Accomplished and highly motivated Accounting Manager seeking to utilize my skills for the betterment of the next team I join. Committed to driving continuous improvements for finance operations through the identification and implementation of process enhancement opportunities.

03/2015 - 07/2021, Accounting Manager, Smith and Caufield, New York

- Review and analyze financial accounting information and present analysis and commentary to key business partners.

- Work to ensure that the financial control framework provides for the accurate reporting of financial conditions.

- Collaborate with teams including Cash Operations, Treasury, and Tax.

- Interpret and communicate financial information to teams across the business.

- Oversee the month-end, quarter-end, and year-end closing of the books, reconciliations, and journal entries.

09/2013 - 03/2015, Accounting Manager, Diamond Marketing, Jersey City

- Oversaw and managed cost accounting, capitalizing variances, and inventory provisions.

- Reviewed and supported the preparation of entries related to business operations.

- Completed the documentation of processes and standardized operating procedures.

- Prepared monthly, quarterly, and annual reports for corporate reporting.

09/2009 - 05/2013, Bachelor of Science in Accounting, Manhattan College, New York

- English

- Polish

- Financial Reporting

- Financial Analysis

- ERP Systems

- Ability to Work Under Pressure

- Interpersonal Communication Skills

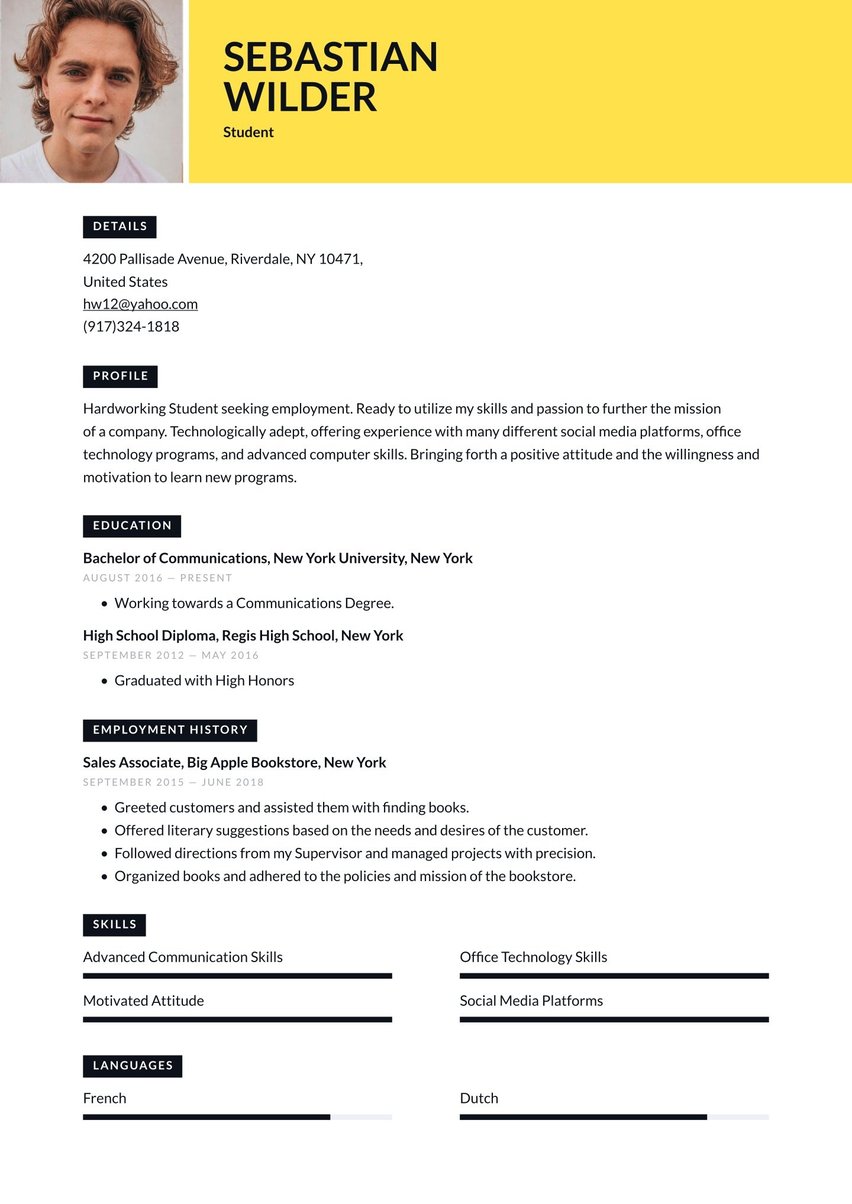

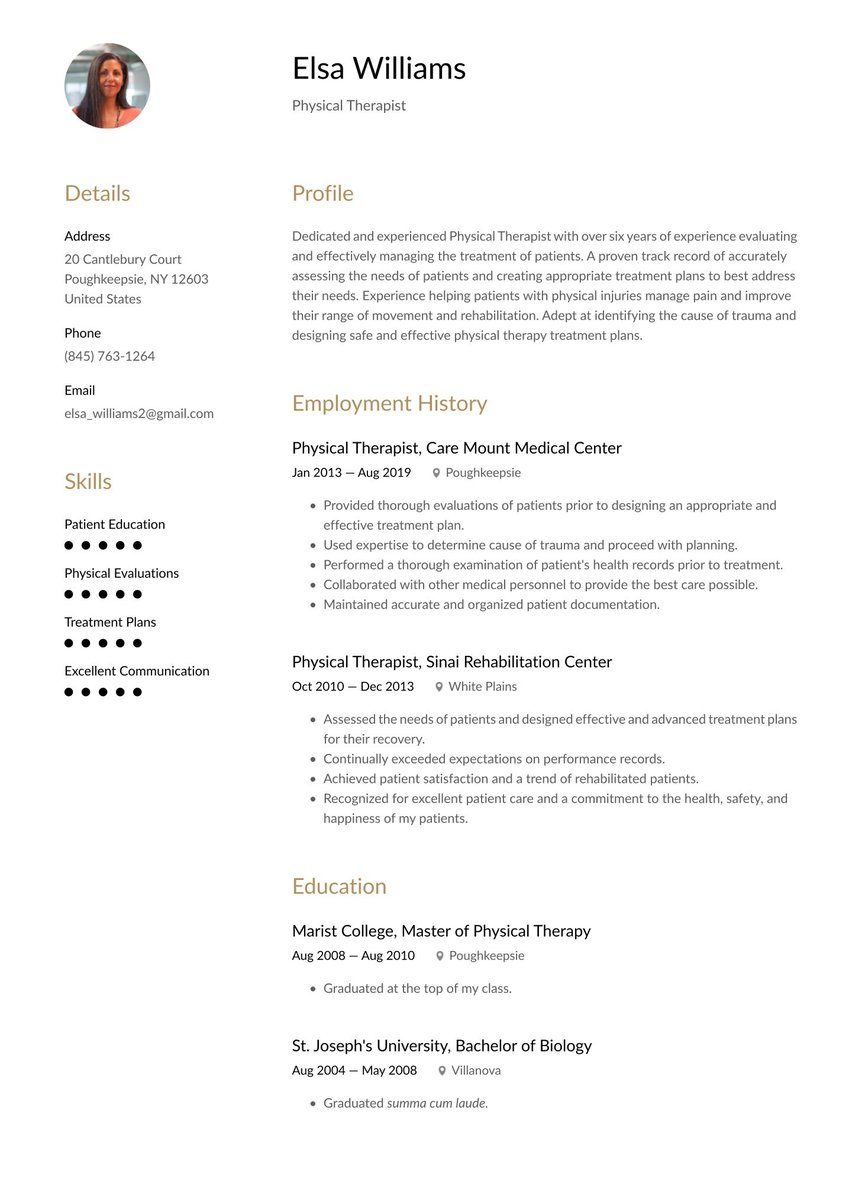

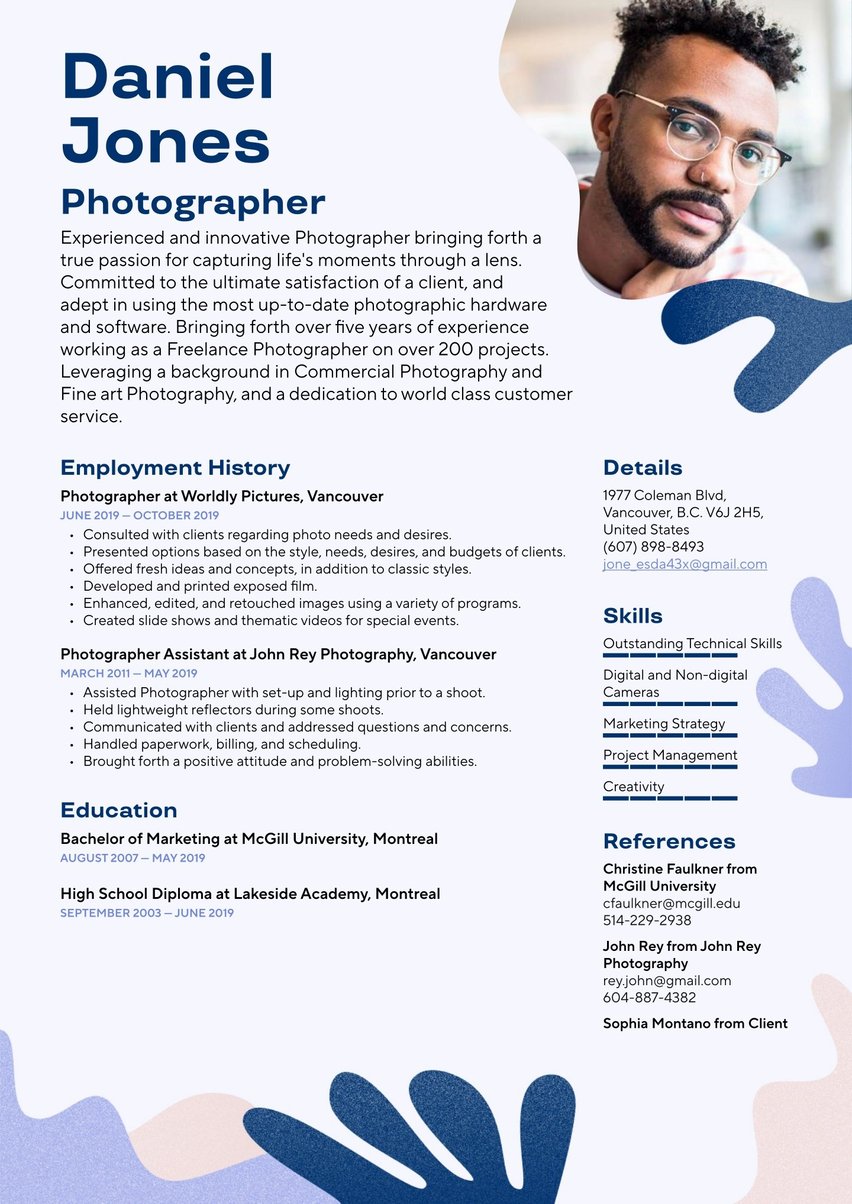

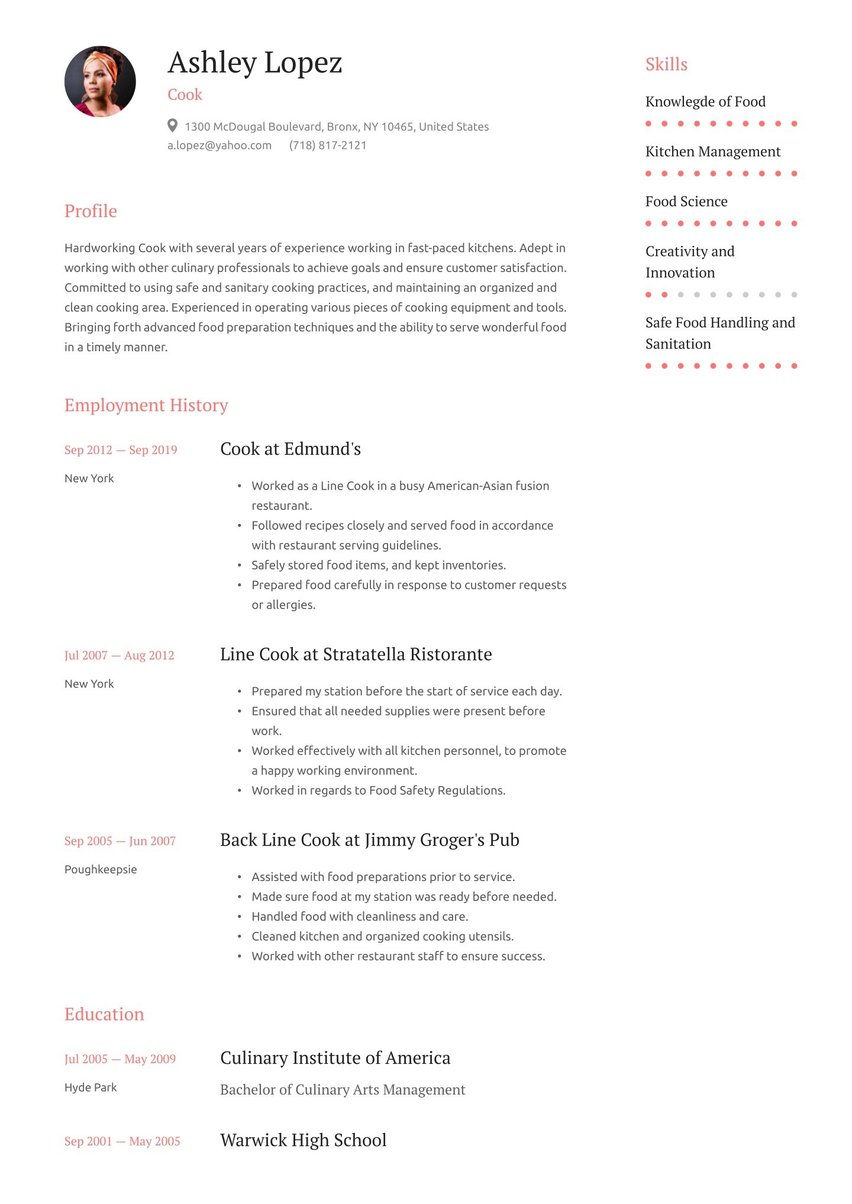

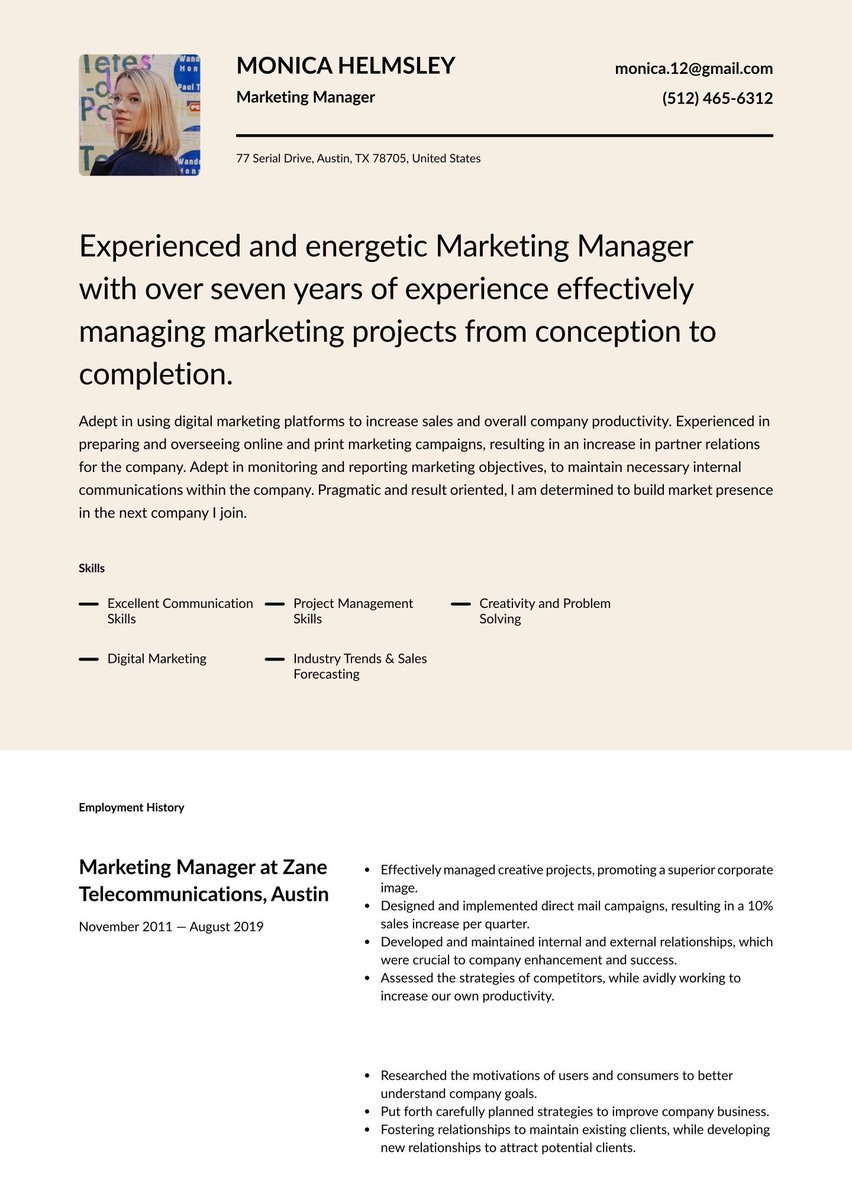

You’re ready for the next step in your career. Now you need a top-notch resume to tip the balance in your favor. A generic or boring resume could leave you in the red. Boost your chances of landing an interview with a resume that shows off your asset column.

Accounting and Finance resume examples by experience level

How can a one-page document do that? With an eye on action, details, and accomplishments!

An accounting and finance resume is your introduction to hiring managers. If you get a detail wrong when you’re trying to make a great first impression, how can they trust you to keep the numbers straight? Don’t let your job hunt dip into the negative before you have a chance to impress. Craft a resume that gets you closer to your dream job.

Resume guide for an accounting & finance resume

Let Resume.io help you get there with its powerful resources for job seekers, including resume guides and resume examples for 500+ professions, backed up by an easy-to-use resume builder.

This resume guide, along with the corresponding resume example, will cover the following topics:

- How to write an accounting and finance resume (tips and tricks)

- The best format for an accounting and finance resume

- Adding your contact information

- Making the most of your summary

- Including your work experience and education

- Professional resume layout and design hints

- What the job market looks like and what you can expect to earn

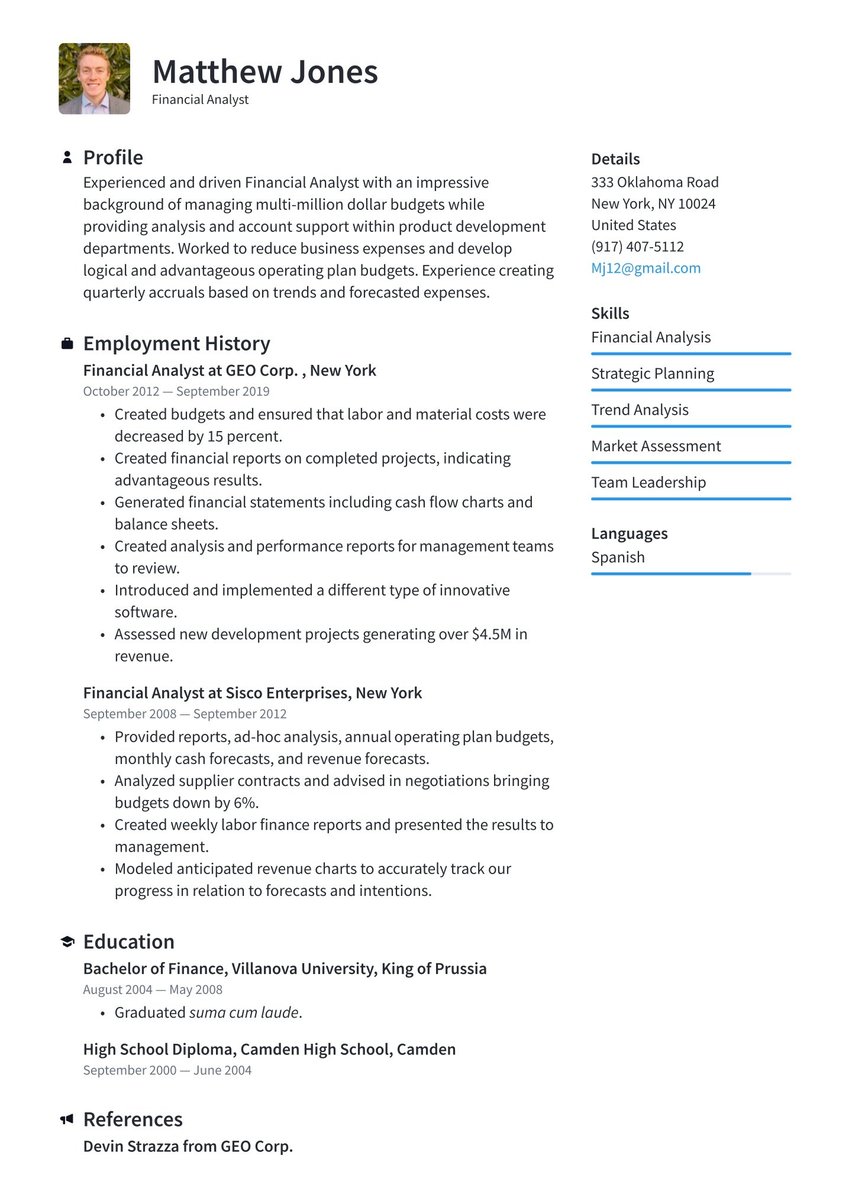

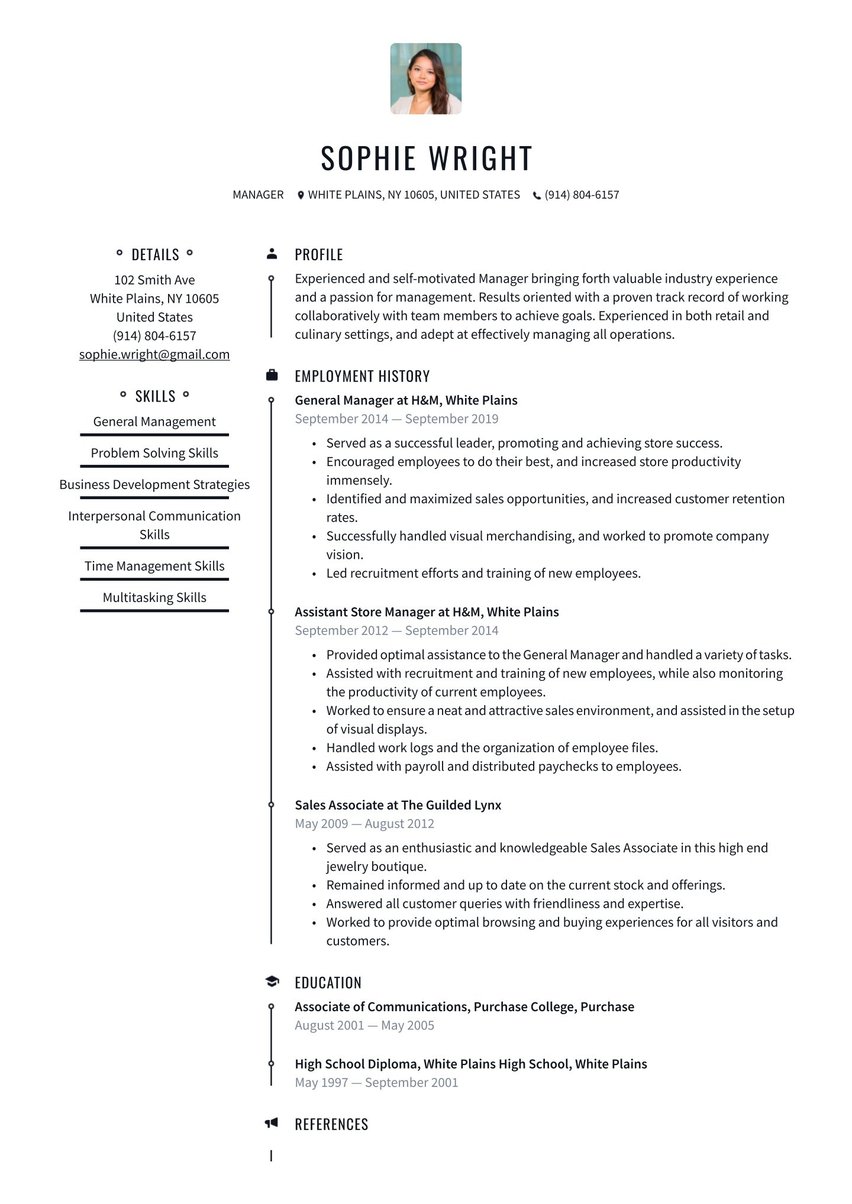

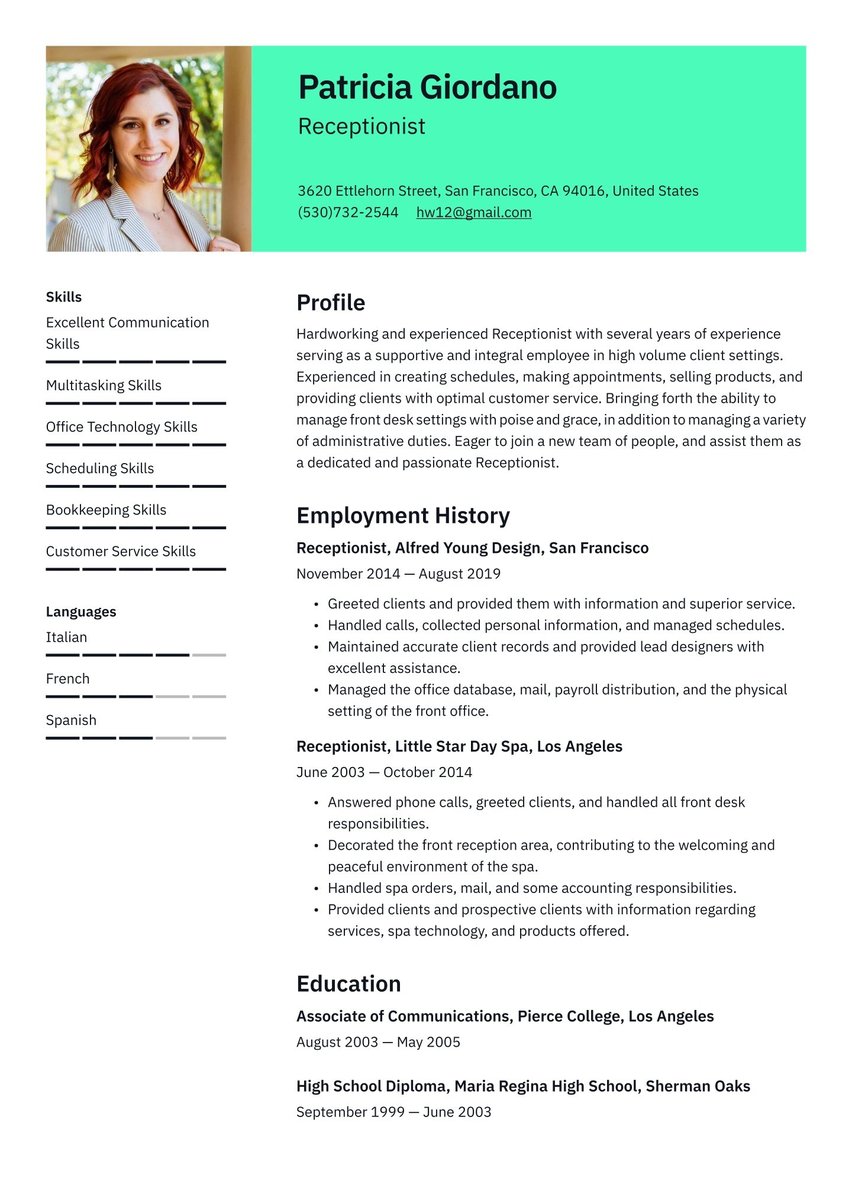

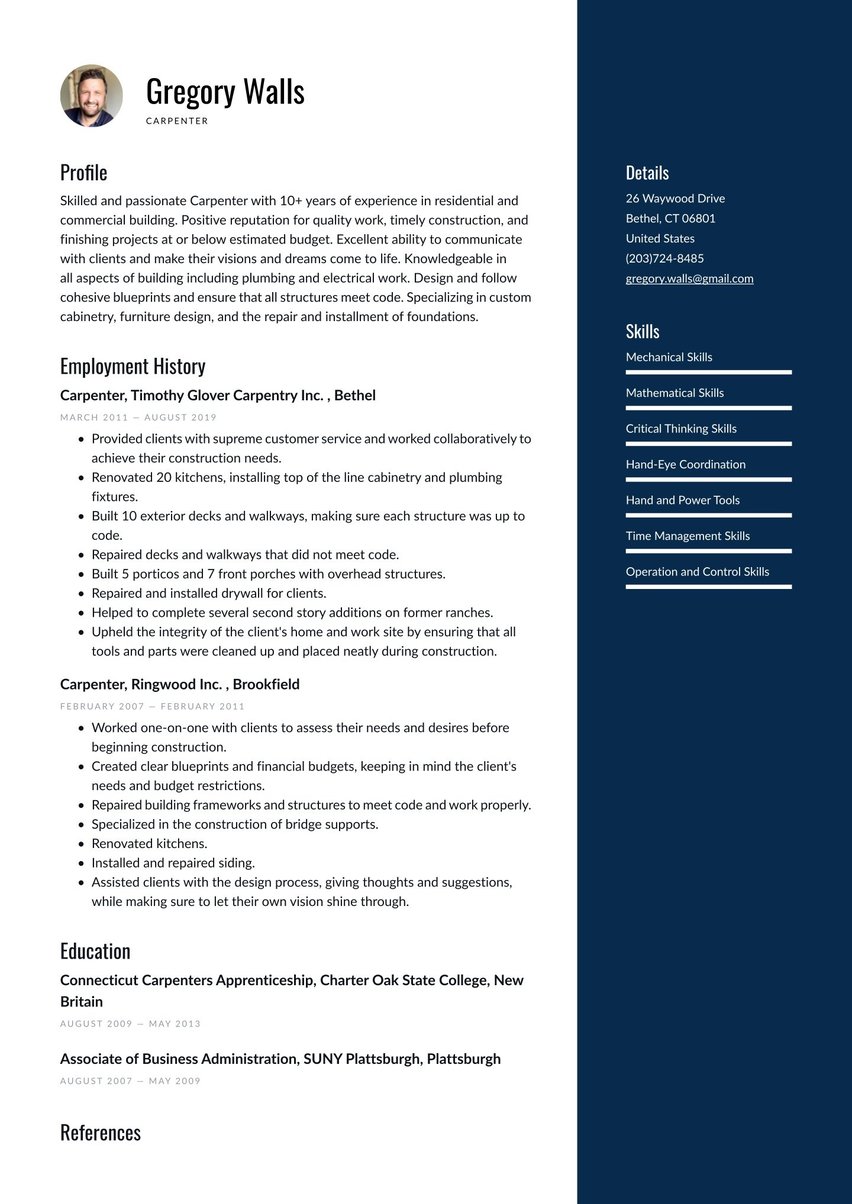

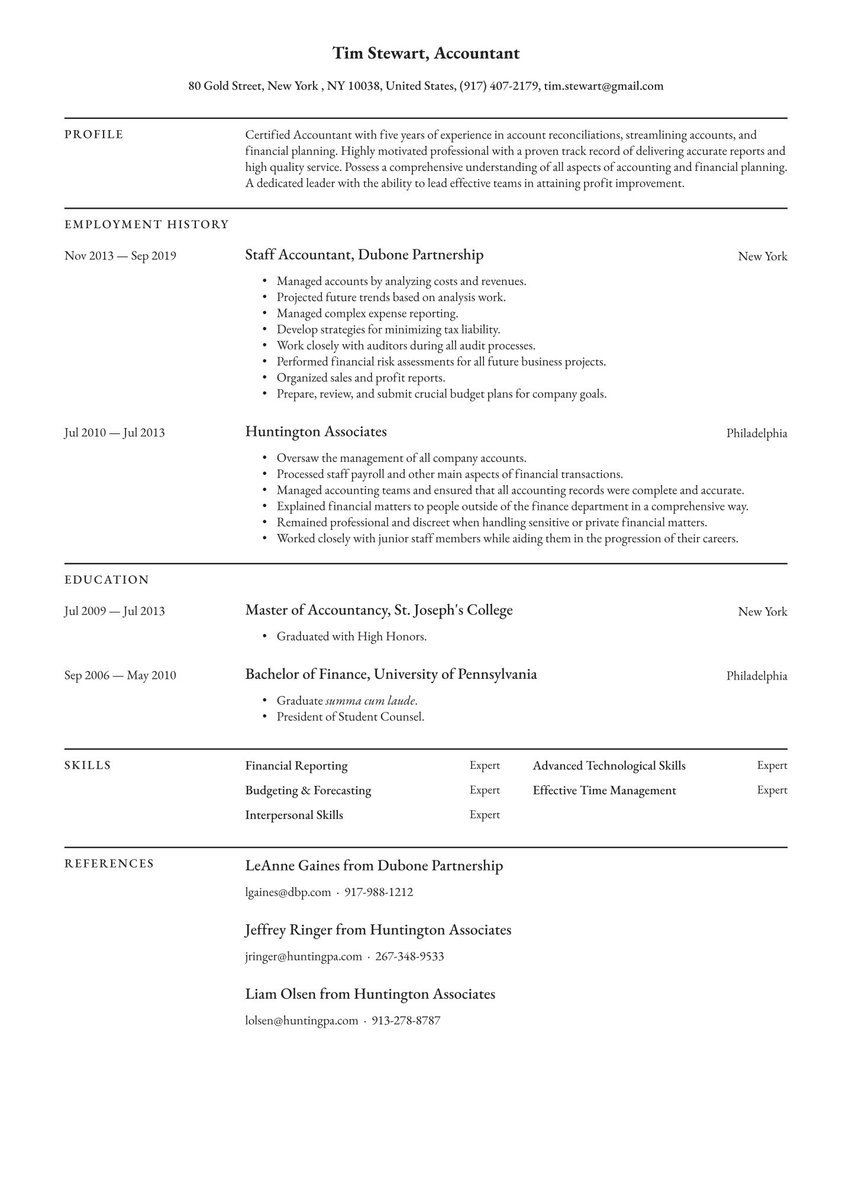

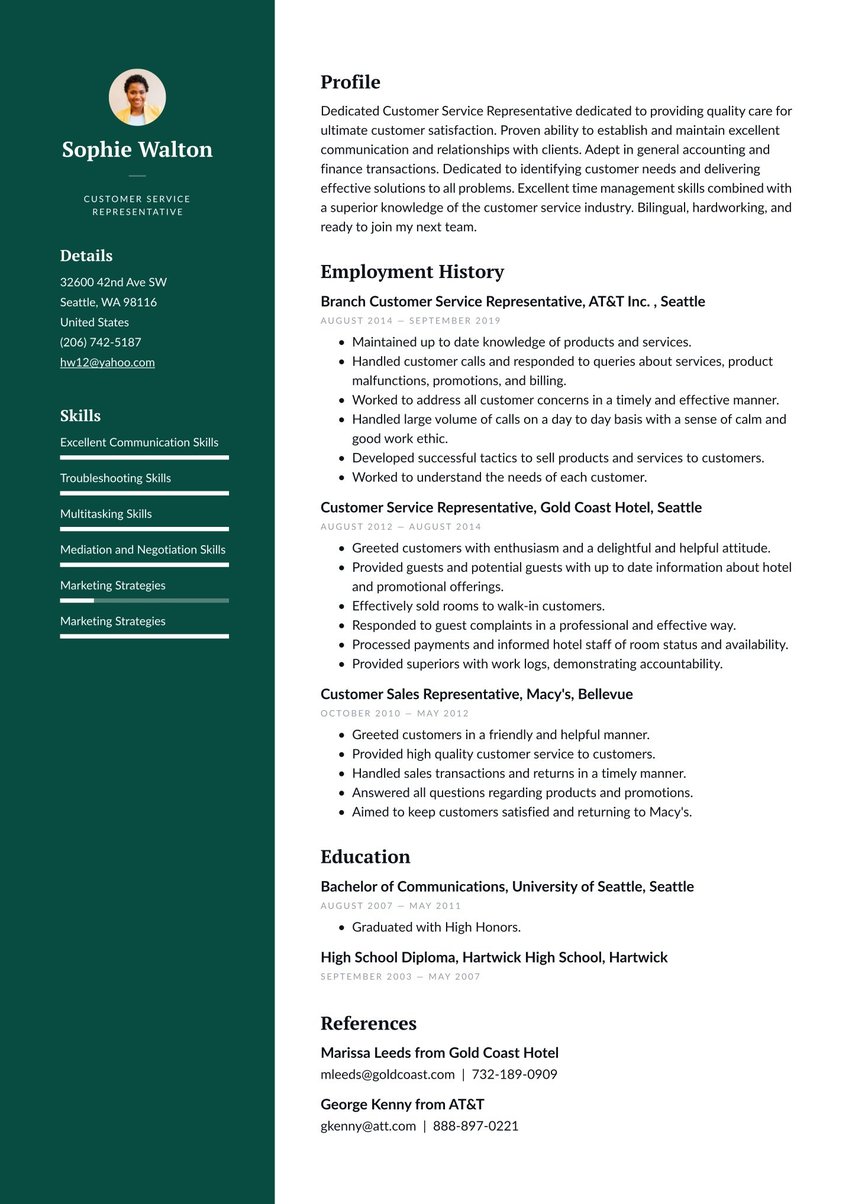

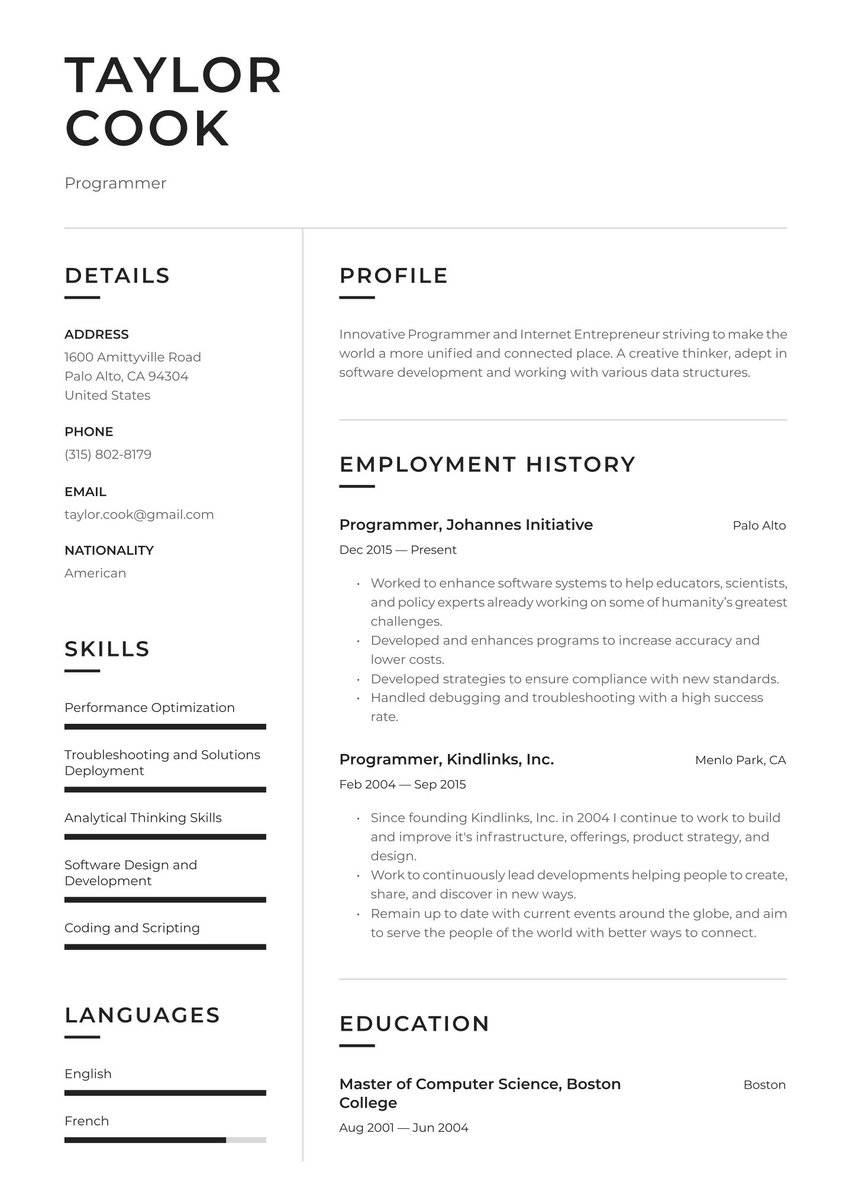

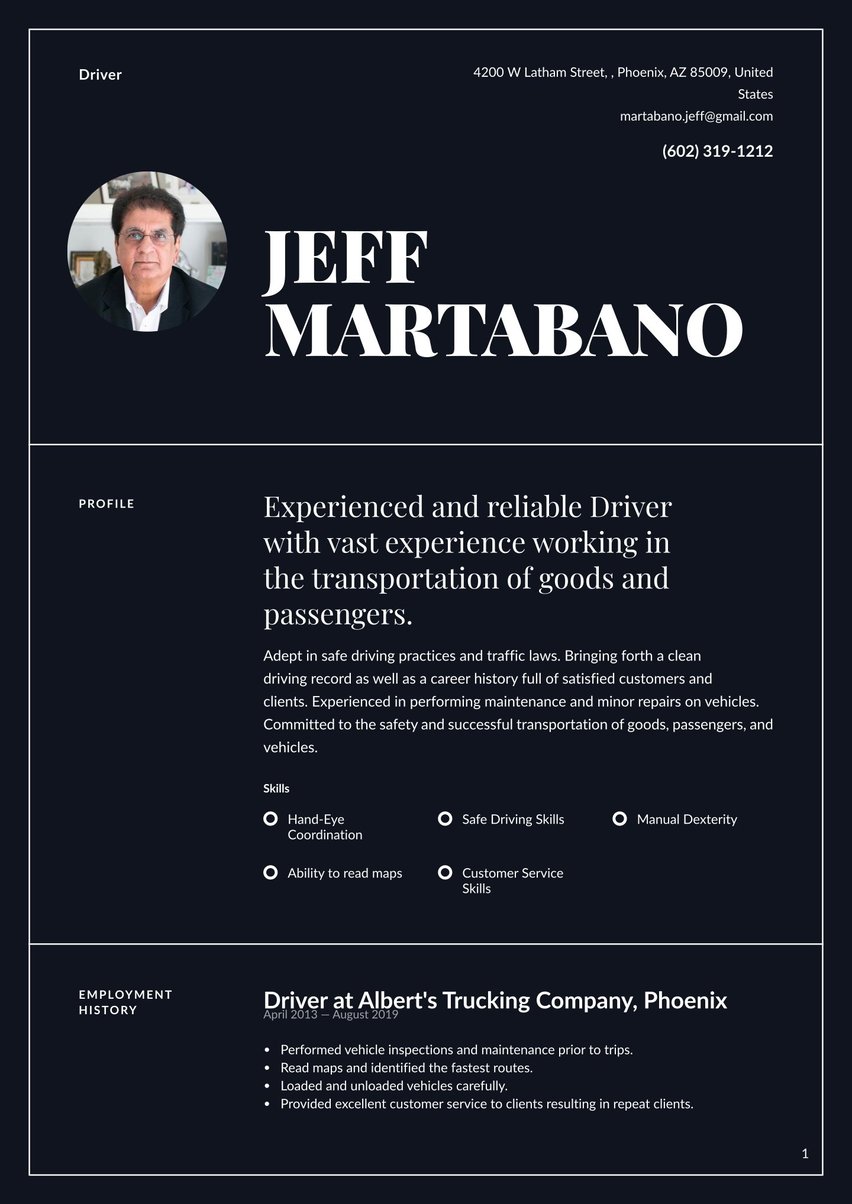

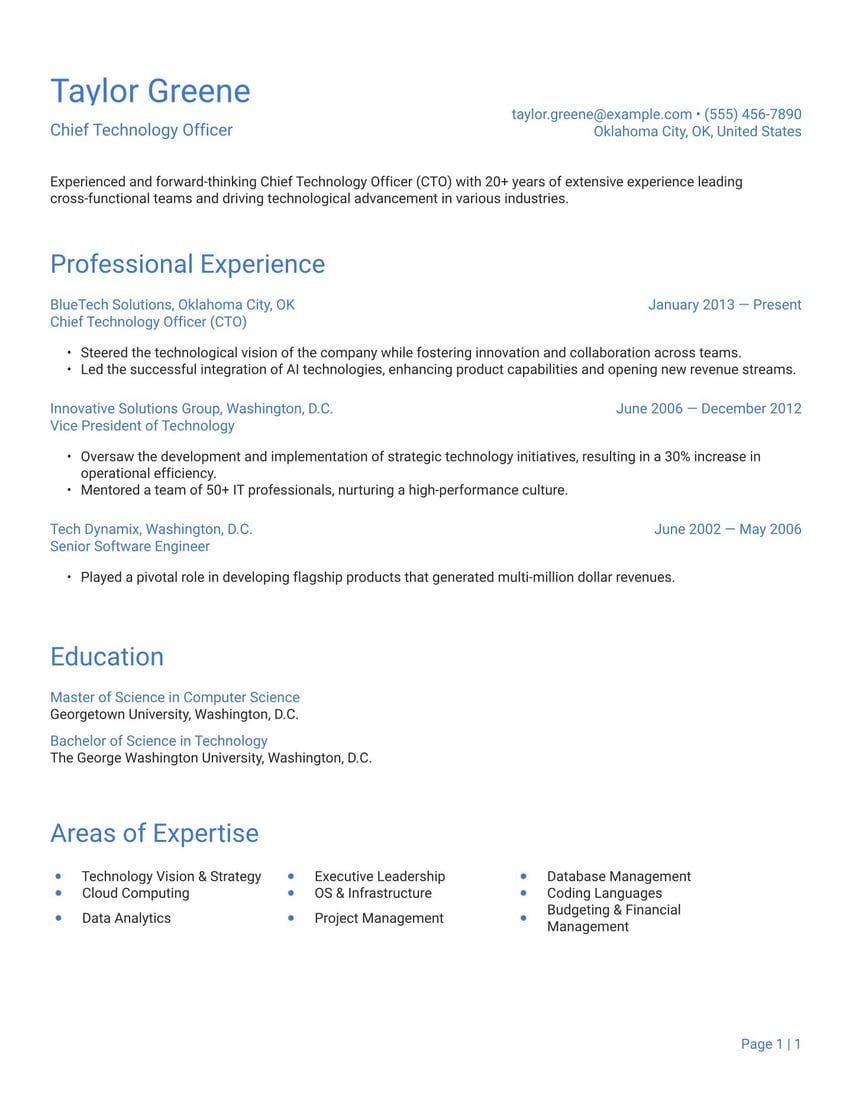

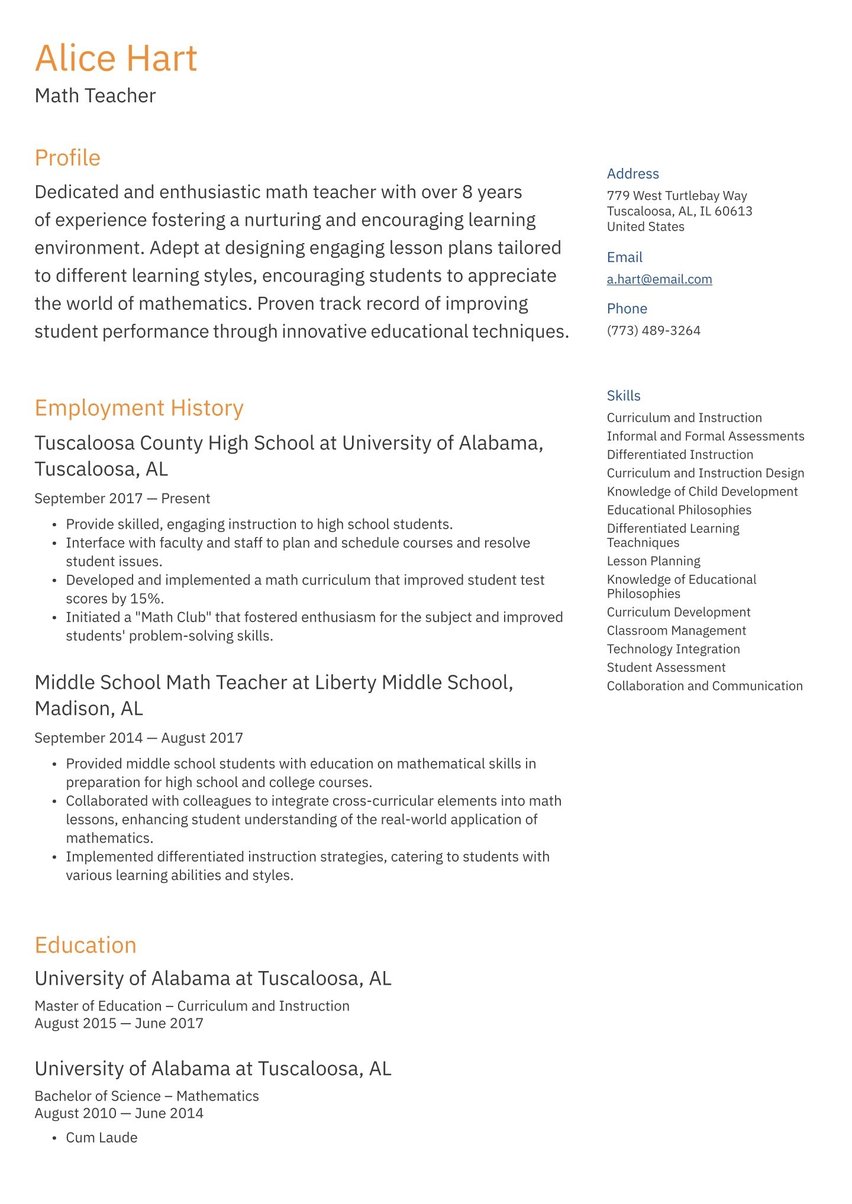

Staff accounting finance

Accounting finance expert

How to write an accounting & finance resume

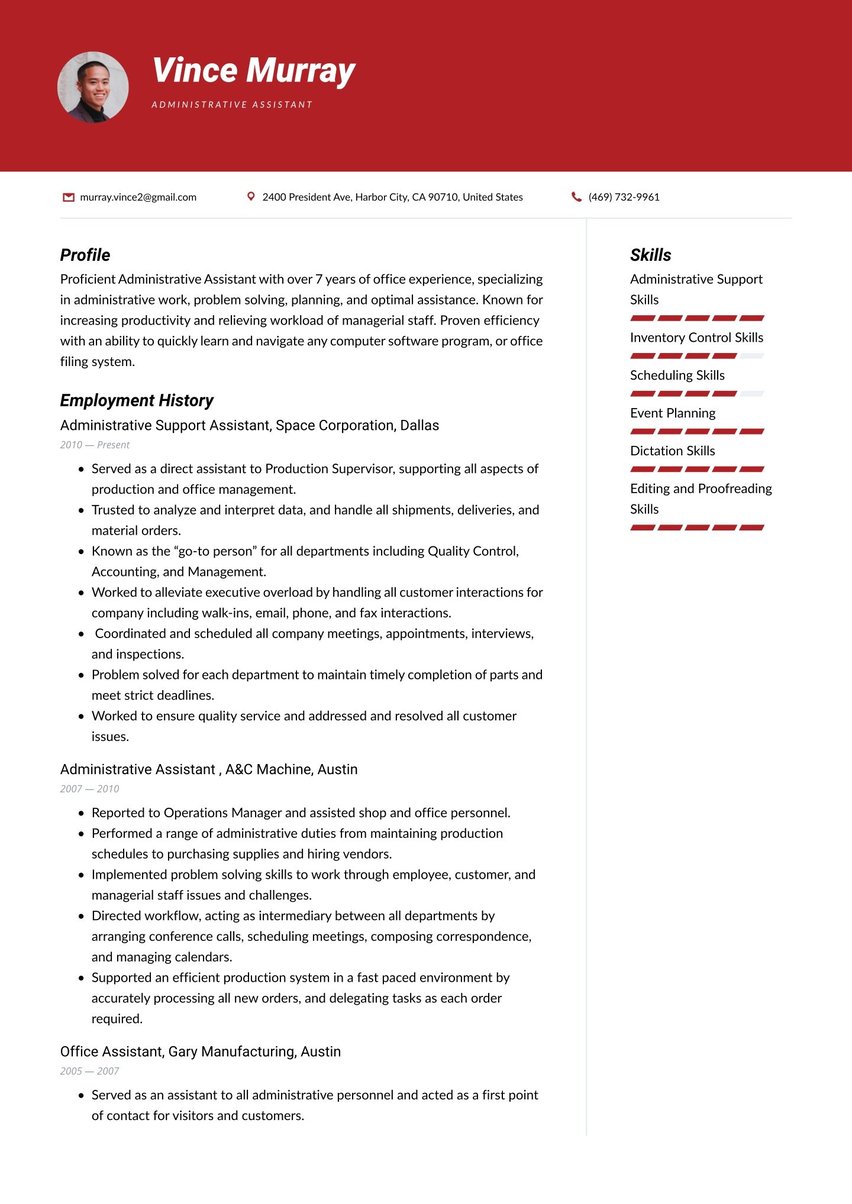

Before you begin a financial analysis or report, you decide what will go into it. You should also know what elements your accounting and finance resume should include before you begin. Here are the parts necessary to create a winning resume:

- The resume header

- The resume summary (aka profile or personal statement)

- The employment history section

- The resume skills section

- The education section

The key to a successful resume is consistent tone, style, and message, but those elements should be adjusted for each job. How do you do that? Research. Find out about your prospective employer’s pain points but also the company’s structure, culture and business model. Incorporate that knowledge into every aspect of your resume so that you are speaking directly to your prospective boss.

A resume that raises your value in the eyes of hiring managers will:

- Focus on accomplishments, not tasks. The results of your actions—not simply that you acted—reveal the value you bring.

- Direct your message directly to the boss with the goal of answering the question: “Why should I hire you?”

- Use a resume template that makes a positive visual impression, since it will be the first impression the hiring manager will get.

- Include tailored keywords and phrases for each job that are designed to give you a better chance at avoiding the ATS filter.

Focus your analysis to beat the ATS

No matter how well-crafted your resume is, it won’t reach a human being if it falls victim to the Applicant Tracking System filter. You can increase your chances of beating this scanning and sorting software used by 99% of Fortune 500 companies with your analysis skills.

Carefully match the words and phrases in the job listing to your resume. This means personalizing your resume for each job. Spell out and include acronyms just in case and stick with standard section headings that the ATS recognizes.

Add this to ATS callout

For example, an accounting and finance job listing requires:

- “Three years’ experience”

- “Monitor company’s finances”

- “Experience with budgeting and forecasting”

- “Understanding of GAAP and finance regulations”

An ATS-optimized resume summary might read:

“Accounting and finance professional with three years’ experience with budgeting and forecasting. Adept at tracking company cash flow and monitoring all transactions for adherence to GAAP and finance regulations.”

To learn more about conquering the ATS, check out our article Resume ATS optimization.

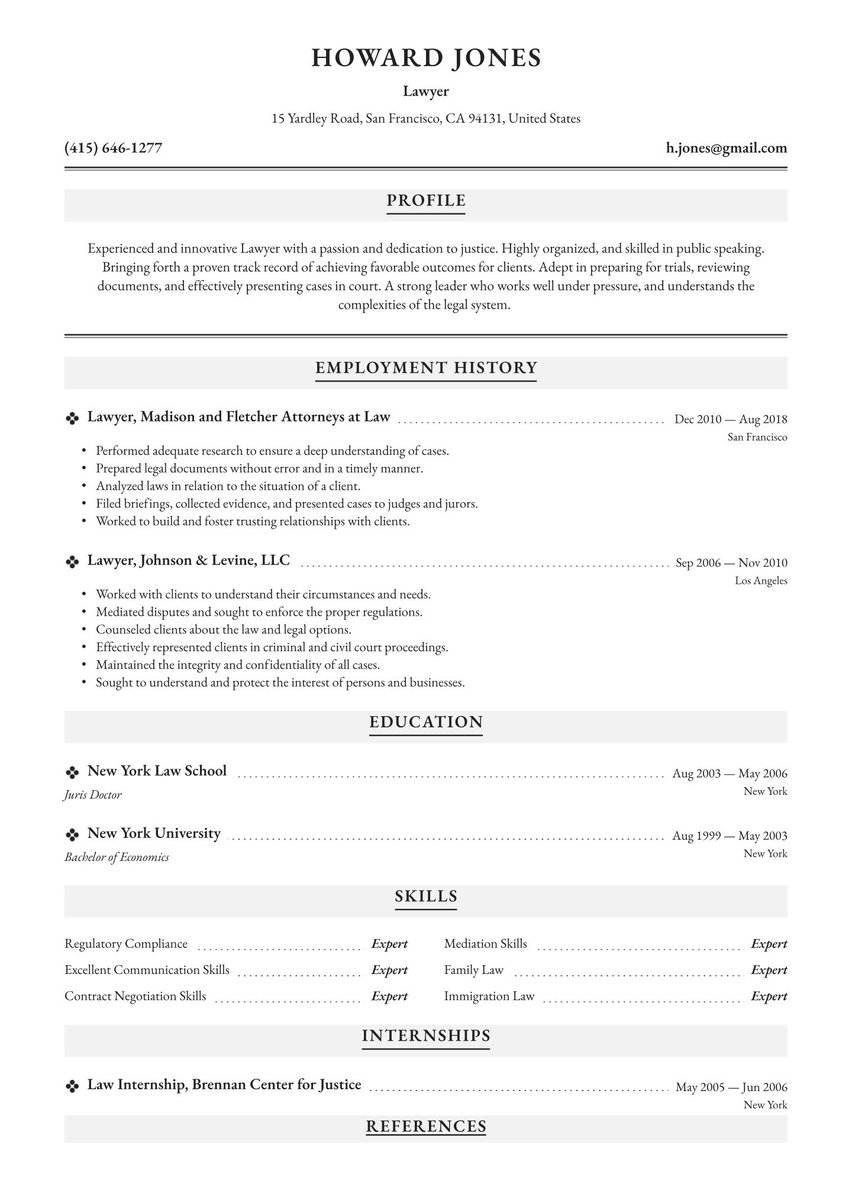

Choosing the best resume format for accounting & finance

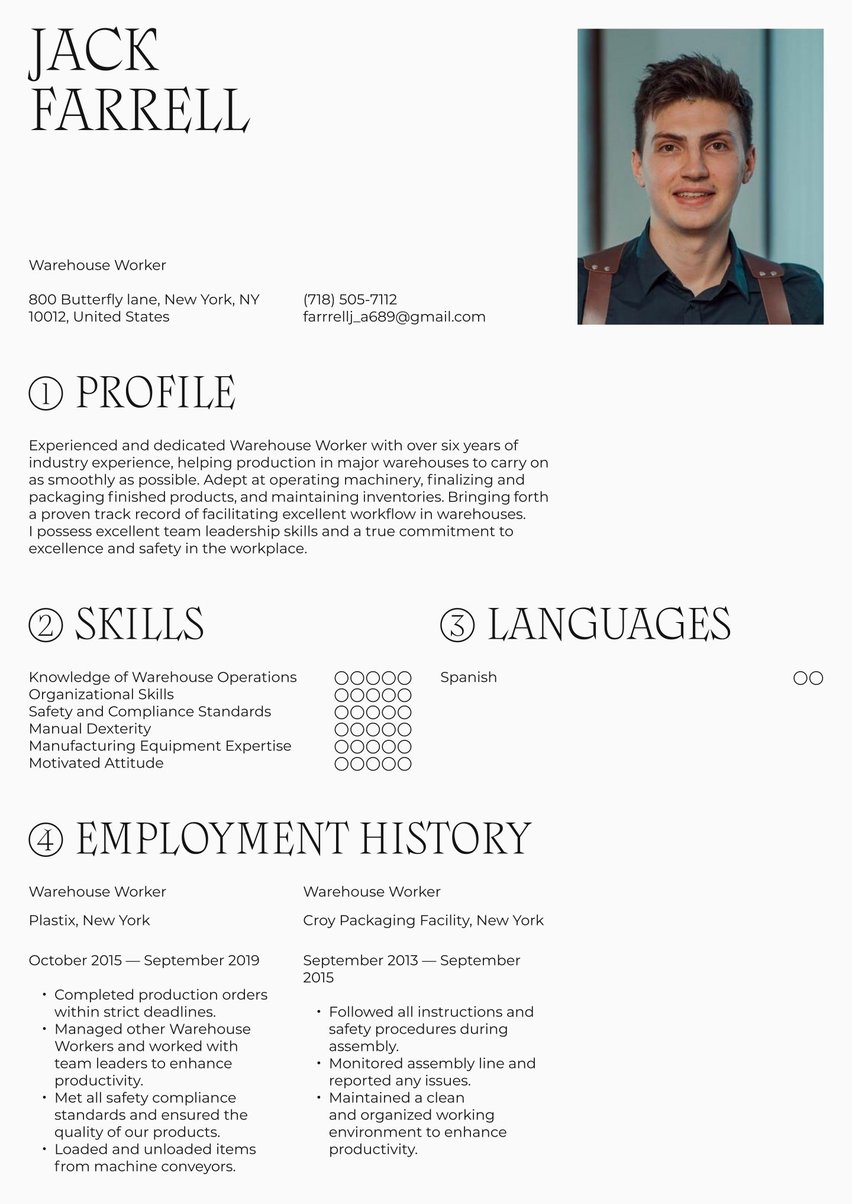

The tried-and-true reverse chronological order resume is most likely to be your best-bet format. Why? Because it works and because it makes it easy for recruiters to find the information they seek.

If you are in a technology or specialty field and need to highlight niche or complex skills, you may want to use the functional resume format instead. Within this format, you can expand your skills section to show off your expertise and contract your employment history to a simple listing of employers or contract engagements.

Other life situations that call for different resume types are gaps in work history, first-time entry into the job market or career changing. Check out our alternate resume formats for more information on how to write resumes in those circumstances.

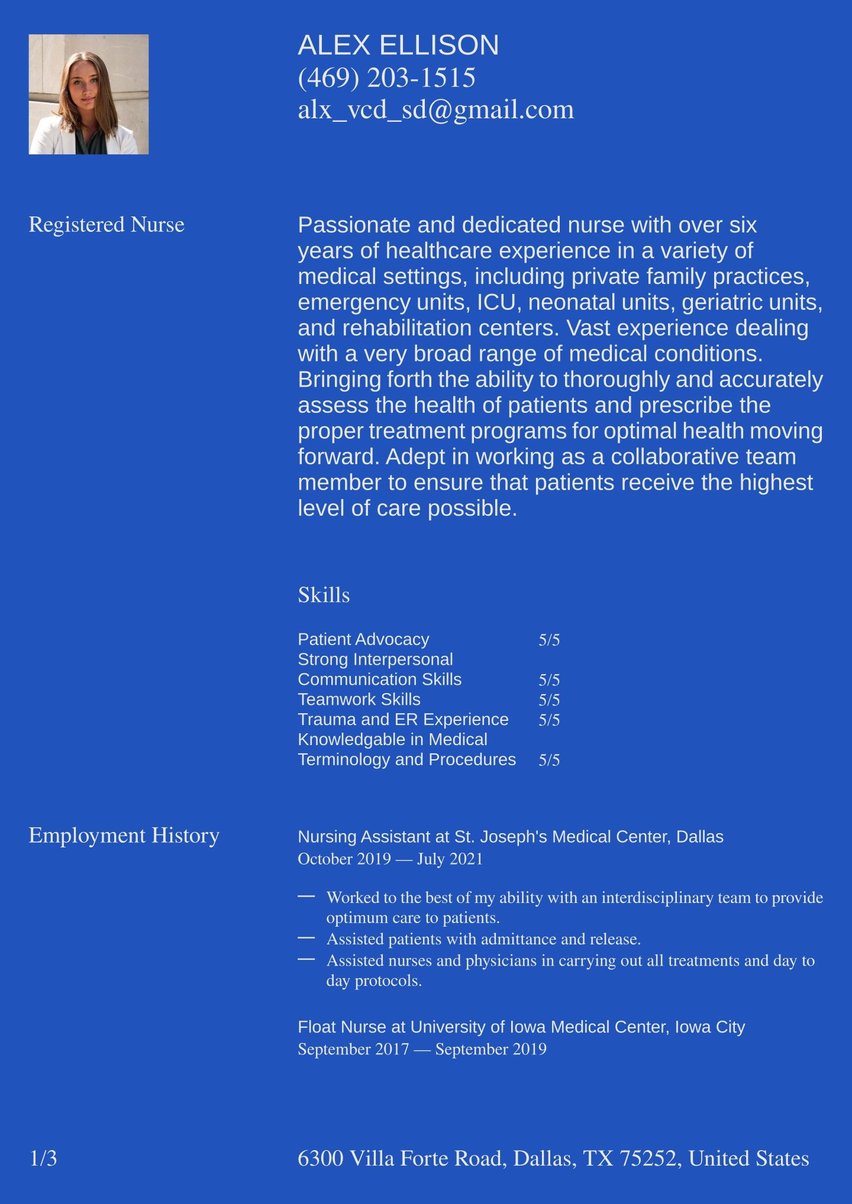

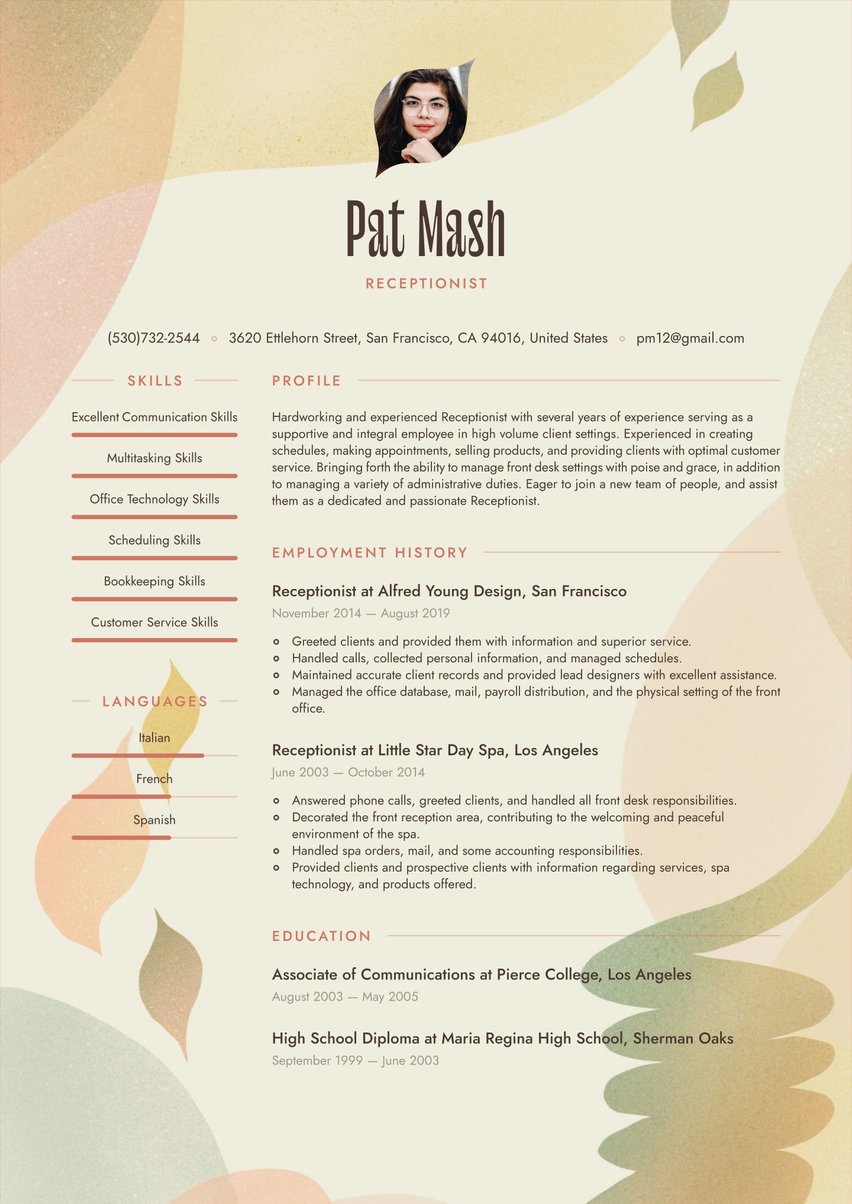

Accounting and finance is a detail-oriented, fairly conservative field. We recommend a professional template to project that image.

Include your contact information

Your header is like the business card of your accounting and finance resume. Make your contact information accessible, professional, and legible.

- Full name and title. List your first and last name. Make sure you customize the job title to match each job listing.

- Professional email address. Use a clean format like [email protected]. Don’t use your current work email.

- Phone number. List a number where you can be readily contacted, with a professional voicemail greeting.

- Location. List only your city and state. Listing your street address unnecessarily exposes your personal information. Note 'Willing to Relocate' here if applicable.

- LinkedIn. If your LinkedIn profile is active, relevant, and shows your business network, include it here.

Don’t include:

- Date of birth: Not necessary and could potentially lead to age discrimination.

- Personal details: Marital status, social security number, passport number, etc.

Jesse Stevens

Accounting Manager, CPA

(212) 345-6799

New York, NY

www.linkedin.com/jstevens

Jesse Stevens

Accounting Manager, CPA

(212) 345-6799

466 West Juniper Road

New York, NY 10003

www.linkedin.com/jstevens

Get value from your summary

You’re well more than a numbers-cruncher, and the summary section of your accounting and finance resume is where you can show that off. Here, you have 2-3 sentences to dig into that fraud you found or the creative budget you prepared. Tailor your highlighted achievement to each position to hook the hiring manager in.

Use action verbs—budgeted, analyzed, audited, reconciled—to kick off each bullet point.

Be sure to include a few glowing adjectives to describe your professional demeanor and attitude. Definitely pat yourself on the back, but avoid veering too far into bragging territory. The best summaries intrigue hiring managers, giving them something to follow up on in the interview and explaining what you will add to the company.

They don’t repeat your work history but provide a career overview. For example, “Career eagle-eyed accountant dedicated to responsible management of company’s finances to increase ROI and eliminate waste.”

If you want summary section resume samples for specific accounting positions, try our:

You can find adaptable examples of accounting and finance resume summary sections below:

Detail-oriented graduate with a degree in Accounting and Finance eager to apply classroom knowledge in Fortune 500 setting. Proficient in reconciliation, financial analysis, and budgeting. Strong analytical skills coupled with a solid understanding of accounting principles and financial management. Adaptable and quick to learn, with a commitment to accuracy and efficiency in all tasks.

CPA and finance professional with five years of experience budgeting, forecasting, and financial analysis for technology company. Consistently deliver insightful financial reports to support strategic decision-making including financial recommendations resulting in reduced tax burden of $1.5 million.

Seasoned accounting and finance leader who drives strategic growth through financial analysis and understanding of business process. Oversee $4 million budget and provide financial insights to senior management to support decision-making and optimize resource allocation. Extensive experience in financial reporting, regulatory compliance, and risk management.

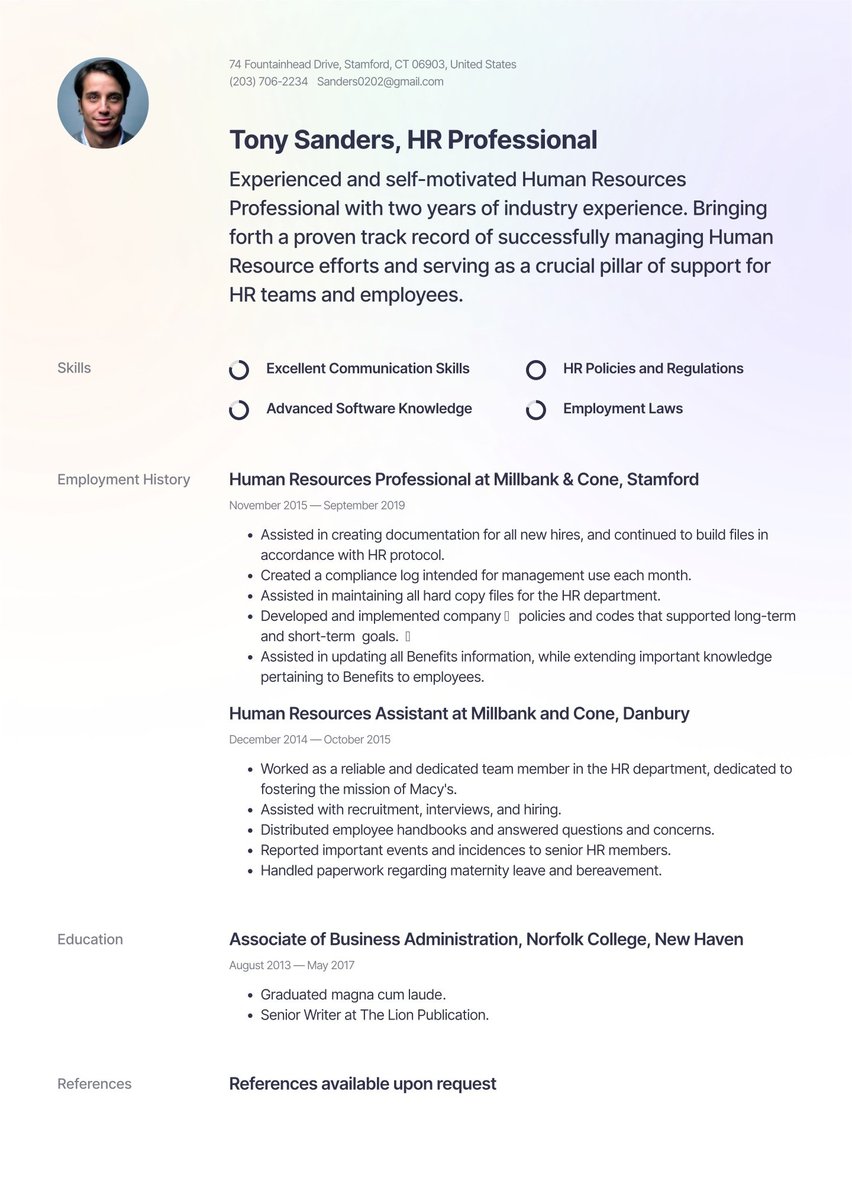

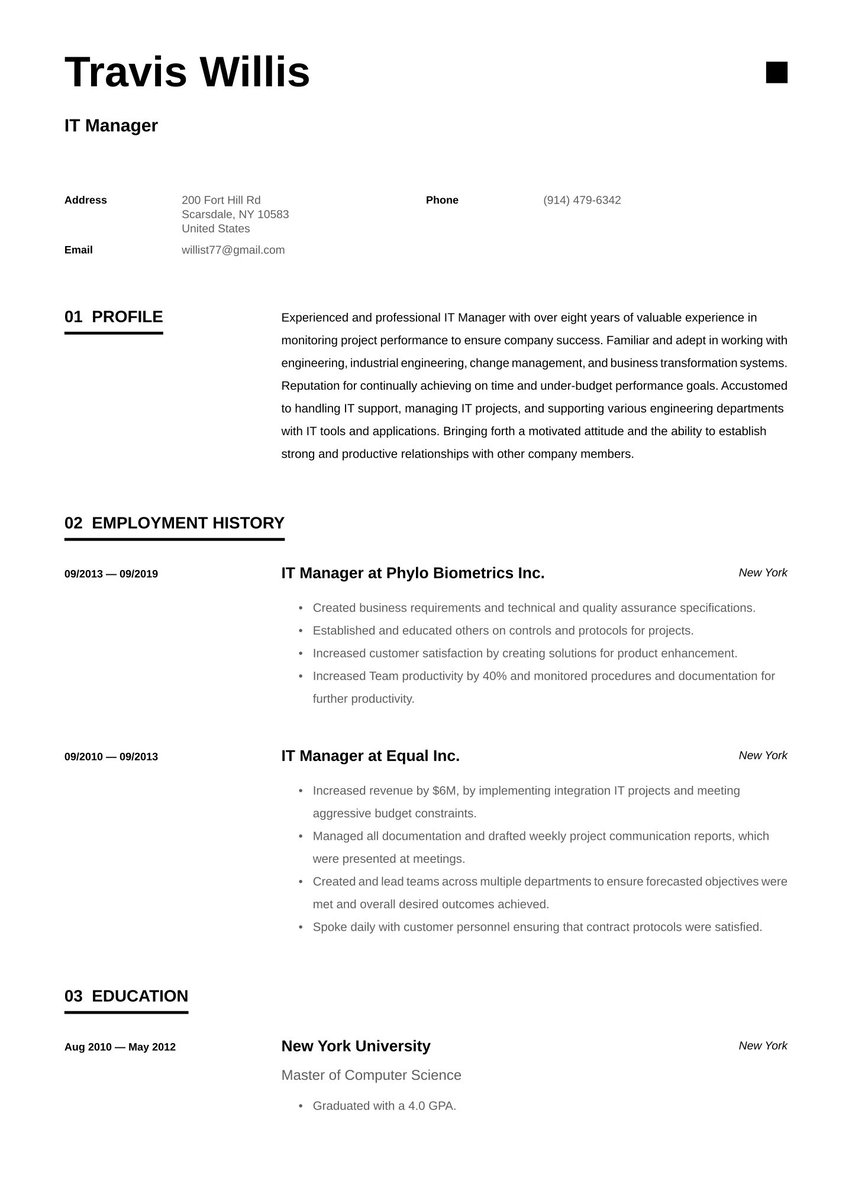

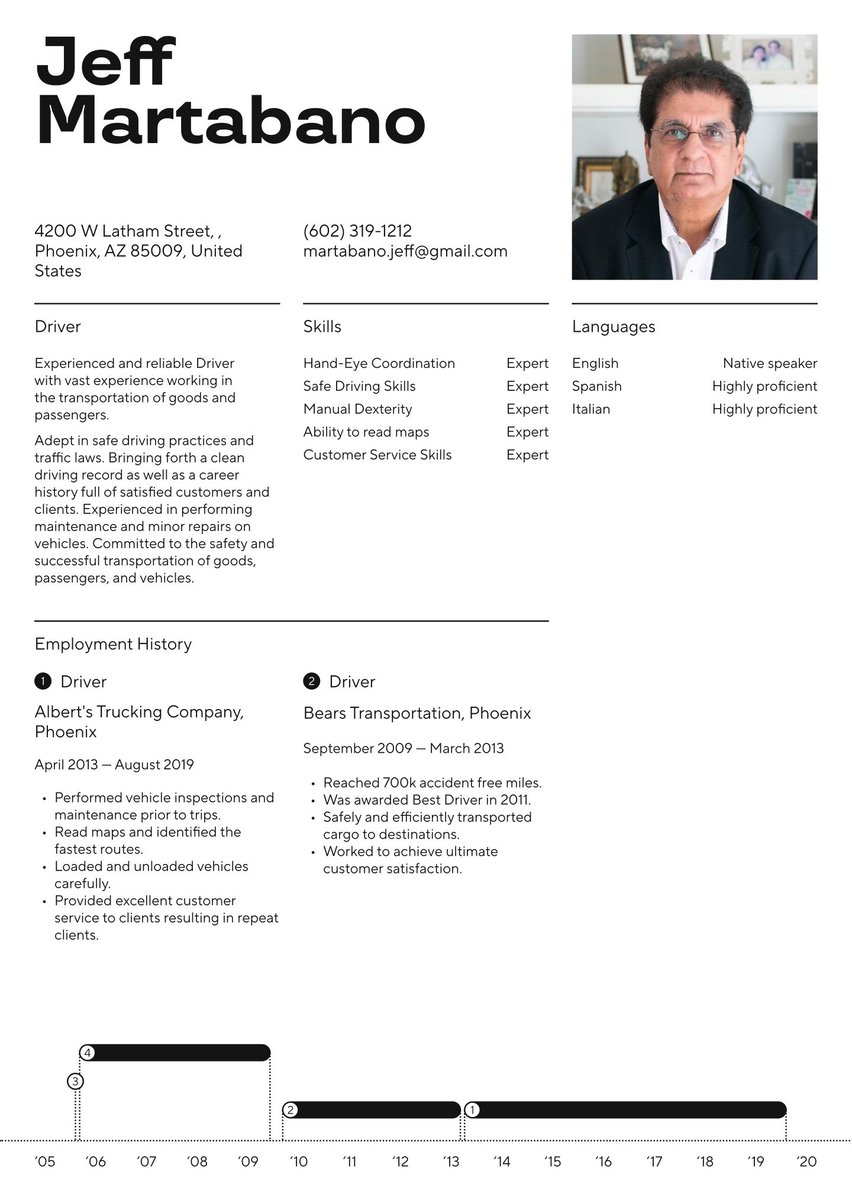

Outline your accounting & finance work experience: career trend analysis

The employment history section of your accounting and finance resume is really an analysis of your career progress and achievements. Beginning with your most recent position (here is where reverse chronological order comes in), you will create bulleted items that detail tangible outcomes, not responsibilities.

Start each item with a strong action word such as accounted, recommended, or managed and follow it with a phrase that describes your achievement. Use data, details, and dollar signs whenever possible. You are, after all, a person who deals with numbers all day.

Descriptions lacking in detail fall flat. Consider the following:

- “Collaborated on annual budgeting.”

- “Reconciled accounts.”

- “Followed all GAAP and financial regulations.”

- “Performed internal audit.”

A hiring manager is likely to think: “That sounds like the wording from the job description!” A dynamic work history section describes what you did in detail and what benefit your actions had for the accounting and finance department or the company as a whole.

Note the difference in these rewritten items:

- “Collaborated with department heads to determine financial needs and balance against projected spending allocation for $3 million subsidiary of multibillion-dollar conglomerate.”

- “Reconciled 10 accounts with more than 100 transactions per day, ensuring accurate accounting of all cash flow.”

- “Created process to review accounting activities to ensure strict adherence to GAAP and financial regulations.”

- “Conducted internal audit and presented recommendations to senior-level staff, resulting in increased accuracy and 10% reduction in time to reconcile accounts.”

Don’t be afraid to head to Thesaurus.com if inspiration for the perfect word is not coming. Just don’t veer too far from your everyday language. You want to sound genuine and professional.

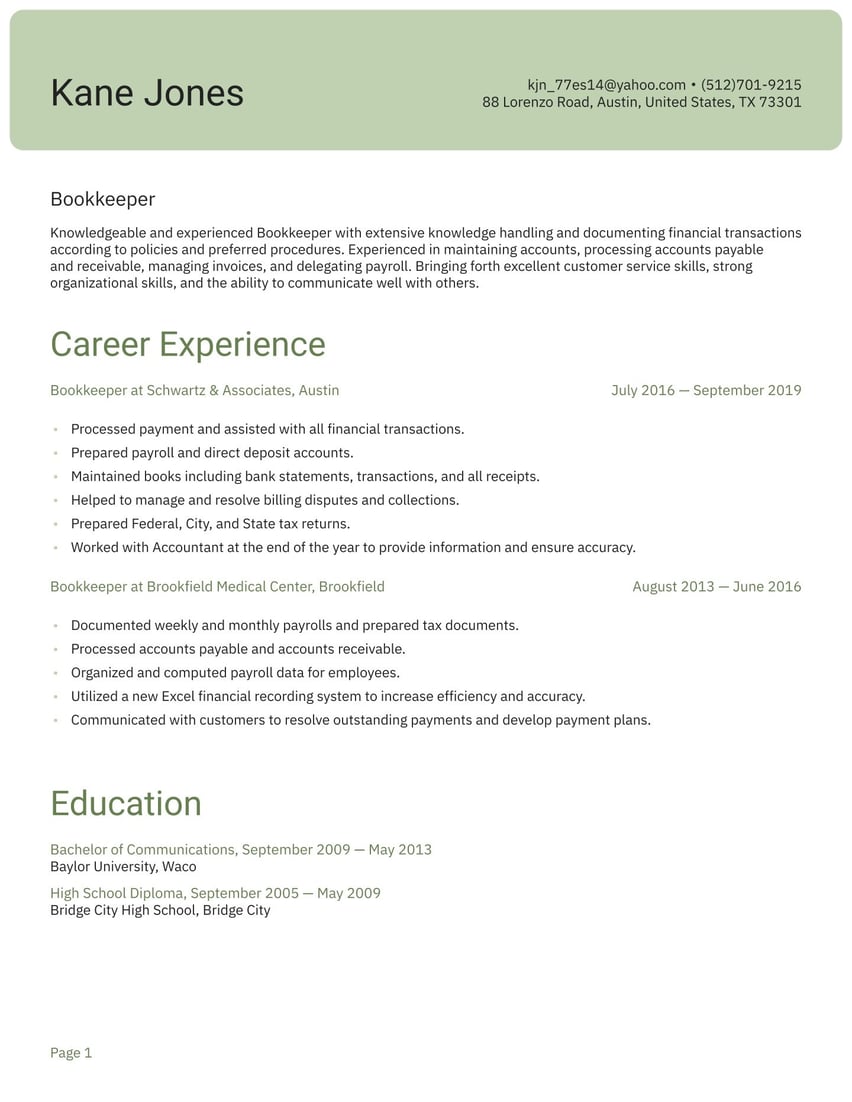

Take a look at the accounting and finance employment history resume sample below:

Accounting Manager at Smith and Caufield, New York

March 2015 - Present

- Review and analyze financial accounting information and present analysis and commentary to key business partners.

- Work to ensure that the financial control framework provides for the accurate reporting of financial conditions.

- Collaborate with teams including Cash Operations, Treasury, and Tax.

- Interpret and communicate financial information to teams across the business.

- Oversee the month-end, quarter-end, and year-end closing of the books, reconciliations, and journal entries.

Accounting Manager at Diamond Marketing, Jersey City

September 2013 - March 2015

- Oversaw and managed cost accounting, capitalizing variances, and inventory provisions.

- Reviewed and supported the preparation of entries related to business operations.

- Completed the documentation of processes and standardized operating procedures.

- Prepared monthly, quarterly, and annual reports for corporate reporting.

How to write an accounting & finance resume with no experience

Accounting and finance professionals typically have at least a bachelor’s degree in one of those fields or a related one. When you write an accounting and finance resume with no experience, you can partly rely on what you learned in school, or your hard skills.

This professional knowledge will form the foundation upon which your career will build.

If you have held a part-time or summer position, even if it isn’t money-related, you demonstrated transferable skills such as time management, communication, and reliability.

Use these to illustrate your readiness for full-time finance work even though you have no direct experience.

Show off the assets that make you great at accounting and finance

Your skills section tells recruiters a few important things quickly. Because this is such a pointed part of your accounting and finance resume, they will know within seconds whether you have the attributes they seek.

The other key piece of information here is what you think are the most important skills for the job. These two factors mean you should curate this section carefully with a blend of hard and soft skills.

The soft skills most in demand by employers are time management, critical thinking, communication, and collaboration, according to the Journal of Accountancy. The top hard skills are knowledge of GAAP (generally accepted accounting principles), Quickbooks, business intelligence software, and tax preparation software.

Proficiency in Microsoft Excel and preparation of financial statements as well as data query and management ability and independent research skills, the staffing agency 4 Corners Resources says.

If you are having trouble deciding on your top skills, try putting the text from your resume and the job listing into a word cloud creator such as WordArt or WordClouds. That will show you which information appears most often.

Here’s what the skills box looks like in our accounting and finance resume template.

- Financial Reporting

- Financial Analysis

- ERP Systems

- Ability to Work Under Pressure

- Interpersonal Communication Skills

Remember to highlight examples of your skills and how you use them to achieve throughout your accounting and finance resume.

For example, in both your work history and summary, you can illustrate your:

- Attention to detail by recounting a time when you found what could have been a costly error

- Communication by describing how you gather information to create a budget

- Tax law knowledge by telling how you limited the company’s tax liability

The job description will guide you in deciding which skills to showcase.

Highlight your education & relevant accounting and finance certifications

The education section of your accounting and finance resume is a straightforward listing of your academic degrees. Accounting and finance jobs typically require at least a bachelor’s degree and some may prefer an MBA.

If you do have an advanced degree, you may leave out your high school diploma. Another item to leave off: your GPA, unless you just graduated and have a 4.0.

The section is also a great place to highlight:

- Training and certifications. If you are a CPA, list that after your name, but also include the details here. Add any other related webinars, trainings, or certificates in your field.

- Internships. Especially if you are early in your career, these college or post-college programs demonstrate your knowledge and experience.

- Professional development. Membership in trade associations, tax law groups, or any other organizations that help you grow as a financial professional belong here.

Below you will find an education section resume example as a formatting guide.

Bachelor of Science in Accounting, Manhattan College, New York

September 2009 - May 2013

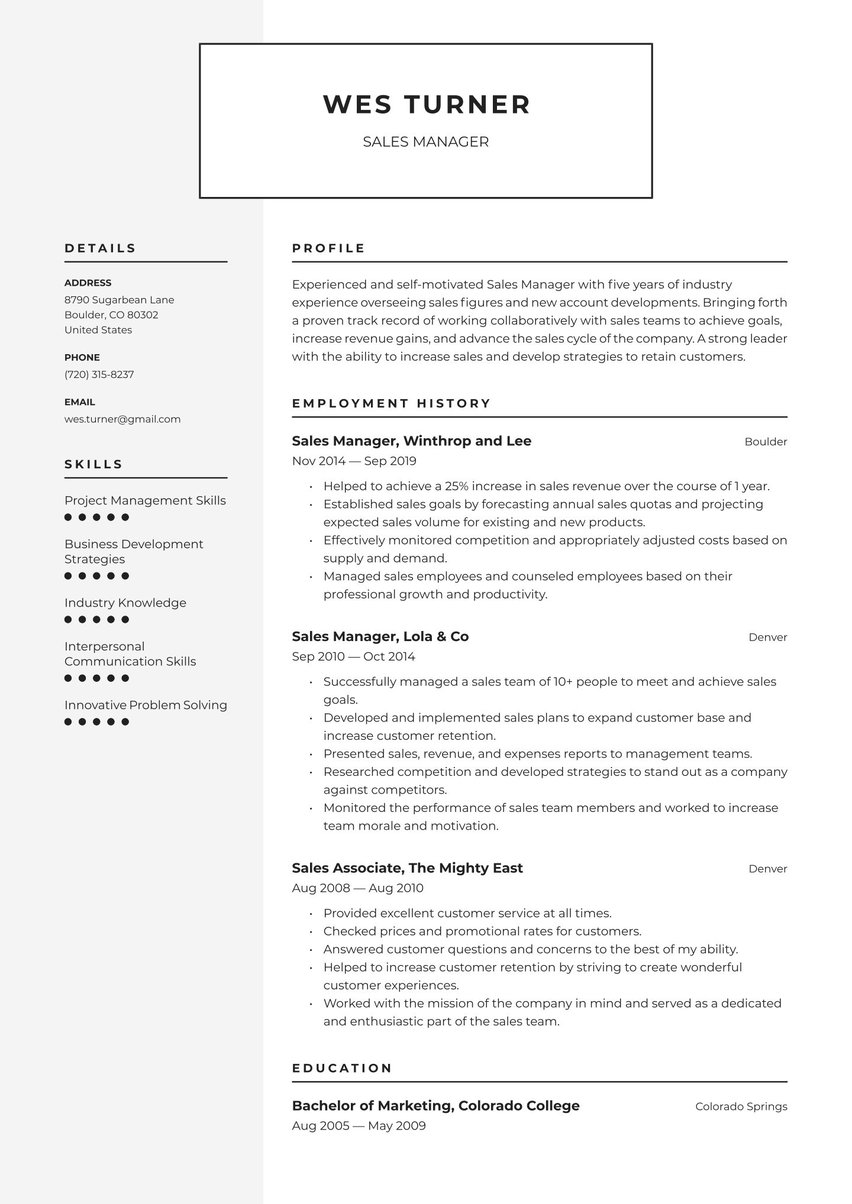

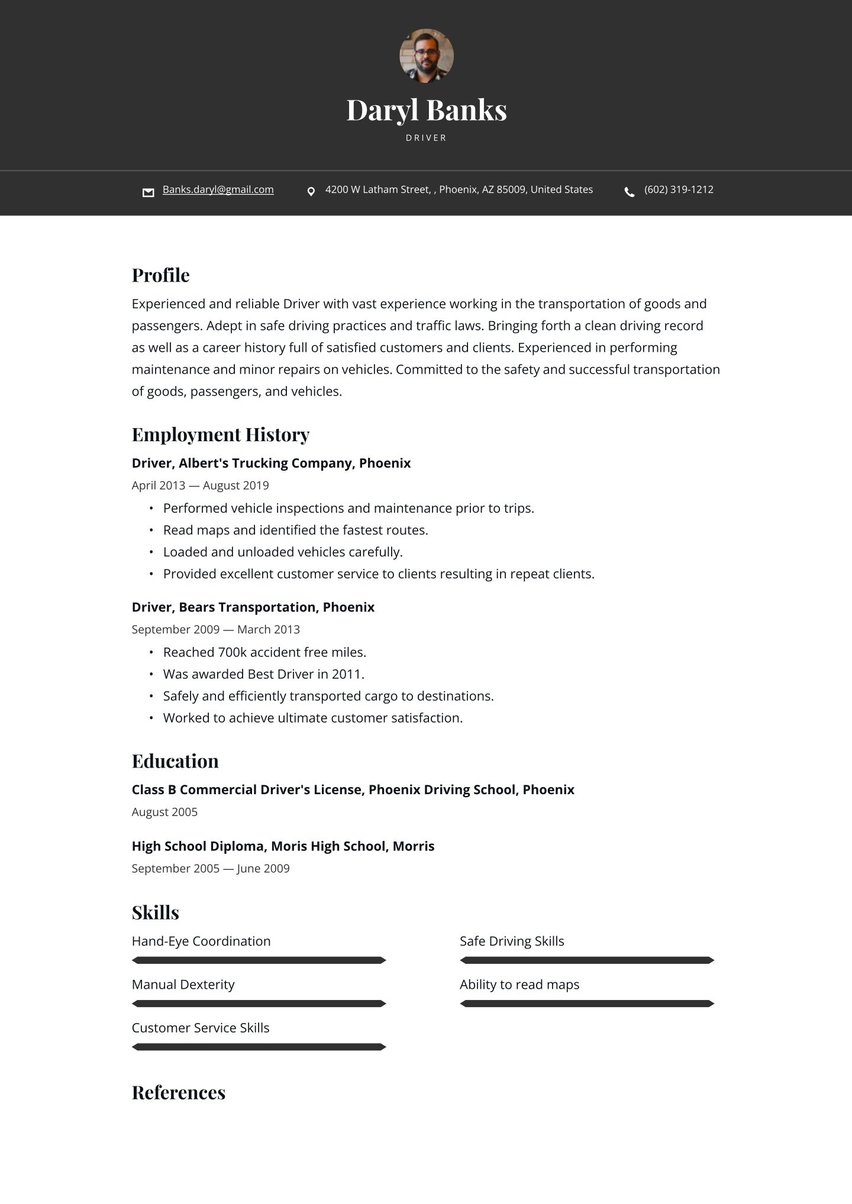

Project the right image with your resume layout and design

Even the numbers people need an art department to give their presentations the proper look. The layout and design of your accounting and finance resume are just as important because before a recruiter reads your resume, they will see it. That first look counts.

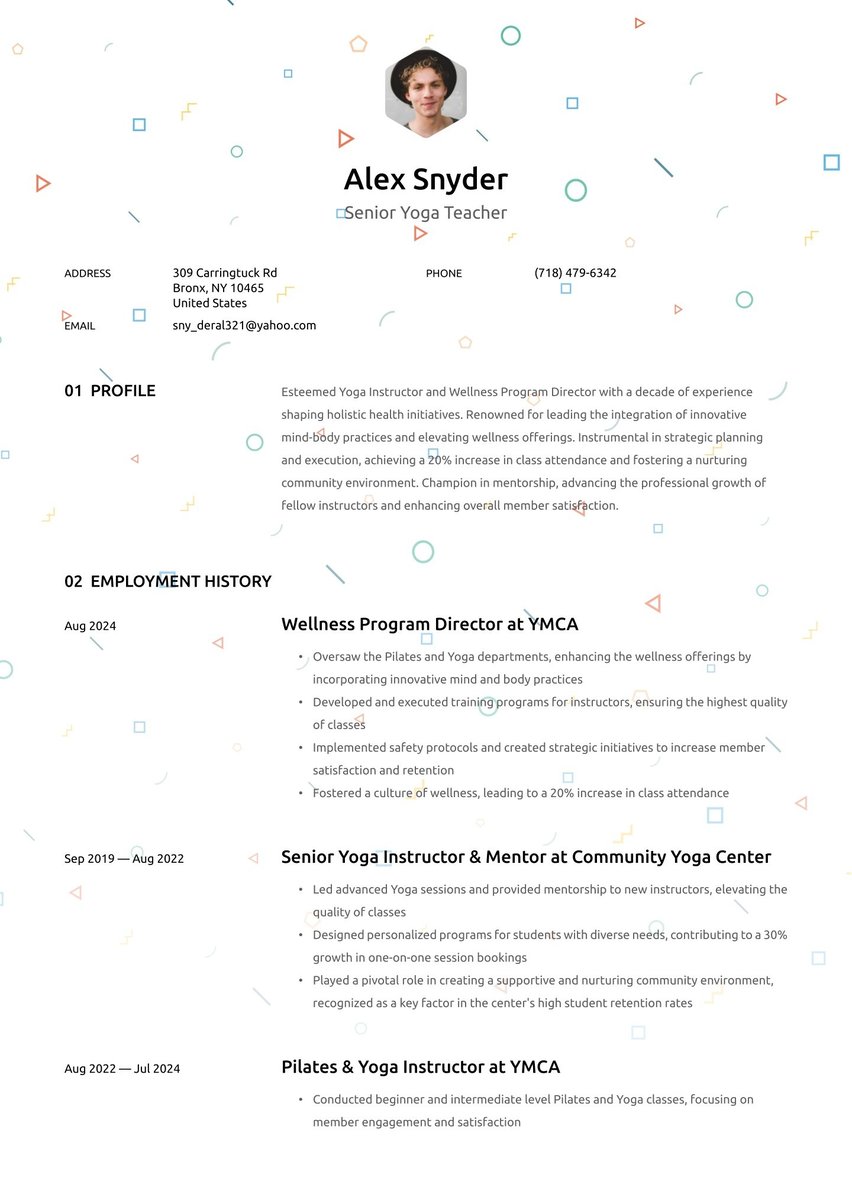

What impression do you want to give? Organized, neat, clear, and professional? Of course! The best way to do that is to keep it simple. Avoid over-designing or using too much color. Stick with easy-to-read fonts and 1-inch margins. Avoid cramming in too much text: Save something for the interview!

To save yourself the time and effort of formatting, use one of our expertly-designed resume templates.

Accounting & finance text-only resume example

Profile

Accomplished and highly motivated Accounting Manager seeking to utilize my skills for the betterment of the next team I join. Committed to driving continuous improvements for finance operations through the identification and implementation of process enhancement opportunities.

Employment history

Accounting Manager at Smith and Caufield, New York

March 2015 - Present

- Review and analyze financial accounting information and present analysis and commentary to key business partners.

- Work to ensure that the financial control framework provides for the accurate reporting of financial conditions.

- Collaborate with teams including Cash Operations, Treasury, and Tax.

- Interpret and communicate financial information to teams across the business.

- Oversee the month-end, quarter-end, and year-end closing of the books, reconciliations, and journal entries.

Accounting Manager at Diamond Marketing, Jersey City

September 2013 - March 2015

- Oversaw and managed cost accounting, capitalizing variances, and inventory provisions.

- Reviewed and supported the preparation of entries related to business operations.

- Completed the documentation of processes and standardized operating procedures.

- Prepared monthly, quarterly, and annual reports for corporate reporting.

Education

Bachelor of Science in Accounting, Manhattan College, New York

September 2009 - May 2013

Skills

- Financial Reporting

- Financial Analysis

- ERP Systems

- Ability to Work Under Pressure

- Interpersonal Communication Skills

Accounting and finance job market and outlook

Despite the automation of many rote accounting tasks, the market for accounting and finance professionals is a robust one. Demand for accounting managers, corporate controllers, directors of finance and senior accountants are among the highest in the field, Robert Half reports.

In fact, the U.S. Bureau of Labor Statistics predicts the addition of more than 100,000 jobs for market research analysts by 2032—that’s a 13% increase, much higher than the average profession’s growth. Financial managers will be in even higher demand, with a 16% projected increase.

Predicting the future of finance

What will finance look like in 2025? Automation will continue to advance, a report from Deloitte says, but companies will look toward their finance divisions for more planning, reporting, budgeting and business insights.

What salary can you expect in accounting & finance

Below are salaries for a range of accounting and finance positions from Payscale.com:

| Job title | Median annual salary | Salary range |

| Staff accountant | $56,801 | $44,000-$71,000 |

| Tax accountant | $60,954 | $48,000-$81,000` |

| Treasury analyst | $63,902 | $50,000-$81,000 |

| Financial analyst | $66,939 | $51,000-$89,000 |

| Risk analyst | $71,676 | $52,000-$101,000 |

| Senior auditor | $76,130 | $61,000-$101,000 |

| Finance director | $120,409 | $69,000-$172,000 |

Key takeaways for building an accounting and finance resume

Many specialties within accounting and finance are in high demand, so this is a great time to set yourself apart with an excellent resume. Your analysis skills will come in handy as you aim to beat the ATS and create a skills section that speaks to your prospective employer. Make your case stronger with data, details, and dollar signs.

Use the online resume maker as a way to make your life easier and the job application process faster!

.jpg)

.jpg)