06/2010 - 08/2019, Banker, PNC Bank, Boston

- Worked to deliver the highest level of client service possible.

- Effectively managed client portfolios and offered advice regarding investments.

- Performed risk assessments and studied market trends.

- Reviewed credit applications, and processed them according to best practices.

- Adhered to bank policies and facilitated safe and protected transactions.

- Trained and supported new team members.

09/2007 - 05/2010, Banker, Wells Fargo & Company, Boston

- Worked as a dedicated team member of the Wells Fargo team.

- Reviewed and processed individual loan and credit applications.

- Provided clients with new product and program information.

- Handled cash transactions.

- Offered clients guidance regarding savings programs.

08/2002 - 05/2006, Bachelor of Economics, St. Joseph's University, Villanova

09/1998 - 05/2002, High School Diploma, Norwell High School, Norwell

- English

- Spanish

- Financial Planning

- Customer Service Skills

- Risk Assessment Skills

- Market Knowledge

- Knowledge of Banking Software

- Problem Solving Skills

The world of financial services has always been a lucrative career path, and today's interconnected global economy makes that truer than ever. If you’re a specialist in banking or are looking to become one, a stellar resume is the key to landing a top job with a great salary, benefits and work environment.

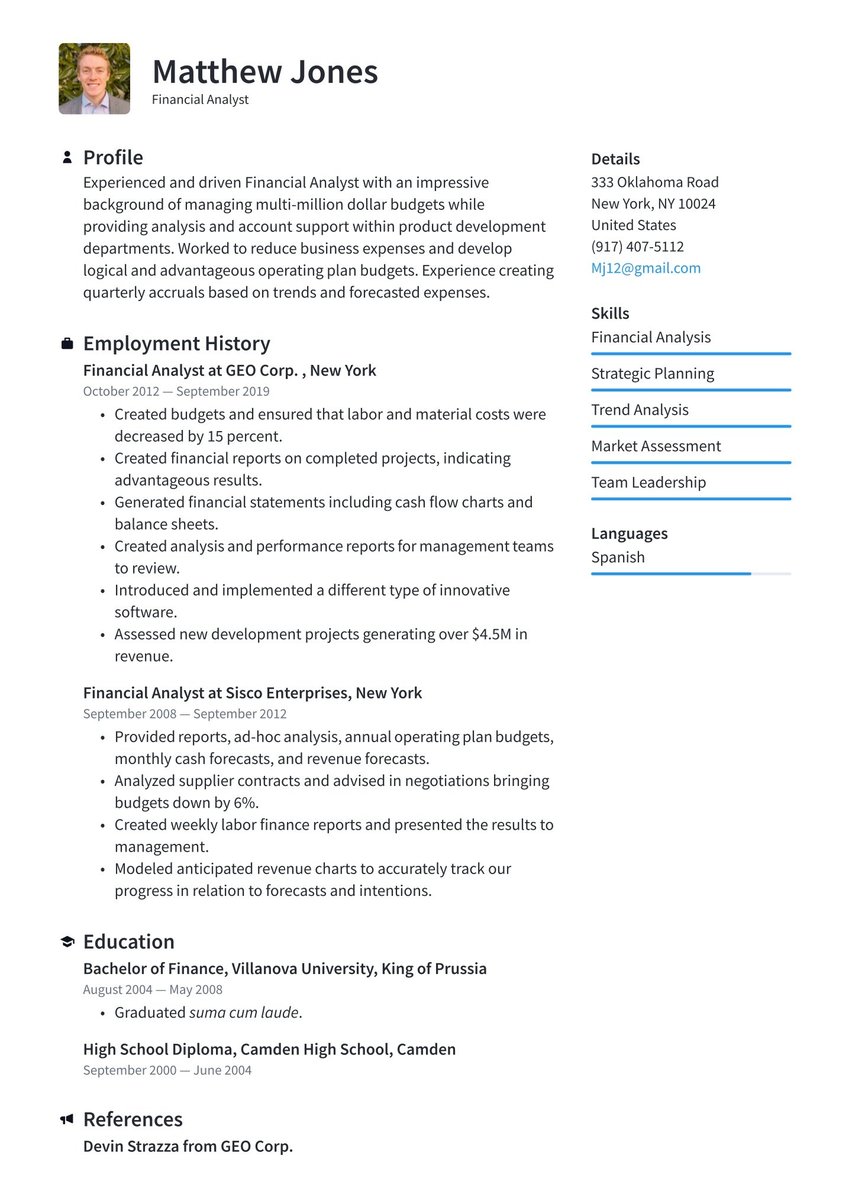

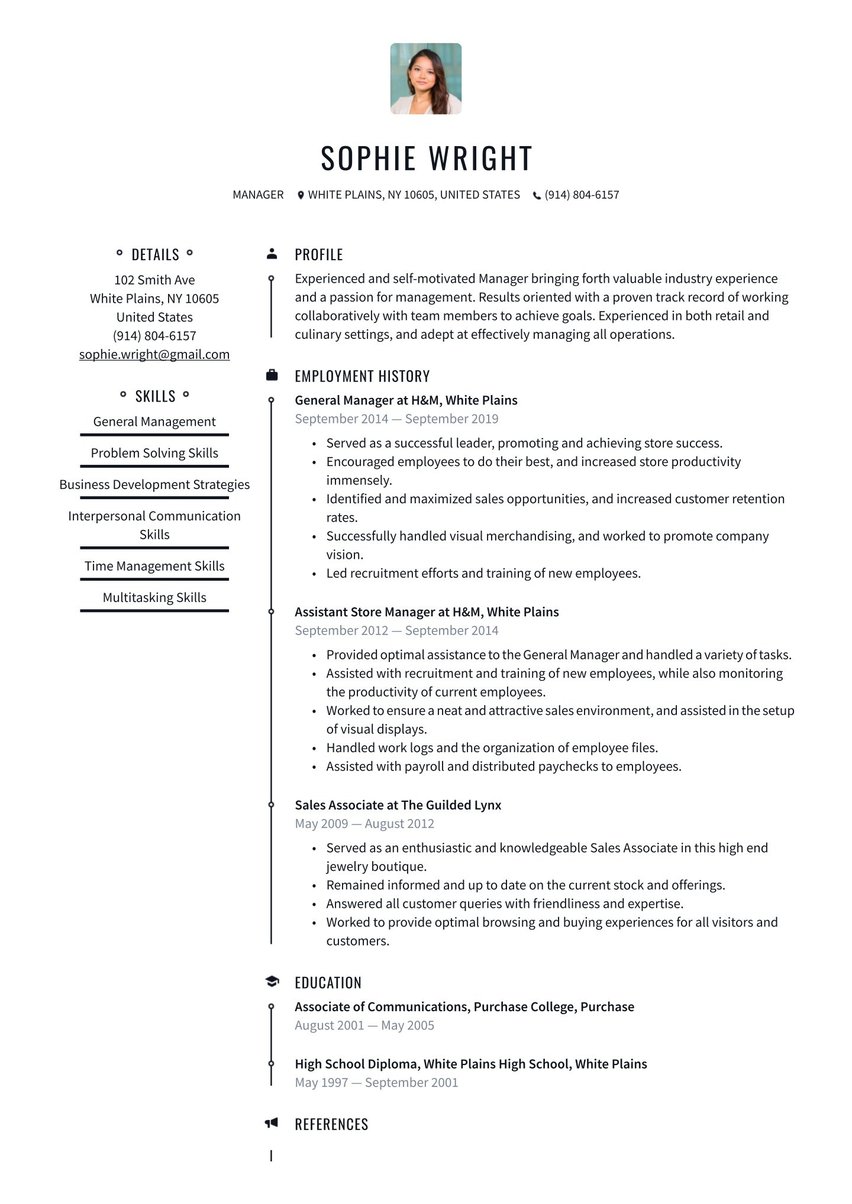

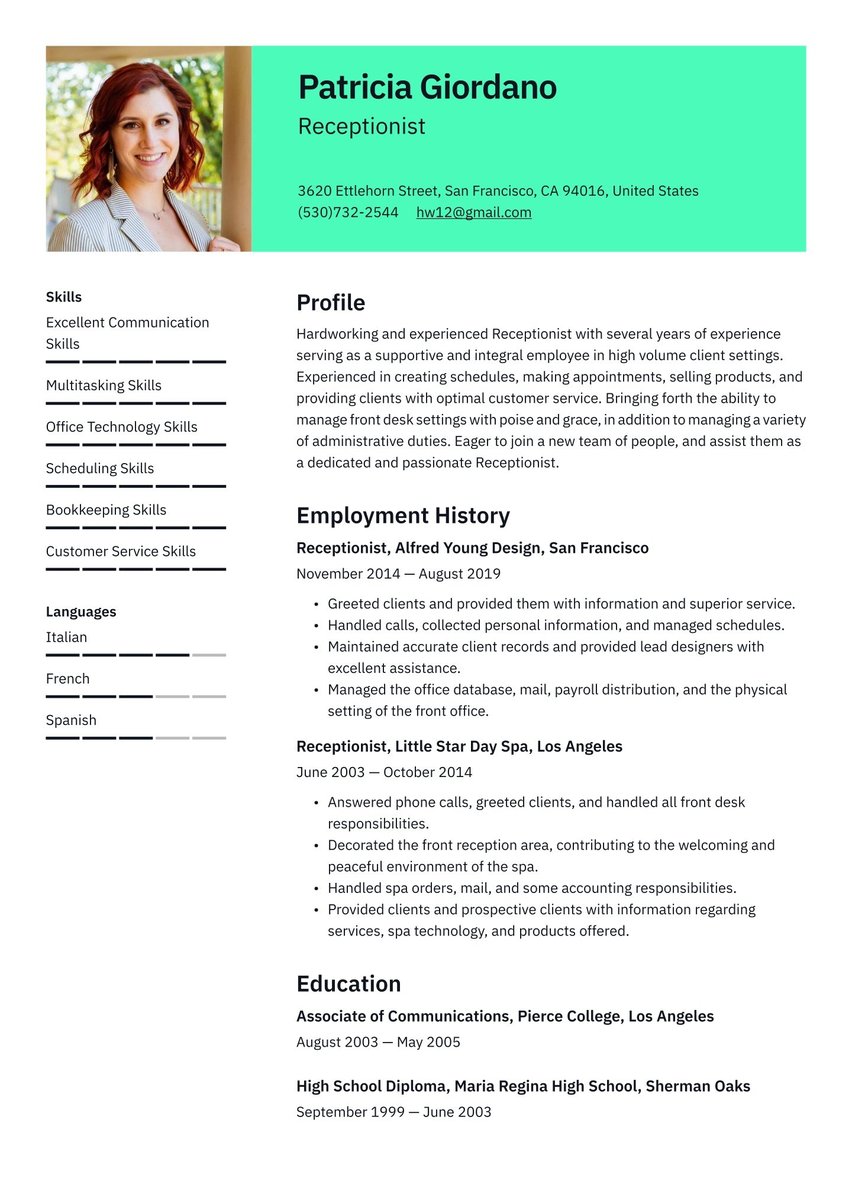

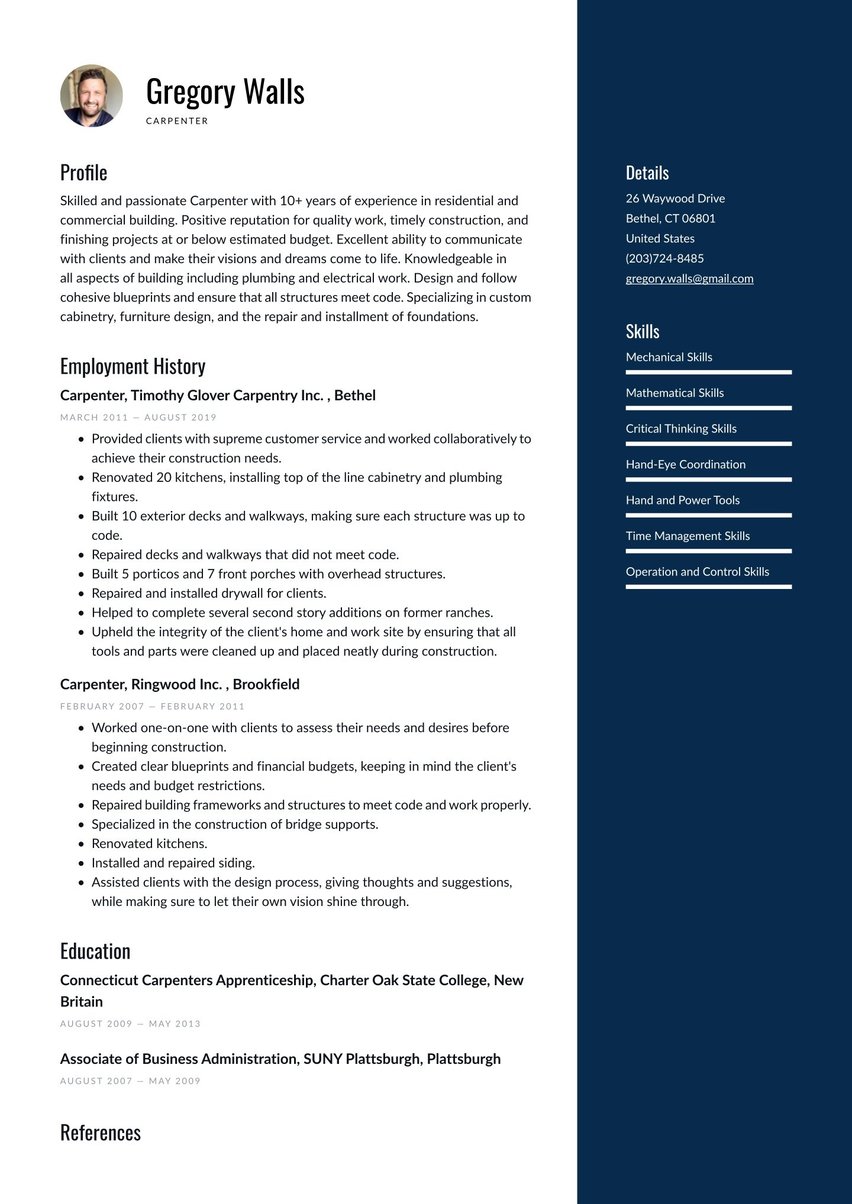

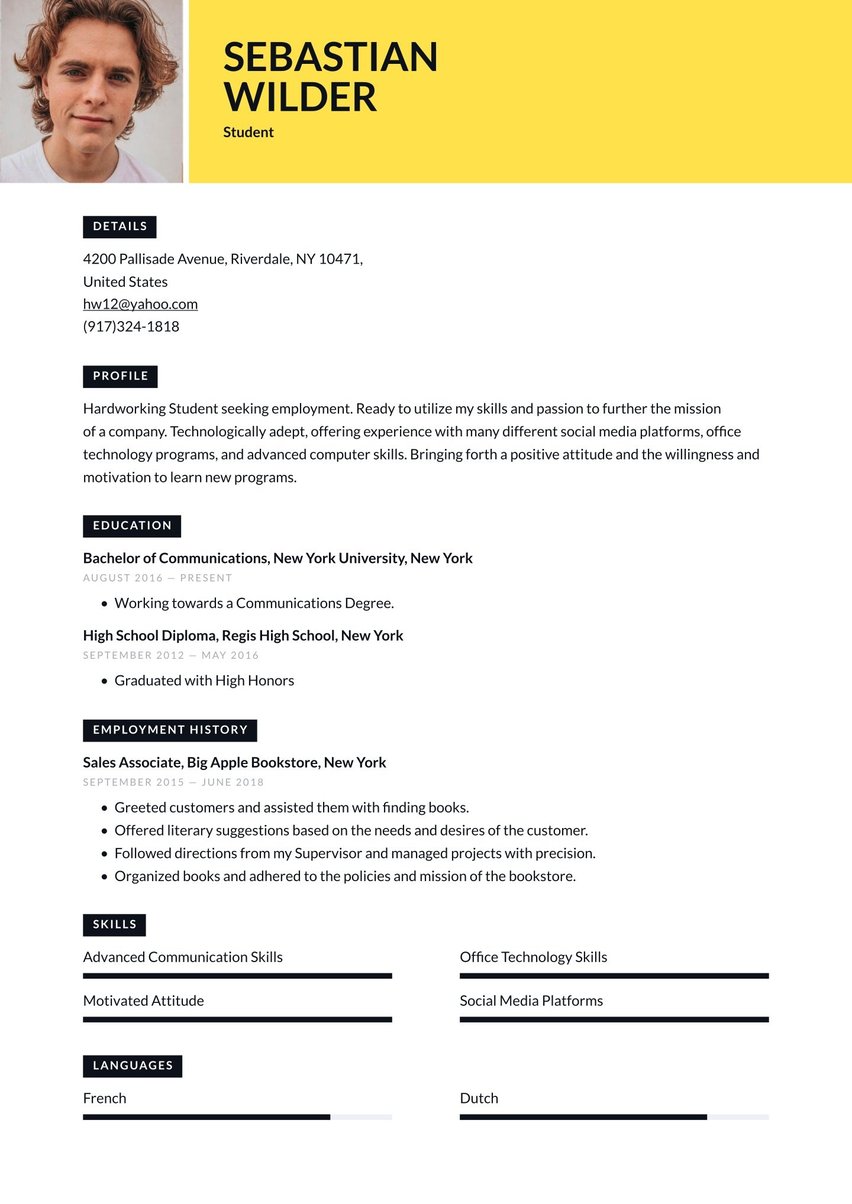

Banker resume examples by experience level

Surveys have shown that hiring managers usually spend only a few seconds reading a resume, so there’s little room for error and little time to make an impact. This is a basis for Resume.io’s ever-expanding collection of tips and tools. It includes more than 350 occupation-specific resume writing guides, plus corresponding resume examples that job seekers are welcome to customize.

This guide, along with sample wording from a banker resume example, is designed to help anyone in the banking industry find a job that’s the right fit. Read along, and learn how to craft a resume that demonstrates your readiness to compete in the globalized banking business. What we’ll cover:

- The state of the banking industry today, with potential salaries and job outlook

- The correct resume structure and how to choose the best format

- How to write a resume profile that makes you stand out from the job-hunting crowd

- How to present your employment history, education and skills to get employers’ attention

- Resume layout and design tips for looking the part of a professional

What does a banker do?

The word “banker” is used to describe a range of business and financial occupations that are discussed here. To define the word broadly, bankers are responsible for storing and managing other people’s money, making banking services available to them, and using their money to generate income for the bank through investments and interest on loans.

Compared to its beginnings, banking today is incredibly complex, having been revolutionized by the digital era. Today we buy and sell online, pay bills electronically, and invest in stock, bonds, CDs and even cryptocurrencies. Loans are usually essential to buy a home, finance an education or purchase a car, and the use of credit cards to make purchases is widespread, even for expenses we can cover with cash.

Bankers help individuals and businesses navigate the complexities of the modern financial world. Job seekers in these fields have lots of options, and lots of competition. The best starting point is an outstanding resume that makes you look better than other candidates.

Not everyone agrees on what a “banker” actually is. Here are some of the major breakdowns in the sector of banking and financial services:

- Personal and retail bankers: Bank branches need tellers to assist customers with routine transactions like cashing checks or withdrawing, depositing or transferring money. Personal bankers also assist with opening savings or checking accounts, advising clients on moving money into higher-yield investment accounts, and processing loan applications.

- Commercial bankers assist business and institutional clients with financing, cash flow and liquidity issues. Loan officers are tasked with determining whether potential borrowers are creditworthy based on their business models and the value of the collateral they put up.

- Investment bankers assist larger businesses with raising capital from investors, assessing their debt load, complying with government regulations and in some cases restructuring, initial public offerings, and mergers and acquisitions.

- Merchant bankers, like private equity companies, use their own capital to invest directly in promising companies in consideration of a substantial share of the profits of companies that succeed.

The U.S. Bureau of Labor Statistics (BLS) lists personal financial advisers, management analysts and financial analysts as the top 3 paid specializations in the banking/financial sector as of 2021, earning $94,170, $93,000 and $$81,410 a year, respectively. However, the rest of financial service jobs also have above average pay rates, ranging from $56,700 to $79,940. So clearly, this is an excellent field to be in regardless of your focus.

U.S. employment in business and financial careers is expected to grow by 8% from 2020 to 2030, adding some 750,800 jobs, according to the BLS. In all U.S. business and financial occupations, the median yearly salary in May 2021 was $76,570. According to Payscale, the average annual salary for all bankers is $72,000.

How to write a banker resume

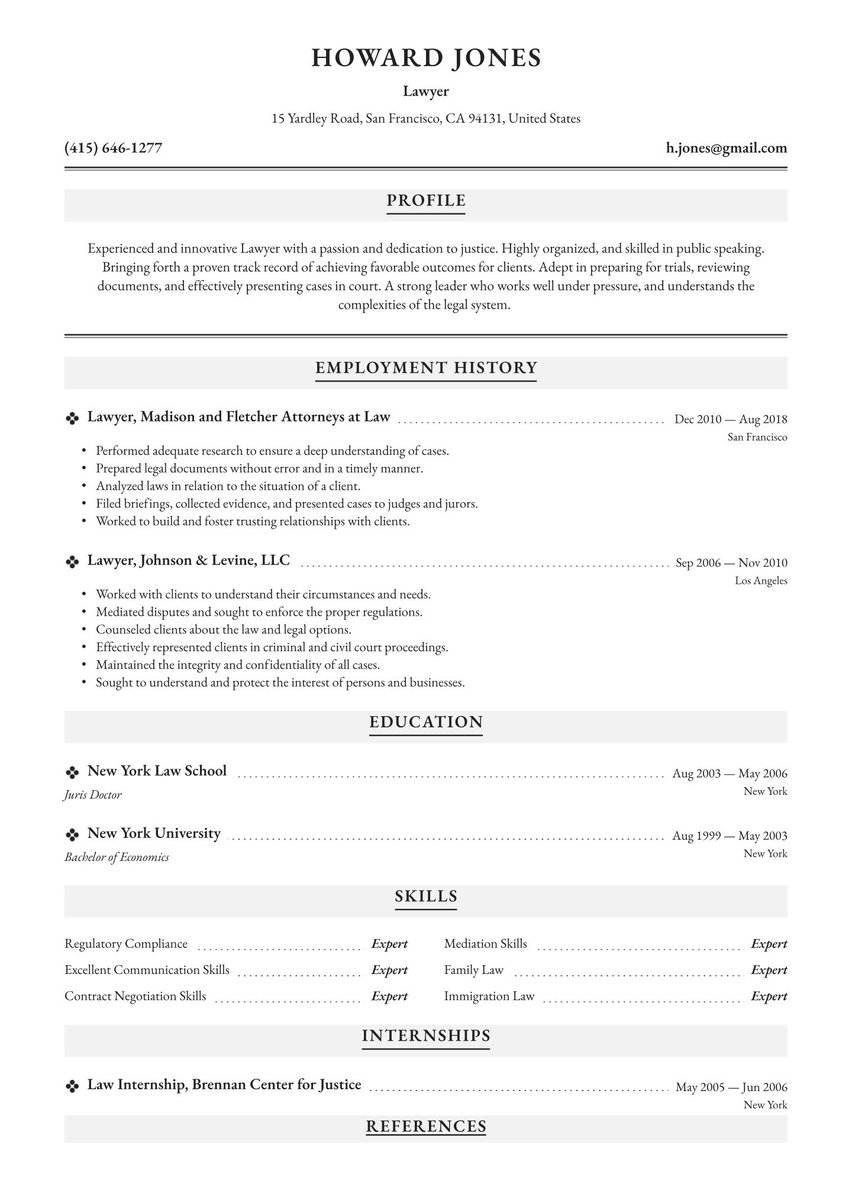

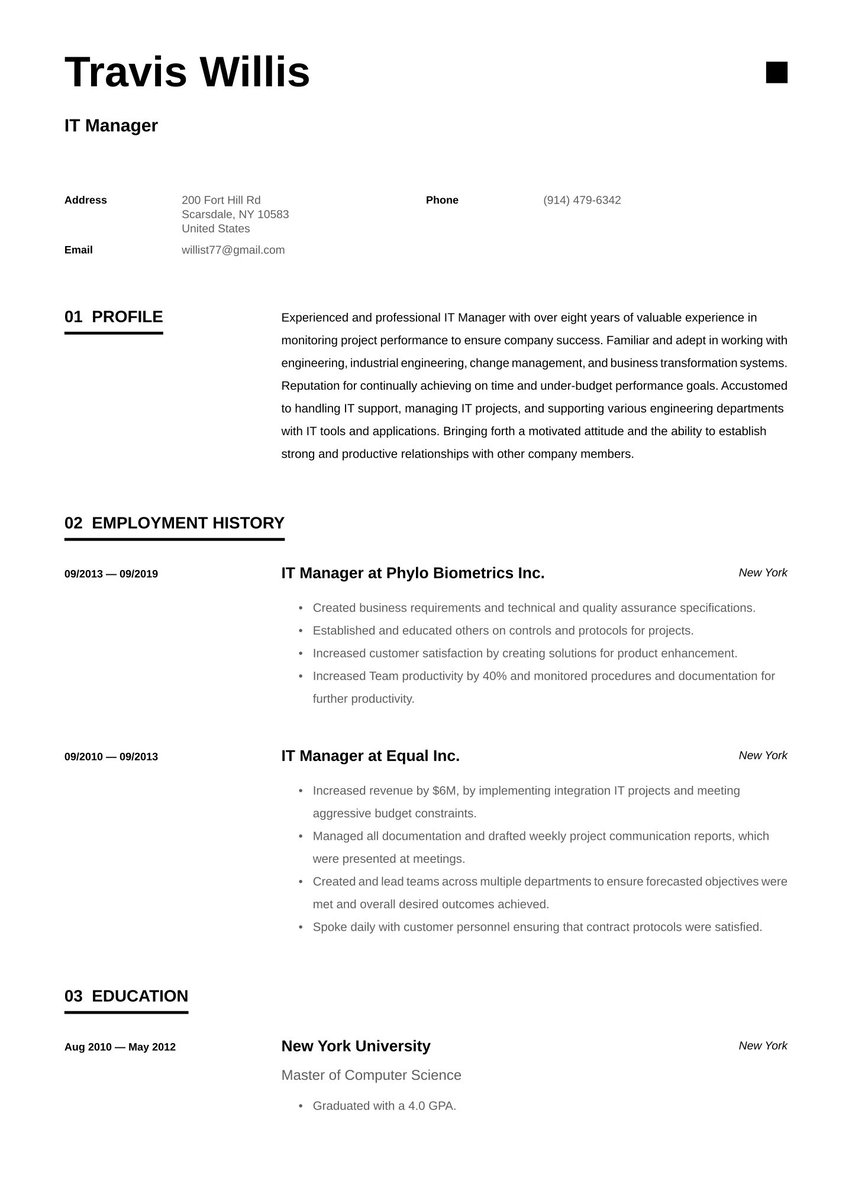

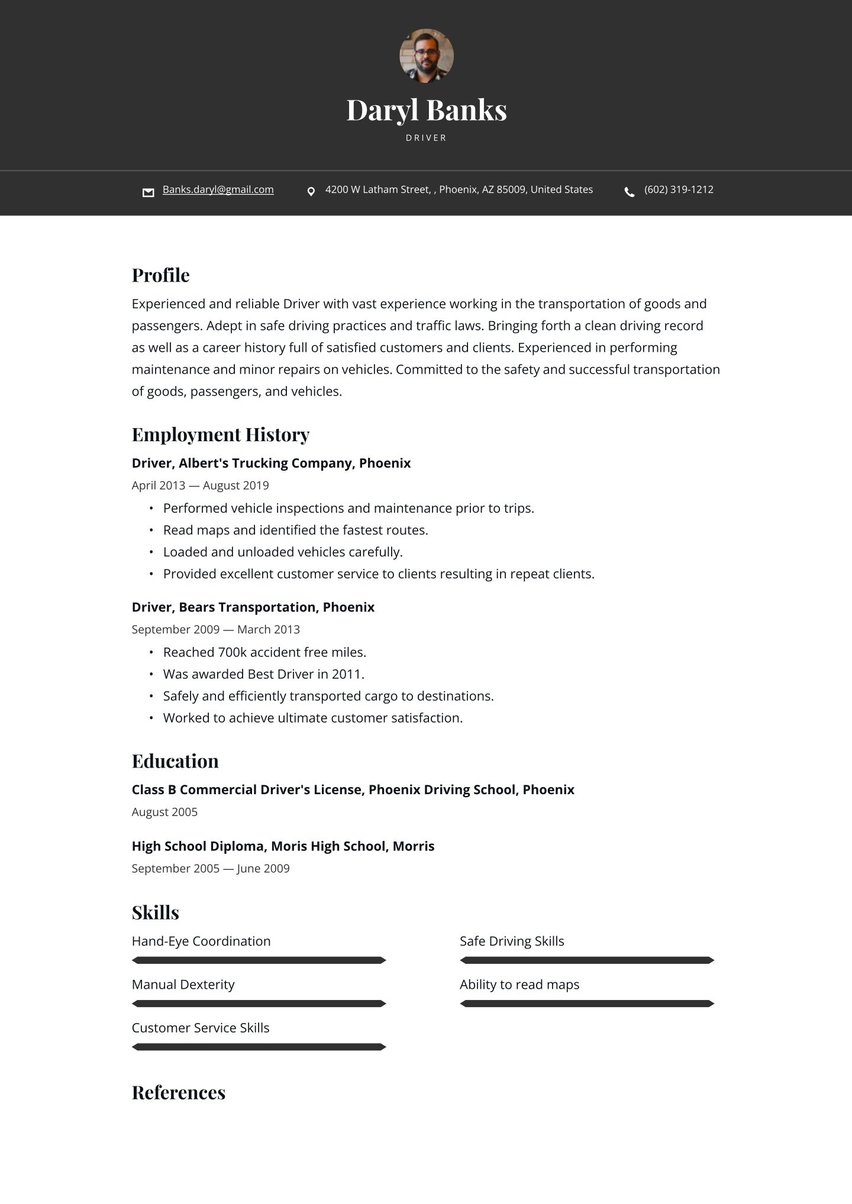

All resumes, regardless of occupation, contain these components, confined to a single page.

- The resume header

- The resume summary

- The employment history section

- The education section

- The skills section

We’ll be taking a closer look shortly at each resume section and how to optimize its impact.

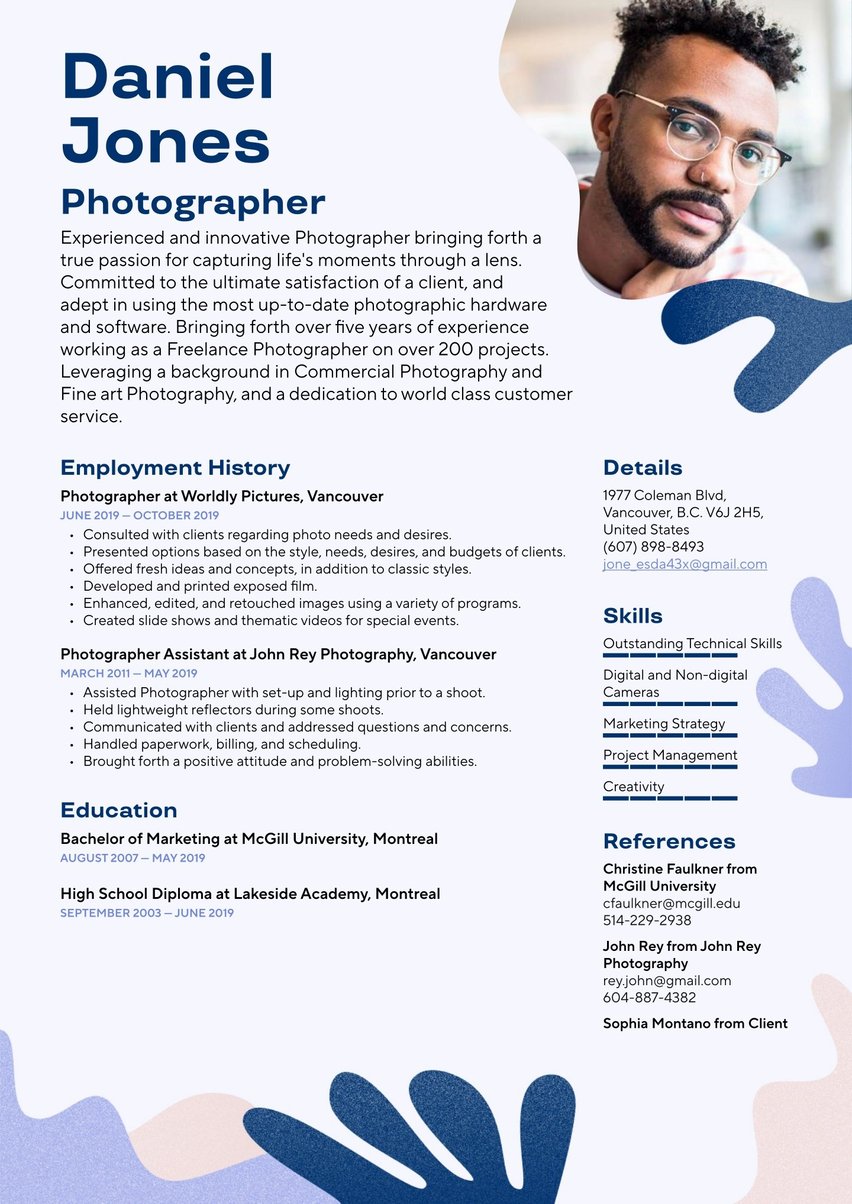

Choosing the best resume format for bankers

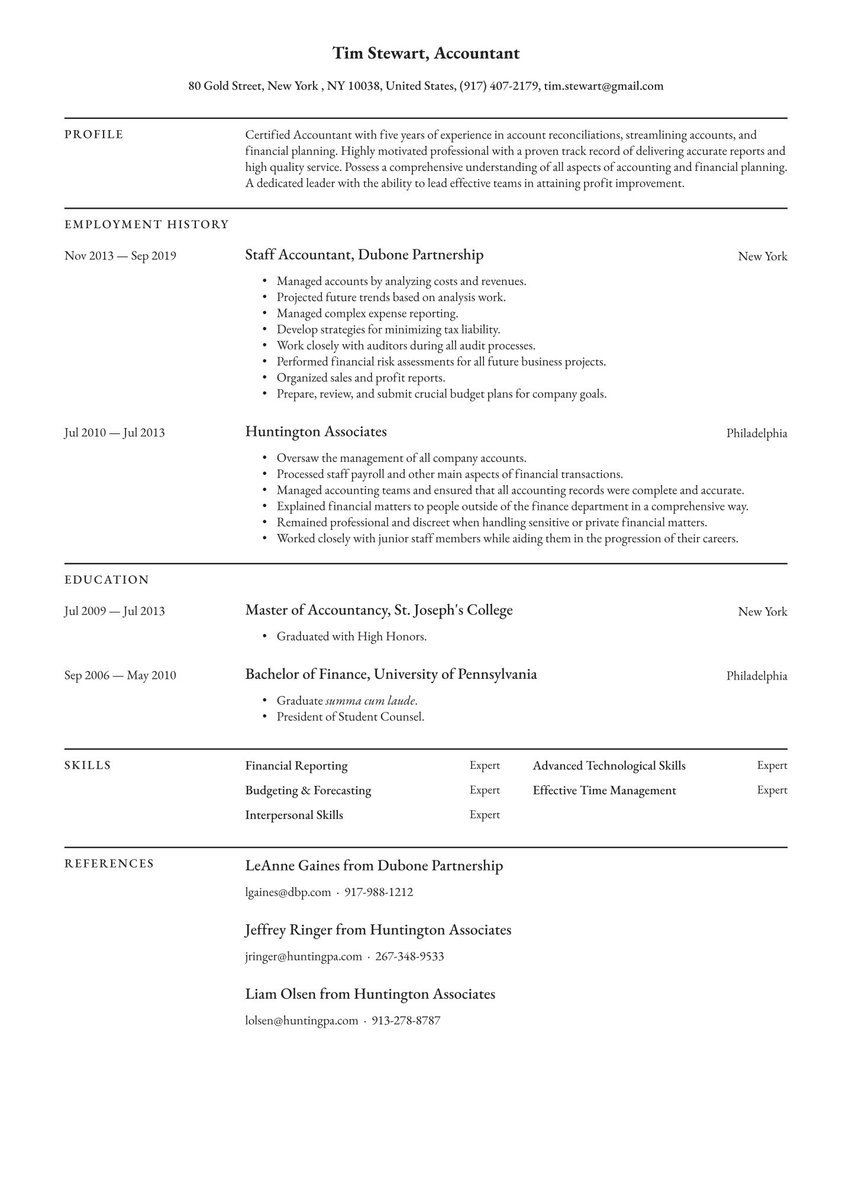

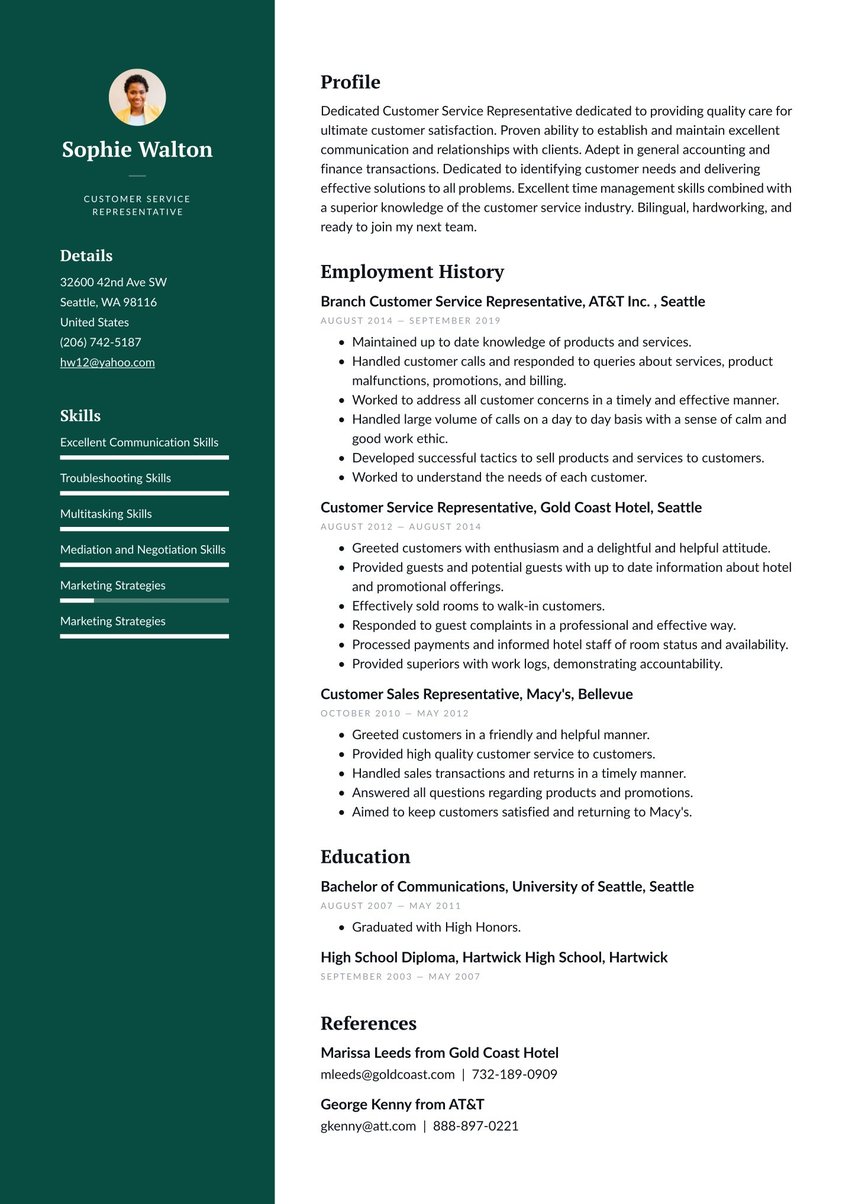

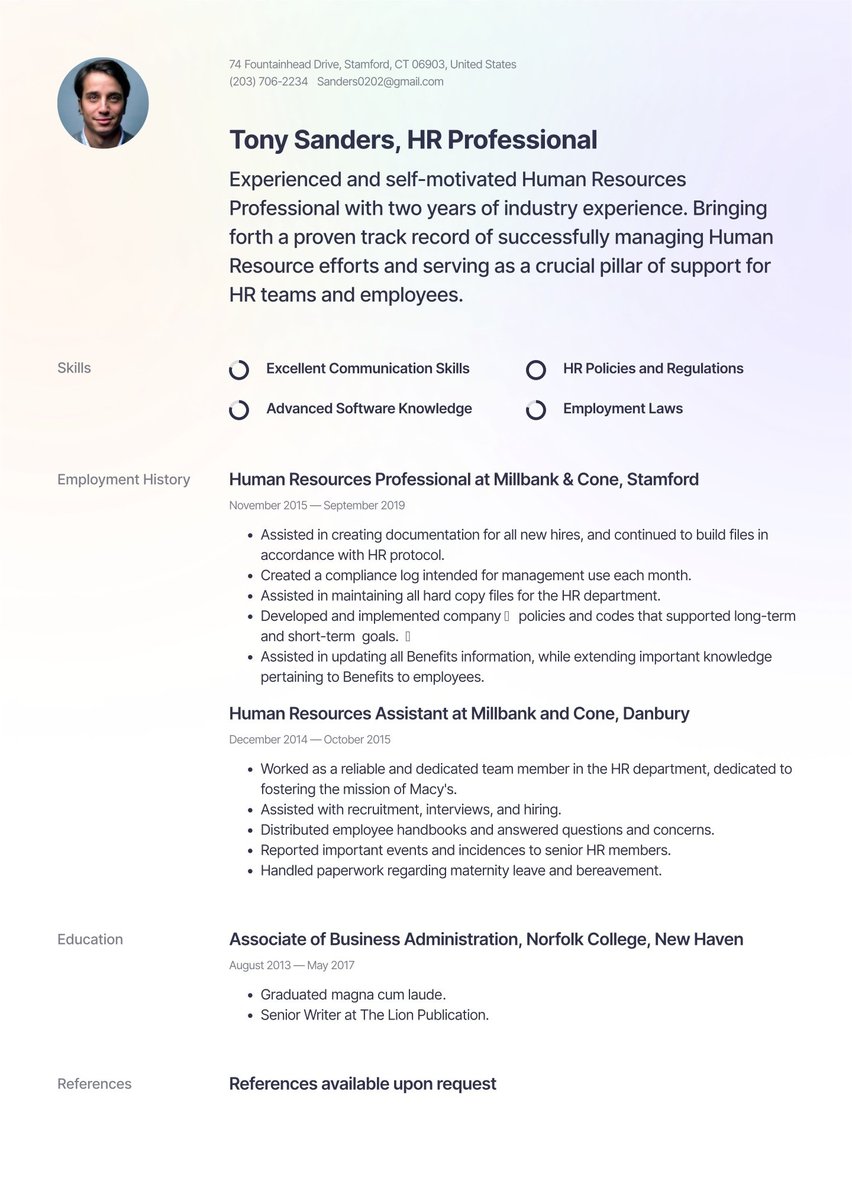

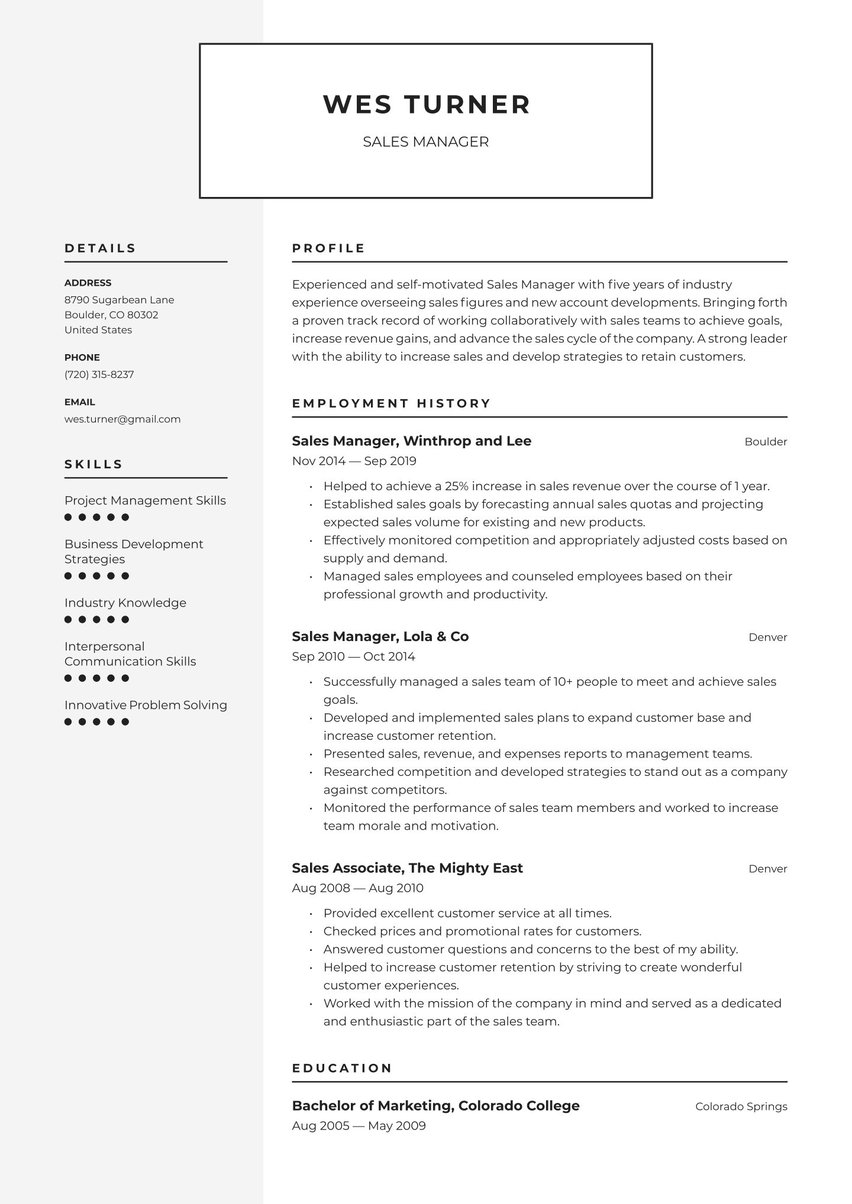

The most commonly used chronological resume format is recommended for bankers, or anyone whose career path has followed a series of employee positions. It’s the format that recruiters prefer too, for being easy to review. It’s the most straightforward way to organize your job history highlights in bullet points below employer headings, dated in reverse chronological order.

Other resume formats may be suitable for job seekers wanting to emphasize specialized or transferable skills rather than employers. A functional resume, or the more versatile hybrid (combination) format, is sometimes preferred for those who have worked independently as a consultant or wish to do so.

Now, let’s discuss how to optimize the impact of your banker resume in each section, one at a time.

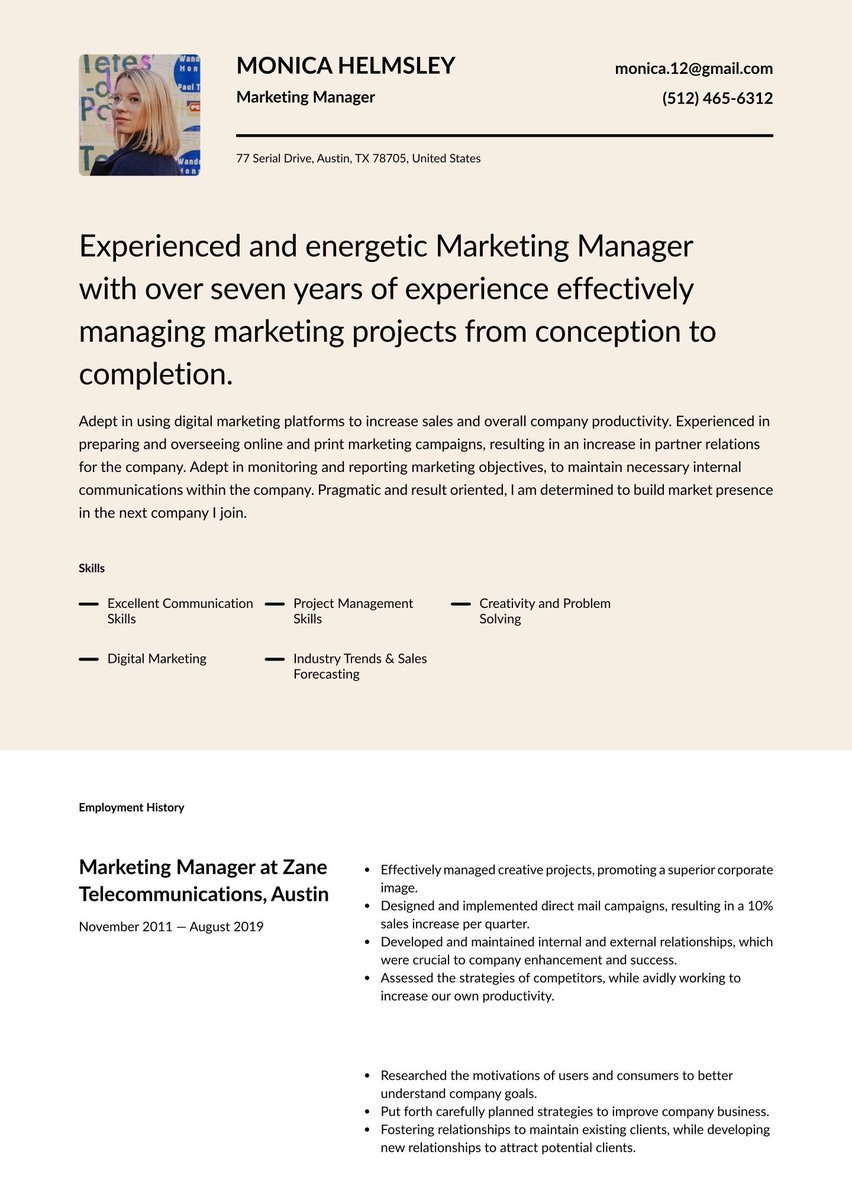

Resume header

Don’t overlook the importance of a distinctive resume header design — ideally the same as your cover letter so they look like a matching pair.

The header sets your job application apart from everyone else’s, like your own visual brand. It draws the reader’s eyes to the place on the page where your name, occupation and contact information are prominently displayed. This will be easier for duly impressed recruiters to come back to when they’re ready to get in touch with you for an interview. And the white space offsetting your resume header makes the page much more inviting to read.

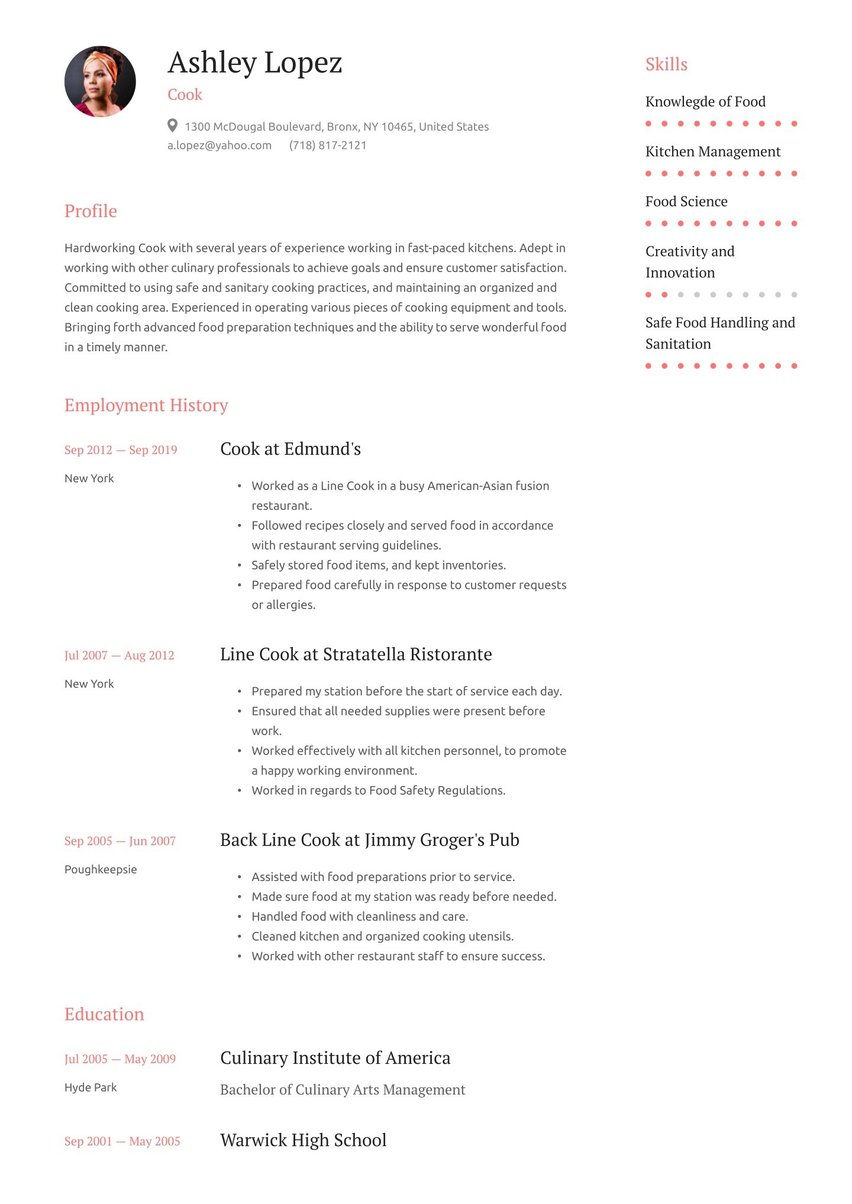

Banker resume profile example: Your ‘elevator pitch’

You’re probably familiar with the term “elevator pitch”. You get in an elevator with someone you want to influence and you have to do so before that person gets off. Brief but persuasive, and no words wasted — that’s also the idea of a resume profile, sometimes known as a summary.

This is your first, best opportunity to tell potential employers about your aptitudes and interests. While resumes are dominated by lists of past jobs, schools and skills, the profile section allows you to use your own words to do some modest boasting. It should project confidence, competence and professionalism.

Also, remember that a resume is not a one-size-fits-all document; the wording should be tailored to each prospective employer’s wants and needs. And while there’s limited room for flexibility in your employment or education history, there’s more wiggle room in the profile. If you’re a specialist in bitcoin but this is irrelevant to the job you’re seeking, it may better not to mention this and instead stress something that the employer actually is seeking.

Remember too that errors in spelling, grammar or punctuation are a total deal-killer. In fact, hiring managers cite bad English as the No. 1 reason resumes are rejected (see below). If English is not your strength, find an expert editor to review your work before you torpedo your own chances.

In a 2018 Harris Poll conducted for CareerBuilder.com, 75% of 1,138 hiring managers surveyed said they had caught an obvious lie on a resume. These were the other most common reasons cited by employers for hitting “delete” on a resume submission:

- Typos or bad grammar: 77%

- Unprofessional email address: 35%

- Resume without quantifiable results: 34%

- Resume with long paragraphs of text: 25%

- Resume is generic, not customized to company: 18%

- Resume is more than two pages: 17%

- No cover letter with resume: 10%

The perils of ATS

Many employers use an electronic applicant tracking system (ATS) to filter resumes according to job skills they are seeking. If those job skills — often keywords — are missing from your resume, it may be flagged as not worth the attention of a reviewer. That means no human being at the company you’re targeting will even read it.

This innovation has given rise to the practice of “resume optimization,” in which resumes and CVs are tailored to the needs and wants of employers. ATS technology creates promise as well as peril, because resumes that do meet the tests of the ATS will be greenlighted for review.

The best way to deal with the ATS issue is to scour your target’s job listing or other relevant language from its website to determine what job skills and qualities the employer is actually seeking. Of course, you have to tell the truth and not claim you have skills that you don’t. But as a very simple example, if a job listing says applicants must be adept in Microsoft Office, including Word, Excel and PowerPoint — and it just so happens that you are — then it would be a mistake not to mention this in the skills section of your resume.

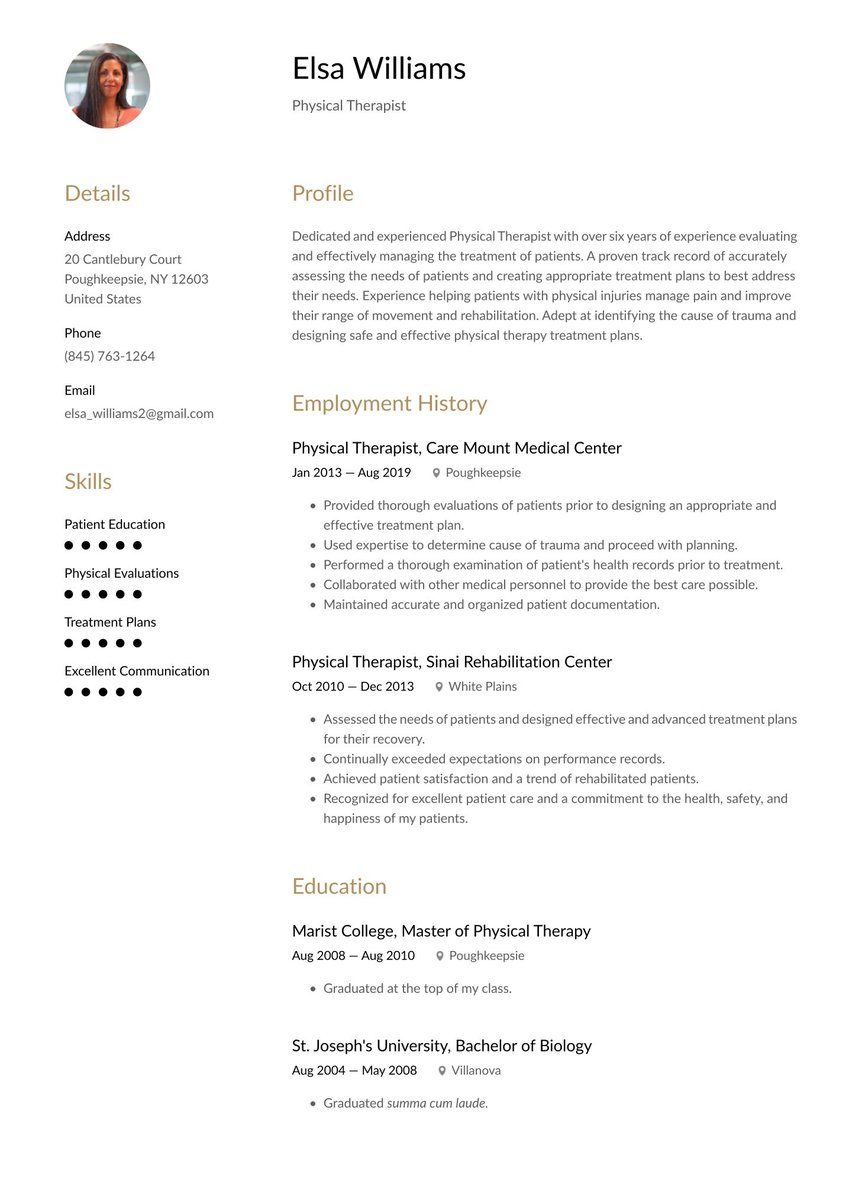

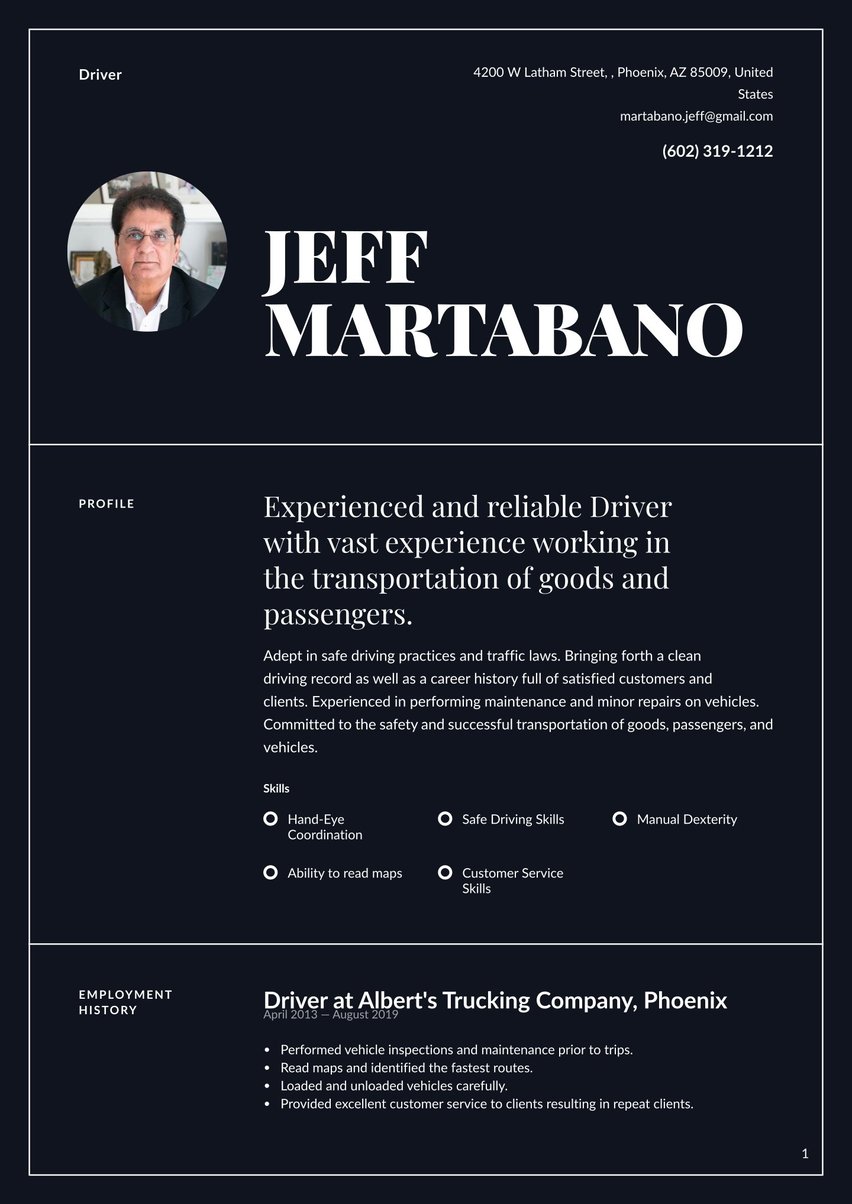

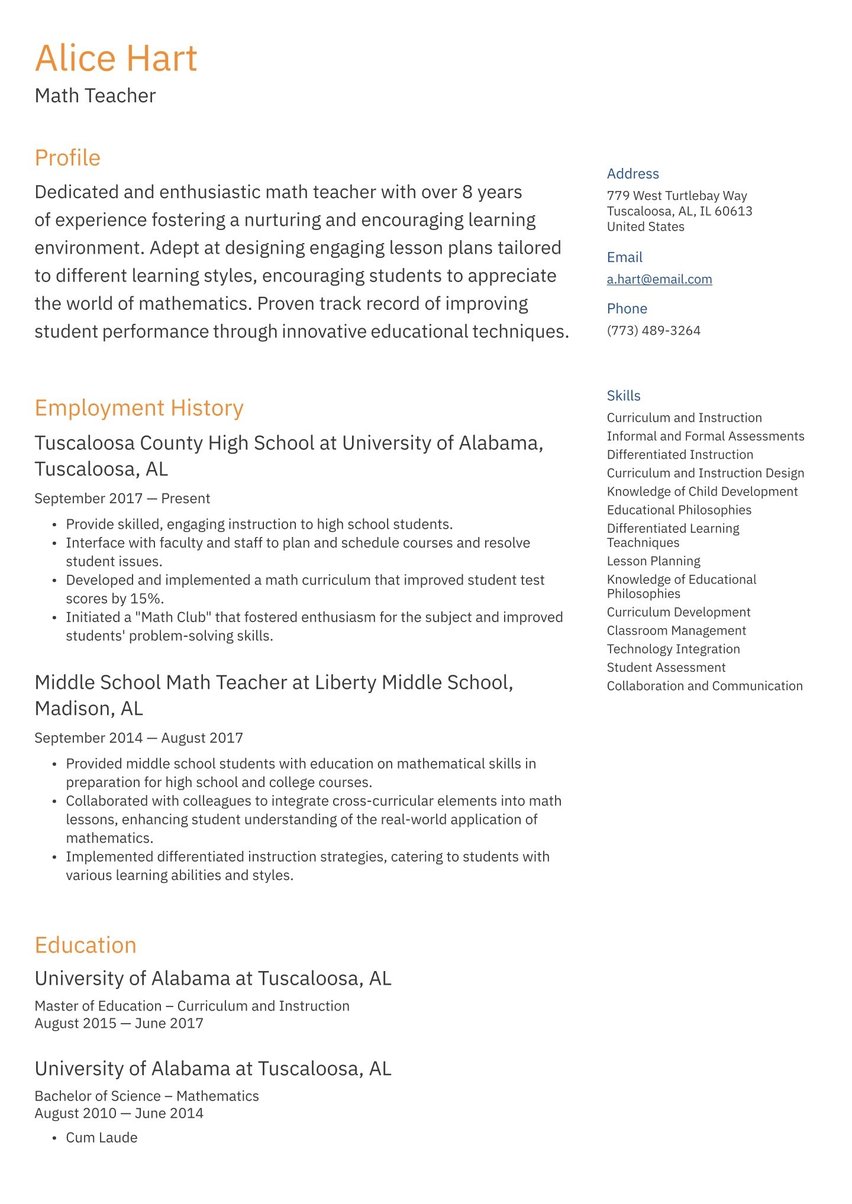

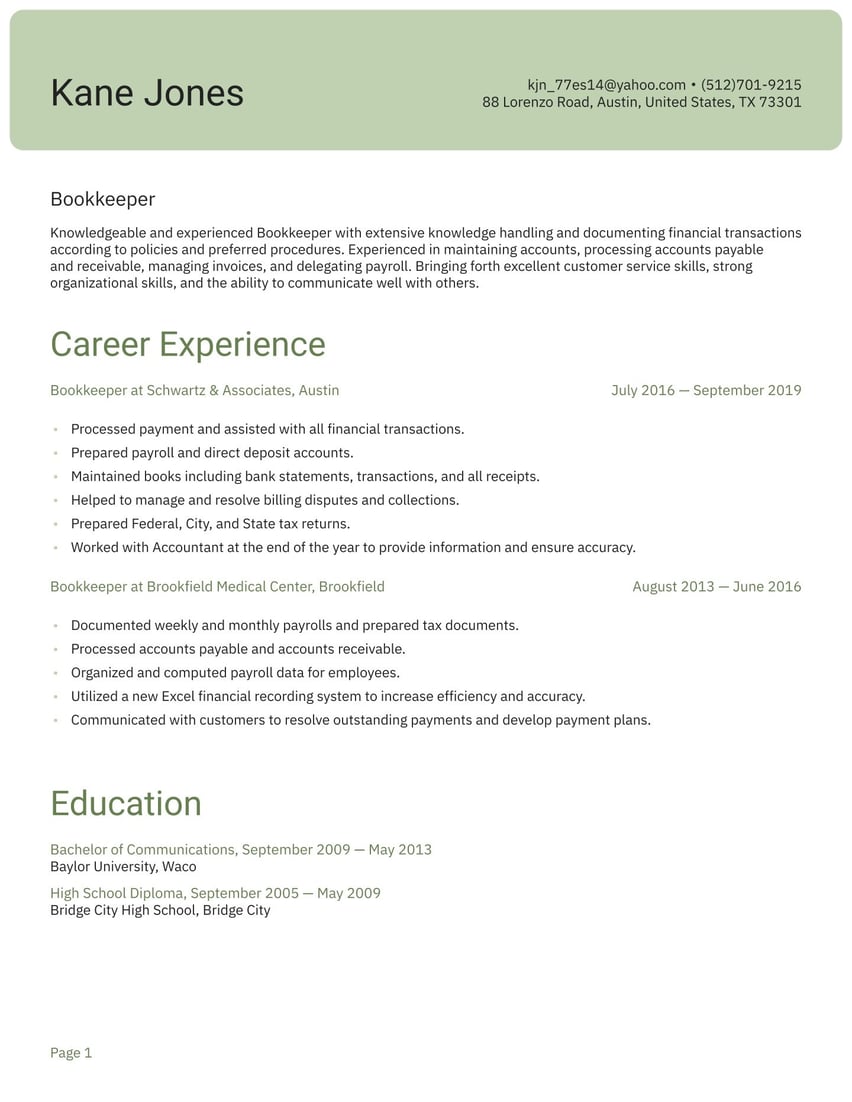

Below is a banker resume sample profile you can modify for your own situation.

Experienced Personal Banker with strong mathematical skills and a devotion to customer service. Highly adept in banking transactions, bringing forth a proven track record of client satisfaction. Knowledgeable about credit and loan processes, and committed to continually enhancing my skills and banking expertise. A strong team member with the ability to work independently, as well as within a division.

Employment history sample: About that ‘experience’ question

Anyone who has ever applied for a job knows the magical value of the word “experience.” Unless you’re volunteering for the first mission to Mars, you’ll probably be asked if you’ve done this before. If you have a strong employment history in banking, milk it. List your employers in reverse order and under each one, describe what you accomplished at each using strong action verbs.

Reverse chronological order is “best by test” for both work experience and education — meaning you list your last job first, and ditto for the schools you attended. Hopefully this will put your most impressive achievements first. It’s also what employers expect, and even if you want your resume to surprise them, breaking this rule is not the way to do it.

In describing your role at each job, avoid saying “Was responsible for,” “Was assigned to” or similar terms. Instead, tell us what you actually did, being as specific as possible. If your job history is less than impressive because you just graduated from college, highlight any relevant internships or volunteer work.

And if a job outside of banking gave you experience that may be useful in banking, be creative in describing how. For example:

- Worked in the financial department of a major logistical corporation, dealing with issues of credit, financial planning, management and budgeting.

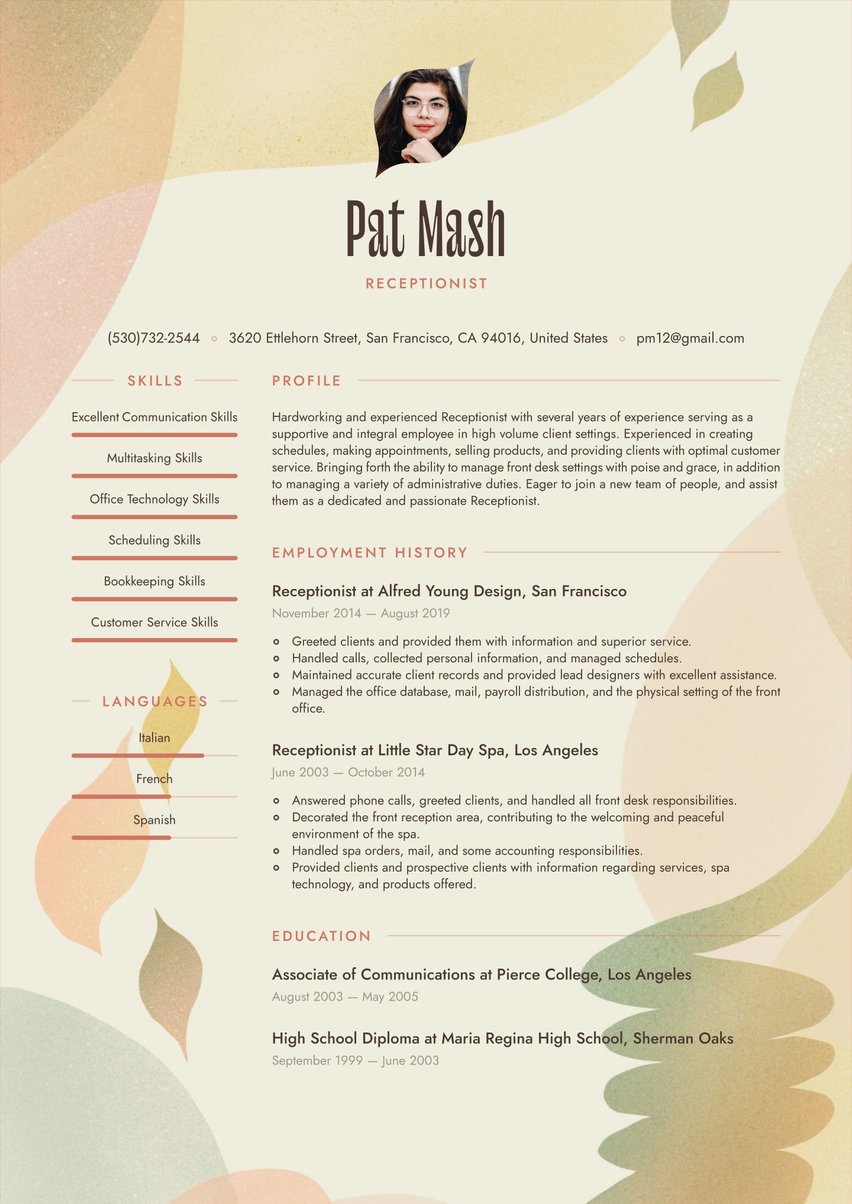

Below is an example of how to write bullet points in the employment history section.

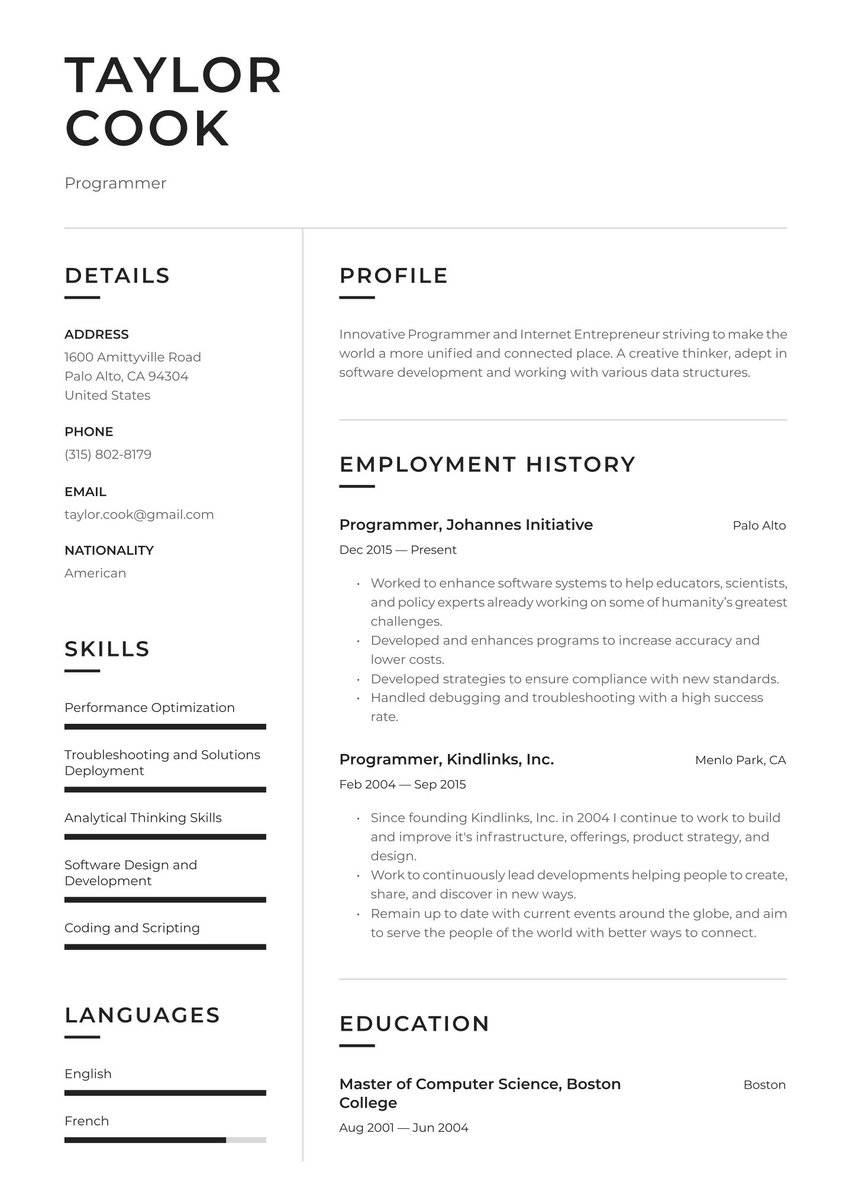

Banker, PNC Bank, Boston

June 2010 - August 2019

- Worked to deliver the highest level of client service possible.

- Effectively managed client portfolios and offered advice regarding investments.

- Performed risk assessments and studied market trends.

- Reviewed credit applications, and processed them according to best practices.

- Adhered to bank policies and facilitated safe and protected transactions.

- Trained and supported new team members.

Banker, Wells Fargo & Company, Boston

September 2007 - May 2010

- Worked as a dedicated team member of the Wells Fargo team.

- Reviewed and processed individual loan and credit applications.

- Provided clients with new product and program information.

- Handled cash transactions.

- Offered clients guidance regarding savings programs.

Bullet points are very popular in resumes, and in general they’re a great idea. But what if you have so many that they take up too much space and push you over your one-page limit? Lots of accomplishments is not a bad problem to have, and there’s no rule against condensing two points into one if it saves vertical space that you need elsewhere. For example:

- Managed biweekly payroll, audited all company books

Banker resume education example: Learning before doing

Banking careers generally require a bachelor’s degree, though a master’s degree in a relevant field like business, finance, economics or accounting can give you a big leg up, and is often required for the more competitive jobs. Present your education history in reverse chronological order, just like your employment history, citing the more advanced level first. If appropriate, you can also cite an impressive GPA, membership in an academic honors society or other academic distinctions.

These are among the best college degrees preparatory to a career in banking, according to bankersbyday.com:

- Master of Business Administration

- Finance

- Business

- FinTech

- Economics

- Accounting

- Financial Engineering

- Physics/Engineering/Mathematics/Statistics

- Banking

- Computer Science/Information Technology

- International Business

- Corporate/Business Law

Advanced certifications in the field are also available and may increase your chances of employment and/or promotion. To earn these certifications, candidates must attend courses in specialized fields and pass professional exams. A more competitive resume or CV and a higher salary can be the reward for this extra work.

These are the seven most useful certifications in the banking industry, according to the Corporate Finance Institute:

- Chartered Financial Analyst (CFA)

- Certified Financial Planner (CFP)

- Financial Risk Manager (FRM)

- Chartered Alternative Investment Analyst (CAIA)

- Certified Public Accountant (CPA)

- Certified Management Accountant (CMA)

- Chartered Mutual Fund Counsellor (CMFC)

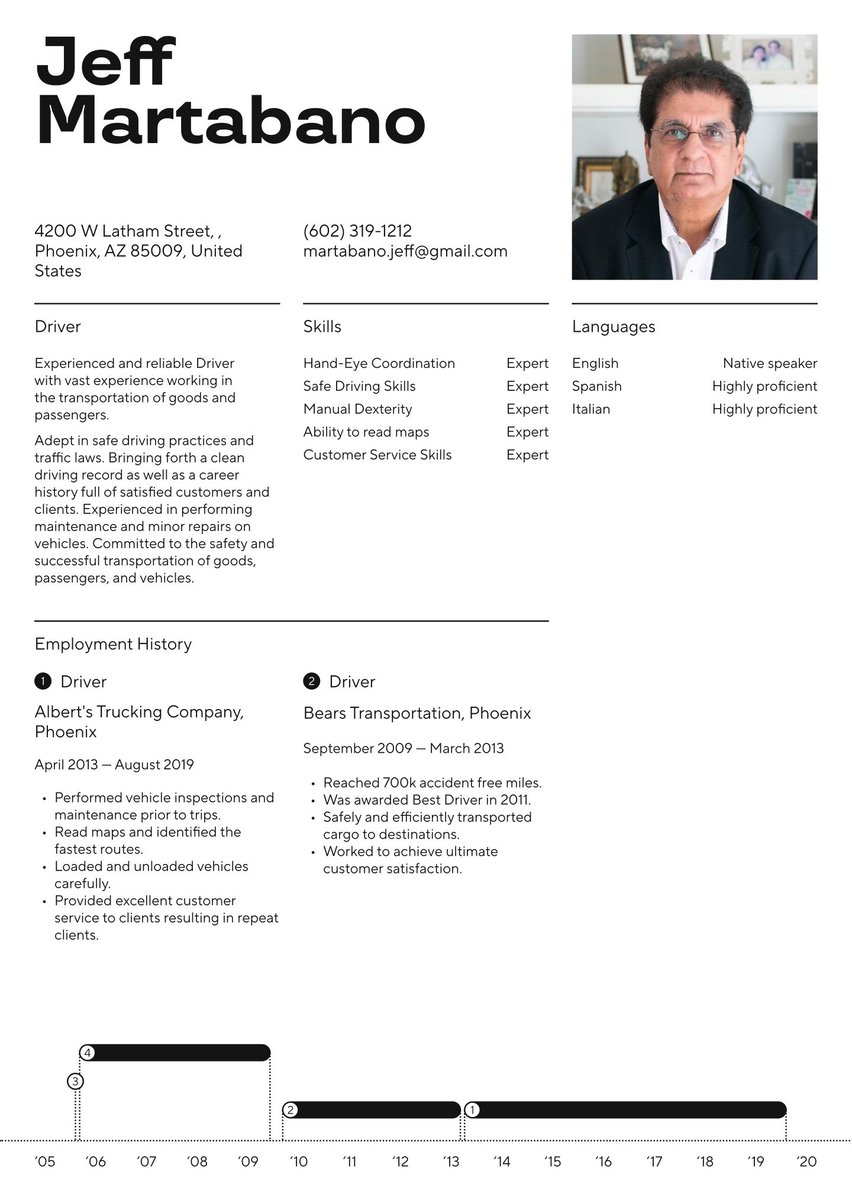

Here’s an example of how to list your education credentials in a banker’s resume.

Bachelor of Economics, St. Joseph's University, Villanova

August 2002 - May 2006

High School Diploma, Norwell High School, Norwell

September 1998 - May 2002

CV skills example: Why you shine

Every CV should include a brief section highlighting the job applicant's skills that are essential to the job. These may include technical skills (in accounting, auditing or relevant software applications, for example). And they should often include soft skills (i.e., people skills) in areas like communication, teamwork and customer service.

The skills section is also an excellent place to mention any relevant qualification that went unmentioned in your profile, job story or education. One way to start compiling your skills list is to brainstorm a master list of everything you’re good at, even if you don’t think it’s relevant at first. Make a list that’s too long. Then take a hard look at your list and pare it down to what your target is actually looking for. Remember also that your resume should be individually tailored for different employers, hitting the points that are important to them (and passing their ATS tests). The skills section is a good place to make sure this happens.

Here are some of the top skills sought by retail banking, insurance and actuarial employers, according to targetsjob.co.uk:

- Communication skills

- Problem solving

- Customer service

- Numeracy skills

- Teamwork

- Organization and time management

- Leadership and team management

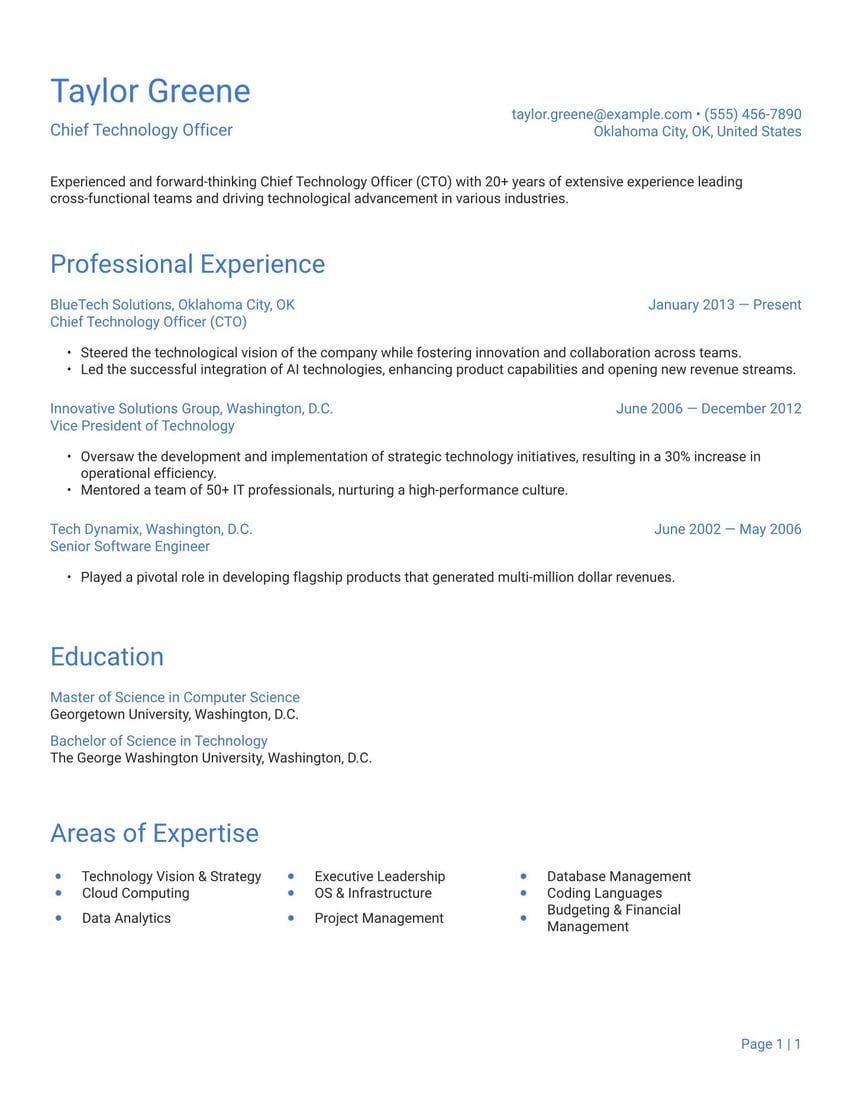

This list of some relevant skills comes from our banker resume example.

- Financial Planning

- Customer Service Skills

- Risk Assessment Skills

- Market Knowledge

- Knowledge of Banking Software

- Problem Solving Skills

Resume layout and design: No gimmicks

Banking is one the world’s most conservative industries, as reflected by the standards of dress and grooming. Your resume should also be clean, professional and free of gimmicks or excessive decoration. A one-page resume is ideal, allowing hiring managers to quickly review your essential qualifications and skills.

And it should be free of any bugs that can be introduced by non-PDF formats, which may look fine on your screen but look totally different on the hiring managers’ computer. The ATS technology mentioned above also screens for these and can lead to automatic rejection. Look through the collection of ready-made templates at resume.io, find one that appeals to your tastes, and use it to fill in your personal information. These resumes are designed by experts and have been tested time and again in the field. Take a specific look at the simple and professional templates — the timeless classics or streamlined designs. All you have to worry about is the content. We took care of the design for you.

Key takeaways for a banker resume

- Banking today is a field that is constantly being reshaped by new technologies and changes in how we spend, borrow and lend. Job candidates in this changing field must find ways to stand out from the competition, and the starting place is a superior resume.

- A resume is a dynamic document that should be tailored to each prospective employer, hitting the notes that each employer is seeking.

- This is especially important in the more flexible profile and skills section of your resume, where you must put your best foot forward in your own words in a way that makes clear why you’re the right candidate for this job.

- Resumes must pass the tests of ATS technology that weeds out CVs that don’t highlight the required job skills, or that contain buggy formats.

.jpg)

.jpg)