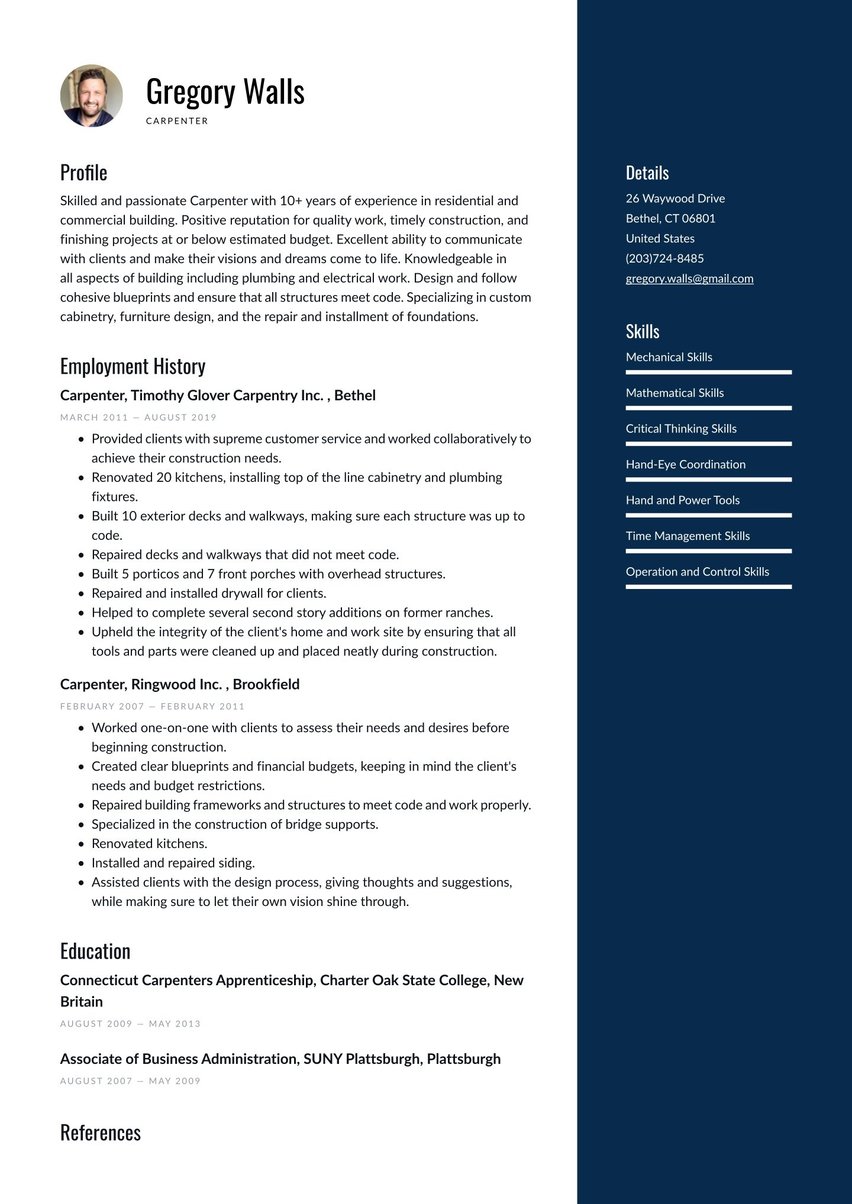

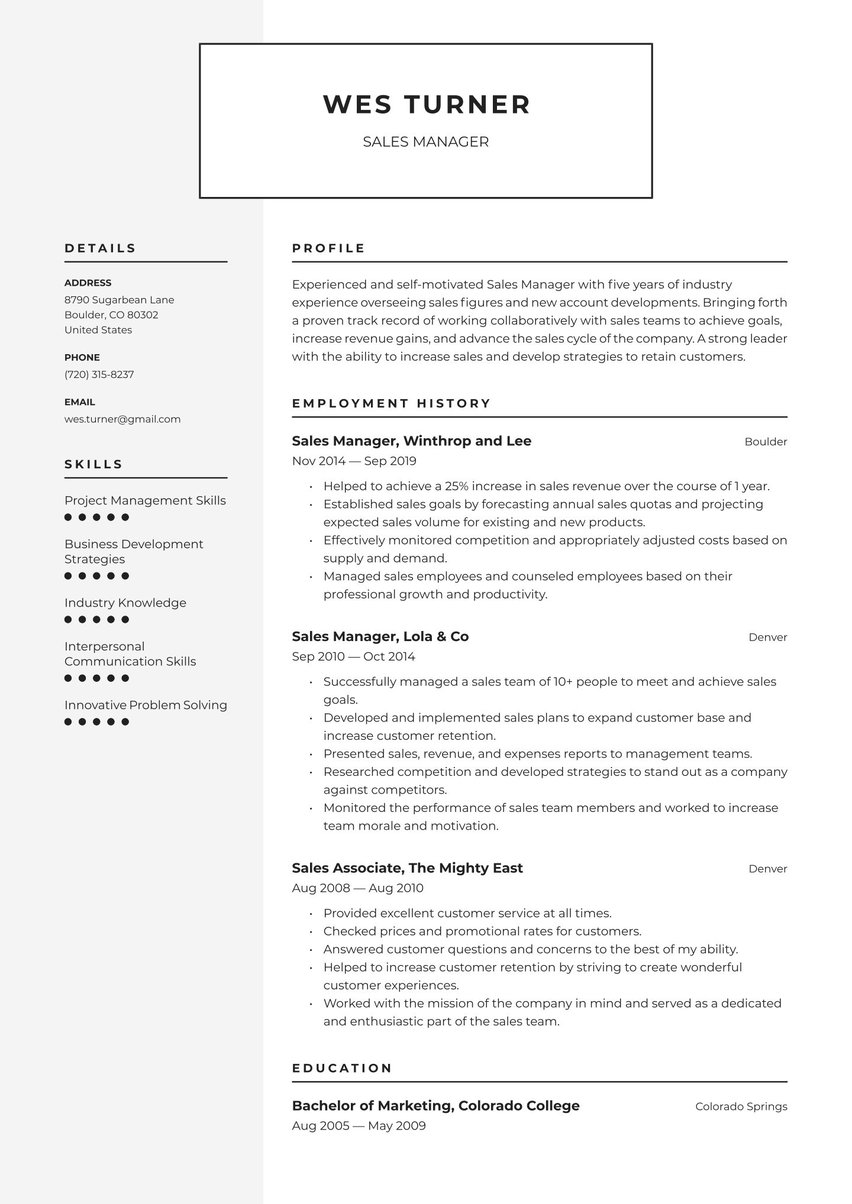

Bookkeeping job market and outlook

Many accounting and bookkeeping functions are being automated, so the overall need for bookkeepers has declined, however, companies still require the human touch to keep their records accurate and organized.

- Overall employment of bookkeepers is expected to decline 5% over the next 10 years.

- Despite this decline, about 174,900 openings for bookkeepers are projected each year over the next decade.

- There are 1,663,800 active bookkeeping jobs in the US.

What type of salary you can expect in bookkeeping

Bookkeepers earn a median annual wage of $47,440. Median salaries for bookkeepers in different industries make roughly the same salary, ranging from $43,150 in the retail industry to $48,960 for those in the professional, scientific, or technical services fields.

Salaries for similar roles

- Accountant $79,880

- Budget analyst $84,940

- Financial clerk $47,070

Key takeaways for building a bookkeeper resume

Make sure that your resume reflects your professionalism and place the focus on your accomplishments, qualifications, and your unique value proposition. Demonstrate how you use the latest technology to enhance your work, and how you have made a measurable financial impact for previous employers. Lastly, optimize your resume using appropriate keywords and action verbs from the job description to pass through the ATS.

Start your job search with a resume builder, but why stop there? With resume.io’s 18 powerful tools, you can search for jobs, track your journey, prepare for interviews, and negotiate salaries—all with our all-inclusive career toolkit at your fingertips.

.jpg)

.jpg)